First the good news. The S&P 500's one-month low of 1294 held. The bad news is that it closed trade today below its 50-day moving average for the first time in six months.

There was no shortage of negative headlines either. But headlines aside, this market has been under pressure for at least 2 weeks. I have to wonder where the averages would be if it wasn't for QE2.

Among the headlines today, China reported a February trade deficit of about $7 billion, which caught analysts off guard. And Japan's fourth quarter GDP was revised downward 1.3%. That was the Asian side of the market. Then, Moody's downgraded Spain's debt and issued a negative outlook, and Germany's January trade balance fell to 10.1 billion euros.

On the domestic front, initial jobless claims came in at 397,000, which was a bit higher than the 382,000 that was expected, while the trade deficit widened to $46.3 billion, which was up from $40.3 billion in the previous month.

During today's trading session another report came out that indicated that shots were fired at protestors in Saudi Arabia. I don't know if that report was verified or not, but that's not the kind of news the market wants to hear. In spite of that headline however, oil prices fell 1.6% overall to $102.70 per barrel.

I had expected that given the degree of selling pressure today the Seven Sentinels would finally roll over to a sell signal. After reviewing them I can say that while they didn't quite achieve a sell signal, they are hanging by thread. Here's the charts:

NAMO and NYMO fell hard today and remained on sells. Also, NYMO hit a 28 day trading low.

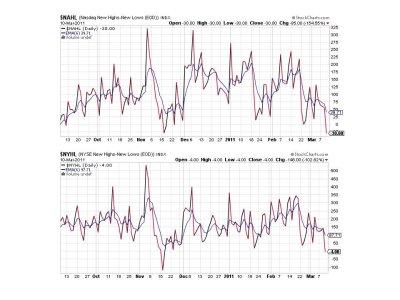

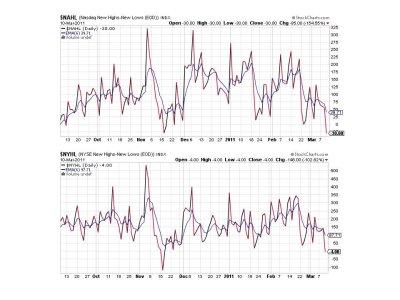

NAHL and NYHL also fell hard are flashing sells.

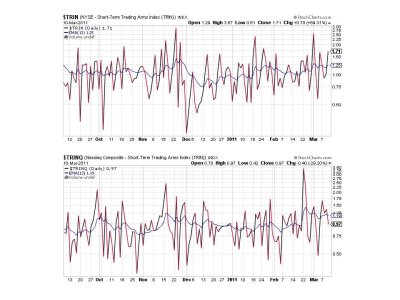

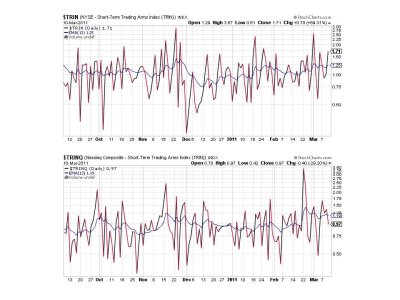

TRIN spiked higher and is on a sell, while somehow TRINQ managed to fall and remains on a buy.

