I'd been saying that OPEX week tends to be supportive of the overall market and that we should see some measure of a rally this week in spite of the selling pressure that market has endured the past few trading days. After today's gains in the broader market, most of the losses since Monday have been erased. And not only did we get a rally, it stuck. My guess was it would be sold, but on that count I was wrong. Of course there's always tomorrow.

Moving on, the biggest non-event of the day would have to be the Fed's FOMC minutes, which were released at 2 p.m. EST. No real surprises were forthcoming, but the minutes did have a hawkish bias. But the market took it all in stride. And the media had its take as well on what to expect from the Fed as we move forward, which you can get a flavor of here.

Commodities were a big part of today's rebound too as oil prices climbed more than 3% to close above $100 per barrel, while the CRB Commodity Index was up 2.3%.

Now let's see how much improvement we got out of today's charts:

We certainly got some improvement here with NAMO and NYMO lifting back up above their respective 6 day EMAs. Both are now flashing buys.

NAHL and NYHL also improved. Both are sitting on their respective 6 day EMAs. I suppose they're close enough to consider them buy signals for the moment.

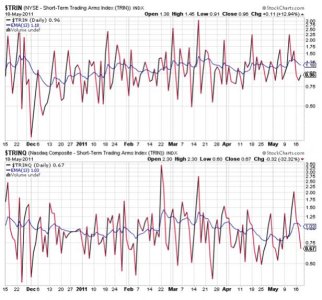

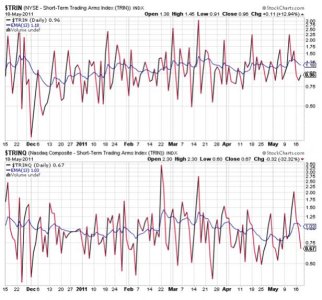

TRIN and TRINQ remain in buy conditions from yesterday.

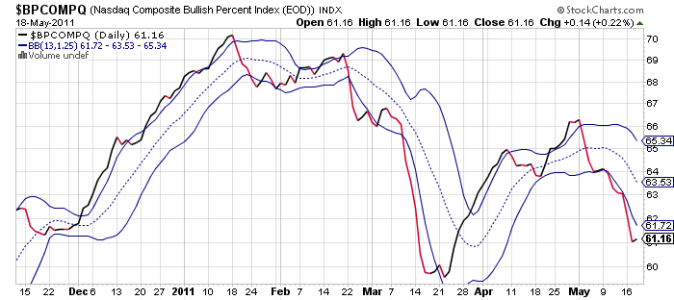

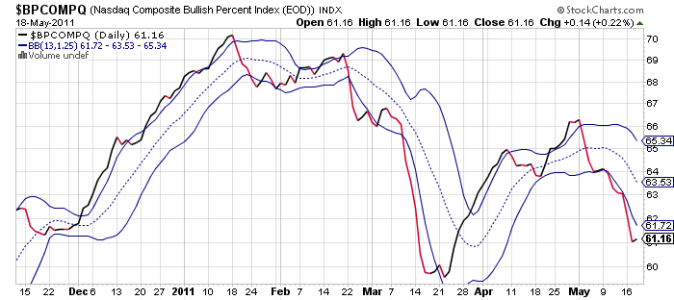

BPCOMPQ eked a bit higher and broke that freefall today. But it remains in a sell condition. This signal suggests we may go lower yet, even if we rally a bit more in the meantime.

So all but one signal are flashing buys, which keeps the system in a buy condition. But it's too early to say whether we'll get any follow-through action the balance of this week. I doubt we've seen the last of the selling pressure, but between the market's comeback rally yesterday and today's healthy gains, I'm not quite as bearish as I was in the short term. But I am wary. I'm thinking this rally gets sold at some point and the market probes lower over the coming weeks with rallies thrown in here and there. No doubt it'll be tricky picking entry and exit points if one is inclined to try and buy low and sell high.

Moving on, the biggest non-event of the day would have to be the Fed's FOMC minutes, which were released at 2 p.m. EST. No real surprises were forthcoming, but the minutes did have a hawkish bias. But the market took it all in stride. And the media had its take as well on what to expect from the Fed as we move forward, which you can get a flavor of here.

Commodities were a big part of today's rebound too as oil prices climbed more than 3% to close above $100 per barrel, while the CRB Commodity Index was up 2.3%.

Now let's see how much improvement we got out of today's charts:

We certainly got some improvement here with NAMO and NYMO lifting back up above their respective 6 day EMAs. Both are now flashing buys.

NAHL and NYHL also improved. Both are sitting on their respective 6 day EMAs. I suppose they're close enough to consider them buy signals for the moment.

TRIN and TRINQ remain in buy conditions from yesterday.

BPCOMPQ eked a bit higher and broke that freefall today. But it remains in a sell condition. This signal suggests we may go lower yet, even if we rally a bit more in the meantime.

So all but one signal are flashing buys, which keeps the system in a buy condition. But it's too early to say whether we'll get any follow-through action the balance of this week. I doubt we've seen the last of the selling pressure, but between the market's comeback rally yesterday and today's healthy gains, I'm not quite as bearish as I was in the short term. But I am wary. I'm thinking this rally gets sold at some point and the market probes lower over the coming weeks with rallies thrown in here and there. No doubt it'll be tricky picking entry and exit points if one is inclined to try and buy low and sell high.