It would be so easy to be bearish right now. Too easy. We had a hard down day the past Friday and Monday's bounce was anemic on relatively low volume. Futures point decidedly lower as I write this.

Earnings have been hit and miss to some extent, but considering all the doom and gloom out there they're pretty decent overall.

On the surface, the charts look bearish too. At least if you look at the pattern of the past few months they do. Rally fast and hard, drop faster and harder, rinse, repeat. We would seem to be on the verge of yet another big dive.

I don't know if that will in fact happen and the market moves too fast for me sitting in this Model T Ford of an account. It's been a market that if you're in, it may be best to stay in to keep from selling low only to see the market move right back up again. If you're out of the market already, that's probably not a bad place to be. Every financial advisor worth his/her salt will tell you that nothing is guaranteed in the market and past performance is no guarantee of future performance either. Yep. I can relate.

So if you have that deer-in-the-headlight stare as this market wildly gyrates, you've got plenty of company.

Let's take a look at the charts:

We're still on a sell with these two signals, but we're not too far below the trigger point should this market decide to move higher again.

Same thing with NAHL and NYHL except NYHL managed to just barely flip to a buy today.

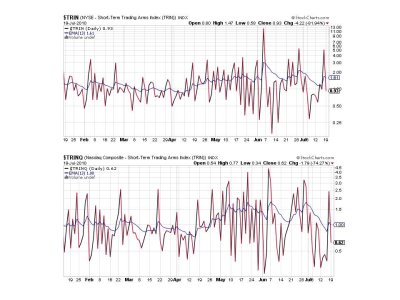

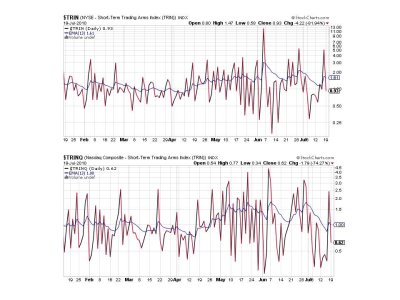

TRIN and TRINQ moved back to buys today.

And this is the signal that makes me a bit cautious. The step ladder pattern seems to be continuing with yet another preciptious drop seemingly on the way.

If it wasn't for such bearish sentiment, I'd embrace that scenario. And even if this signal does move lower, the SS may not trigger a sell signal.

So I wait.

For now we have 3 of 7 signals on a buy, which keeps the system on a buy. Still 100% S fund for now.

Earnings have been hit and miss to some extent, but considering all the doom and gloom out there they're pretty decent overall.

On the surface, the charts look bearish too. At least if you look at the pattern of the past few months they do. Rally fast and hard, drop faster and harder, rinse, repeat. We would seem to be on the verge of yet another big dive.

I don't know if that will in fact happen and the market moves too fast for me sitting in this Model T Ford of an account. It's been a market that if you're in, it may be best to stay in to keep from selling low only to see the market move right back up again. If you're out of the market already, that's probably not a bad place to be. Every financial advisor worth his/her salt will tell you that nothing is guaranteed in the market and past performance is no guarantee of future performance either. Yep. I can relate.

So if you have that deer-in-the-headlight stare as this market wildly gyrates, you've got plenty of company.

Let's take a look at the charts:

We're still on a sell with these two signals, but we're not too far below the trigger point should this market decide to move higher again.

Same thing with NAHL and NYHL except NYHL managed to just barely flip to a buy today.

TRIN and TRINQ moved back to buys today.

And this is the signal that makes me a bit cautious. The step ladder pattern seems to be continuing with yet another preciptious drop seemingly on the way.

If it wasn't for such bearish sentiment, I'd embrace that scenario. And even if this signal does move lower, the SS may not trigger a sell signal.

So I wait.

For now we have 3 of 7 signals on a buy, which keeps the system on a buy. Still 100% S fund for now.