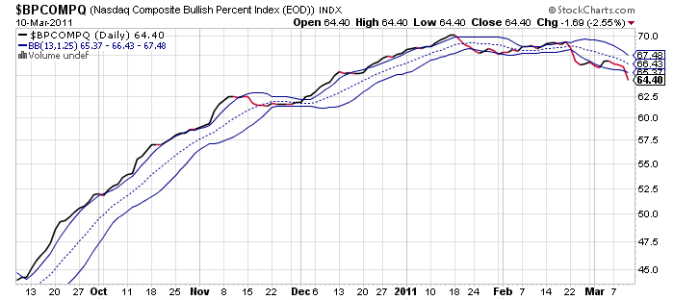

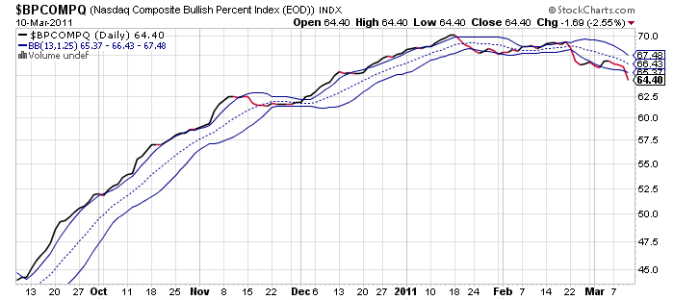

BPCOMPQ took a decided turn lower today and rolled over to a sell.

I am really surprised that I didn't get a confirmed sell signal today. NYMO hit a 28-day trading low and BPCOMPQ spiked lower to flip to a sell. It's only TRINQ that keeps the system on a buy.

I had mentioned a few blogs ago that given the volatile nature of this market, the Seven Sentinels will probably not give me a sell signal as quickly as I'd like should the market make a decided move lower. This is because the system is not designed to bob and weave in and out of the market on short term trading cycles. It is an intermediate term system that tries to discern market direction over weeks and months at a time. It troubles me that a sell didn't get initiated today, but that doesn't mean it won't happen in the days ahead.

We're oversold in the short term now, so a bounce might happen as soon as tomorrow. I have been very careful not to get too bearish given the high liquidity levels being injected by the Fed, but today's action tells me that getting defensive is probably a prudent thing to do. I am already 50% G fund myself and won't take anything else off the table given I've only got one more IFT and too much time left before April 1st.

There was no shortage of negative headlines either. But headlines aside, this market has been under pressure for at least 2 weeks. I have to wonder where the averages would be if it wasn't for QE2.

Among the headlines today, China reported a February trade deficit of about $7 billion, which caught analysts off guard. And Japan's fourth quarter GDP was revised downward 1.3%. That was the Asian side of the market. Then, Moody's downgraded Spain's debt and issued a negative outlook, and Germany's January trade balance fell to 10.1 billion euros.

On the domestic front, initial jobless claims came in at 397,000, which was a bit higher than the 382,000 that was expected, while the trade deficit widened to $46.3 billion, which was up from $40.3 billion in the previous month.

During today's trading session another report came out that indicated that shots were fired at protestors in Saudi Arabia. I don't know if that report was verified or not, but that's not the kind of news the market wants to hear. In spite of that headline however, oil prices fell 1.6% overall to $102.70 per barrel.

I had expected that given the degree of selling pressure today the Seven Sentinels would finally roll over to a sell signal. After reviewing them I can say that while they didn't quite achieve a sell signal, they are hanging by thread. Here's the charts:

NAMO and NYMO fell hard today and remained on sells. Also, NYMO hit a 28 day trading low.

NAHL and NYHL also fell hard are flashing sells.

TRIN spiked higher and is on a sell, while somehow TRINQ managed to fall and remains on a buy.

BPCOMPQ took a decided turn lower today and rolled over to a sell.

I am really surprised that I didn't get a confirmed sell signal today. NYMO hit a 28-day trading low and BPCOMPQ spiked lower to flip to a sell. It's only TRINQ that keeps the system on a buy.

I had mentioned a few blogs ago that given the volatile nature of this market, the Seven Sentinels will probably not give me a sell signal as quickly as I'd like should the market make a decided move lower. This is because the system is not designed to bob and weave in and out of the market on short term trading cycles. It is an intermediate term system that tries to discern market direction over weeks and months at a time. It troubles me that a sell didn't get initiated today, but that doesn't mean it won't happen in the days ahead.

We're oversold in the short term now, so a bounce might happen as soon as tomorrow. I have been very careful not to get too bearish given the high liquidity levels being injected by the Fed, but today's action tells me that getting defensive is probably a prudent thing to do. I am already 50% G fund myself and won't take anything else off the table given I've only got one more IFT and too much time left before April 1st.