And the guessing game continues. Just when you think you know where it's headed, it throws another curve.

After an intital gap down to start the trading day, the market managed to bottom early, fight back close to the neutral line before noon, and after about 2 hours of sideways action begin another ascent picking up short covering along the way to post some healthy gains by the close.

Earnings continue to be hit and miss, but the market is punishing some stocks in spite of reasonable earnings and outlooks given the current economic climate.

But as we saw, buyers stepped up after early selling pressure to take positions in beaten down stocks and sectors.

After their reports were issued late this afternoon, AAPL is trading 2.5% higher, while YHOO is 6.3% lower. So more mixed results, but AAPL knocked the socks off expectations, so it'll be interesting to see how the market reacts tomorrow.

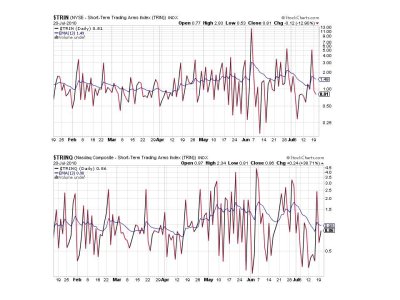

Here's tonight's charts:

All it took was some decent buying pressure and both NAMO and NYMO flipped back to buys today.

NAHL didn't quite make it back above its 6 day EMA, but it's darn close. NYHL remains on a buy from yesterday.

TRIN and TRINQ remain on buys.

BPCOMPQ also remains on a buy, but the bollinger bands are starting to tighten up. That's not a problem necessarily, but it shows a market that's a bit range bound at the moment.

So we have 6 of 7 signals flashing buys and the one sell signal is very close to its trigger point too. But the system remains on a buy regardless.

I'm still expecting the market to breakout to the upside, but more headfakes may be in store. See you tomorrow.

After an intital gap down to start the trading day, the market managed to bottom early, fight back close to the neutral line before noon, and after about 2 hours of sideways action begin another ascent picking up short covering along the way to post some healthy gains by the close.

Earnings continue to be hit and miss, but the market is punishing some stocks in spite of reasonable earnings and outlooks given the current economic climate.

But as we saw, buyers stepped up after early selling pressure to take positions in beaten down stocks and sectors.

After their reports were issued late this afternoon, AAPL is trading 2.5% higher, while YHOO is 6.3% lower. So more mixed results, but AAPL knocked the socks off expectations, so it'll be interesting to see how the market reacts tomorrow.

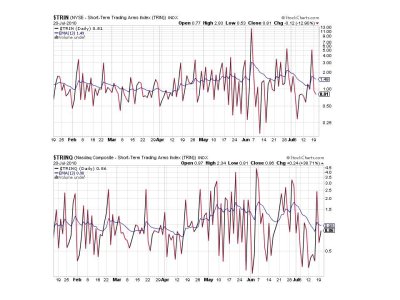

Here's tonight's charts:

All it took was some decent buying pressure and both NAMO and NYMO flipped back to buys today.

NAHL didn't quite make it back above its 6 day EMA, but it's darn close. NYHL remains on a buy from yesterday.

TRIN and TRINQ remain on buys.

BPCOMPQ also remains on a buy, but the bollinger bands are starting to tighten up. That's not a problem necessarily, but it shows a market that's a bit range bound at the moment.

So we have 6 of 7 signals flashing buys and the one sell signal is very close to its trigger point too. But the system remains on a buy regardless.

I'm still expecting the market to breakout to the upside, but more headfakes may be in store. See you tomorrow.