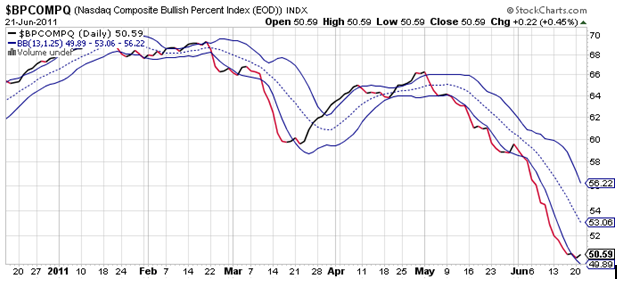

Yesterday I tried to convey a bullish bias that I believed the charts were suggesting, although some charts were decidedly bearish (NAHL, NYHL, and BPCOMPQ). I didn't want to go too far out on limb though as this market was not moving higher in a convincing fashion. Today was a bit more convincing as the S&P 500 jumped +1.34%, while the DOW and Nasdaq posted 0.92% and 2.19% gains respectively.

Perhaps the big money is finally front running the FOMC announcement tomorrow, or maybe they know the situation in Greece is about to receive temporary relief, but something made them turn the risk on, risk off trade back off again. This evening, the latest chapter in the Greece financial debacle is the vote of confidence for the country's prime minister, which is anticipated to tun out positively. And the vote did in fact favor the Prime Minister.

Next up is the FOMC announcement.

Here's the charts:

Huge move higher in both NAMO and NYMO today. Both are now back in positive territory with room to move higher still. And NYMO is within striking distance of making a 28 day trading high.

Yesterday, NAHL and NYHL were flashing buys, but they were weak buys. They just didn't seem to be confirming recent market strength. Today, they spiked a bit higher and appear much more bullish.

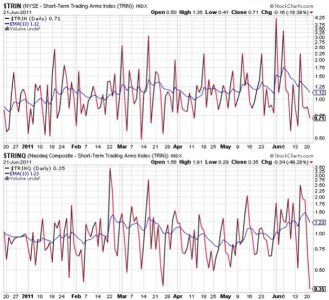

TRIN and TRINQ were suggesting a rally yesterday (in conjunction with the NAMO/NYMO signals), and we got that in spades today. Now they are suggesting a very overbought market in the short term. I would expect weakness very soon just based on these two signals alone. But that weakness doesn't have to be severe, it only has to be enough to work off this overbought condition.

BPCOMPQ finally made a more convincing move to the upside today, but it's still not particularly impressive. But then again, if we are about to move from an intermediate term sell signal to an intermediate term buy signal, it may simply be the start of a sustained move higher.

So all signals remain in a buy condition, but NYMO has not confirmed a buy signal yet with a 28 day trading high. But it's much closer today than it was yesterday. Can we get more follow through action to the upside? Of course we can, but given QE2 is ending next week, anything can happen. Tomorrow's FOMC announcement may help clear some of the mystery surrounding the Fed in terms of what they'll do next, but I wouldn't hold my breath for them to actually tip their hand. And there's no shortage of other headline issues that continue to plague our economic recovery either. But sentiment has been supportive of this latest rally. If bearishness can persist we have a better chance to see a sustained move higher. If not, we'll probably reverse at some point and head back down.

My guess is that we move higher for another day or so, but I'm not convinced this market can hold onto its recent gains much longer than that. With NAMO and NYMO hitting the upper end of their multi-month range as well as TRIN and TRINQ showing a very overbought market, higher prices may be too much to ask for. But we'll know the answer to that soon enough.