I said the market was not going to make things easy for either bulls or bears, and so far volatility has proven this so. Unfortunately, the bulls are losing ground in spite of the rallies. Today was certainly no exception and makes decision making more difficult as the seven sentinels issued a sell signal today. We are at the bottom of the rising channel and if we fall through that it could prove very difficult to get back to 1100 SPX. But if there is one thing this market has proven since March, it is its resilience to selling pressure. Have we reached the tipping point? I can't be sure. Is this going to be another case of following a sell signal only to get left behind again? It's possible, and I do think there is another rally left in this market, but it's too early to know.

When the market began rallying early in the trading day I was seriously considering selling a portion of my stock holdings into it. But the rally didn't even last until our cut-off time (which may have been a good thing if we bounce soon), so I decided to hold my position and see how things play out. However, I can't hold my position for too long given how the seven sentinels look right now.

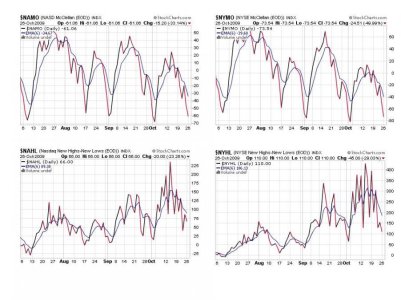

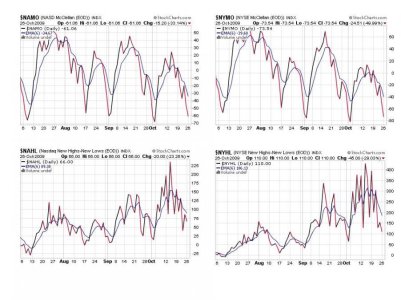

Here's the charts:

All four signals are in a sell condition here.

NAMO and NYMO are at the bottom of their range as measured over the last few months. If this market is to rally again, I would expect it to happen very soon.

NAHL and NYHL are also deteriorating, and are not too far from their lows of the past few months.

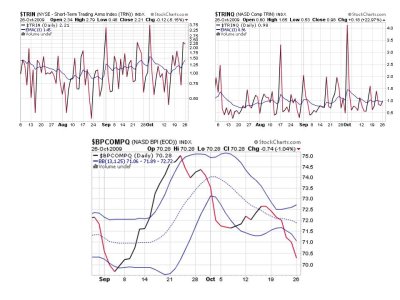

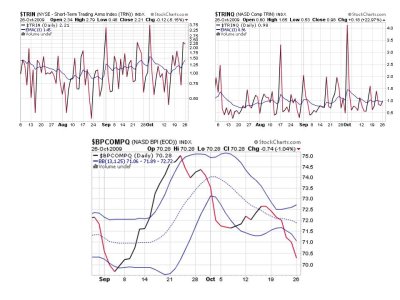

TRIN is still on sell and TRINQ turned to a sell today, but barely.

BPCOMPQ appears to be gaining a little downside momentum after today, however, and that is troubling.

So all seven signals are in sell mode, which triggers an intermediate term sell condition in the market. The system has seen this before in the recent past and been taken out of its position prematurely on more than one occasion. That is the only thing that is troubling me as far as following the sell signal. I cannot get out of the market until close of business tomorrow and we are oversold right now. Given the market's underlying bullish disposition since March, it would certainly not be out of the question for the market turn quickly again. I do have two new IFTs next Monday, which helps to a limited extent, but it depends on what the market does in the next few days.

I will be gauging sentiment between now and tomorrow morning. That will help me decide how I want to play this market right now. Risk is very high, but then that's how it was on previous rallies. I'll post in my account thread tomorrow morning what I plan to do next.

When the market began rallying early in the trading day I was seriously considering selling a portion of my stock holdings into it. But the rally didn't even last until our cut-off time (which may have been a good thing if we bounce soon), so I decided to hold my position and see how things play out. However, I can't hold my position for too long given how the seven sentinels look right now.

Here's the charts:

All four signals are in a sell condition here.

NAMO and NYMO are at the bottom of their range as measured over the last few months. If this market is to rally again, I would expect it to happen very soon.

NAHL and NYHL are also deteriorating, and are not too far from their lows of the past few months.

TRIN is still on sell and TRINQ turned to a sell today, but barely.

BPCOMPQ appears to be gaining a little downside momentum after today, however, and that is troubling.

So all seven signals are in sell mode, which triggers an intermediate term sell condition in the market. The system has seen this before in the recent past and been taken out of its position prematurely on more than one occasion. That is the only thing that is troubling me as far as following the sell signal. I cannot get out of the market until close of business tomorrow and we are oversold right now. Given the market's underlying bullish disposition since March, it would certainly not be out of the question for the market turn quickly again. I do have two new IFTs next Monday, which helps to a limited extent, but it depends on what the market does in the next few days.

I will be gauging sentiment between now and tomorrow morning. That will help me decide how I want to play this market right now. Risk is very high, but then that's how it was on previous rallies. I'll post in my account thread tomorrow morning what I plan to do next.