06/25/25

Stocks took Monday's positive reversal day and tacked on a follow through day with a second straight 1% gain in the major indices. The I-fund and the small caps of the S-fund both gained closer to 1.5% on the day. Oil dropped another 5% yesterday, falling to a level that we saw before the Israel and Iran missiles started flying. The 10-year yield closed at a 7-week low pushing the F-fund higher.

(The most current commentary is always posted here: www.tsptalk.com/comments.php)

The ducks are lining up nicely for the stock market with liquidity still favoring buying assets in general. An interest cut is a matter of when, not if. The weak June seasonality period is just about over. July has become one of, if not the best month of the year for stocks in recent years - overtaking December. Investors are still underinvested with plenty of cash on hand and they are not very bullish as they don't trust what is going on, which is not a bad thing. Oil just fell $14 a barrel (peak to trough) in two days, and that's because of the potential cease-fire in the Middle East.

Are stocks overvalued? Maybe, but that's not what stops a bull market. Extreme valuations can stop a market but it usually takes a monetary event to change the trend. The market is not currently extremely overvalued, maybe just fully valued.

If there is a concern it is that the S&P 500 (C-fund) is flirting with the all-time highs and there is a tendency for charts to stall or pullback at double tops. However there is a lot of support below because of the month long consolidation we just went through, so any pullback may be modest. The gap that opened on Tuesday morning now becomes a possible pullback target if the double top is going to add some pressure.

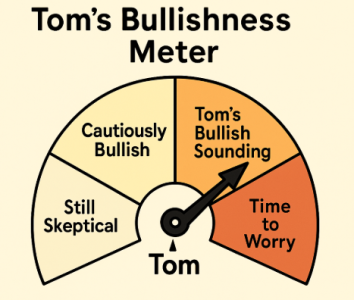

Another concern is how bullish I sound. The more people you start hear talking like I am talking right now, that's when we should be worried. But I haven't really been hearing that too broadly yet.

If anything it has been the opposite, and depending on party affiliation, sentiment can be quite bearish. Again, that's not a bad thing. Check out this Gallop poll that came out a few days ago...

When we see any sentiment-type charts with this much skepticism, it tends to mean that there is plenty of cash on the sidelines to continue to feed the markets. It was the republicans that were very bearish in 2023 and the C-fund (S&P 500) gained 26% that year. In 2019, the last time the democrats were extremely bearish, the C-fund (S&P 500) gained 31%.

The 10-year Treasury Yield fell again, and this time closed near the lows of the day making it two closes below the red channel that we have been watching for many weeks. Like the tariff tantrum, the military action in the Middle East contributed to the break down. Now we need to see if it holds this time. The prior two breakdowns climbed back up just as quickly as they fell. The market doesn't need it to come down, but keeping it from rising is better than falling.

The dollar also fell again and here it is testing the lower end of its two month double, now triple, bottom low. It looks like it wants to fall further and with liquidity the way it is, it just may do it this time. I don't know how great that is for the US financial system strength, but it is good news for stocks and other assets.

Oil fell sharply again yesterday - right back into the area it was before the heightened Middle East military action. It looks like there is support in the 63 - 64 area, but if this can stay below 70, the stock market shouldn't get too concerned, however the stock market is always looking for a catalyst and the ups and downs in oil over the next couple of weeks could become part of the catalyst again.

The Dow Transportation Index bounce strongly off its 50-day EMA again this week as it looks to break above that resistance in the 15,250 area. However, FedEx was down after reporting earnings last night and that may add some pressure here today.

Consumer Confidence came in weaker than expected, 93.0 vs. 99.0 expected, and 98.4 the prior month. I'm sure the volatility in the Middle East played a part. On Thursday we'll get a GDP estimate, and on Friday key inflation data in the PCE Prices and Personal Income and Spending reports. PCE is the Fed's favorite inflation indicator.

The DWCPF / S-fund gave us the fake out on on the downside on Monday morning, then the reversal later that day, and yesterday the rebound continued and it made a multi-month closing high. As I mentioned yesterday, these formations often breakout after the fake out on the opposite side.

A longer-term view shows a breakout above descending resistance off the all-time highs.

The ACWX (I-fund) had a big day thanks to that 0.51% decline the dollar yesterday, and of course the rally in global stocks following the cease fire and sharp decline in oil prices.

BND (bonds / F-fund) had a big day and it is in the process of filling in a gap that opened back in early April. The support below looks firm but this could now start to consolidate for a while between 72.75 and 73.75.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

Stocks took Monday's positive reversal day and tacked on a follow through day with a second straight 1% gain in the major indices. The I-fund and the small caps of the S-fund both gained closer to 1.5% on the day. Oil dropped another 5% yesterday, falling to a level that we saw before the Israel and Iran missiles started flying. The 10-year yield closed at a 7-week low pushing the F-fund higher.

(The most current commentary is always posted here: www.tsptalk.com/comments.php)

| Daily TSP Funds Return

More returns |

The ducks are lining up nicely for the stock market with liquidity still favoring buying assets in general. An interest cut is a matter of when, not if. The weak June seasonality period is just about over. July has become one of, if not the best month of the year for stocks in recent years - overtaking December. Investors are still underinvested with plenty of cash on hand and they are not very bullish as they don't trust what is going on, which is not a bad thing. Oil just fell $14 a barrel (peak to trough) in two days, and that's because of the potential cease-fire in the Middle East.

Are stocks overvalued? Maybe, but that's not what stops a bull market. Extreme valuations can stop a market but it usually takes a monetary event to change the trend. The market is not currently extremely overvalued, maybe just fully valued.

If there is a concern it is that the S&P 500 (C-fund) is flirting with the all-time highs and there is a tendency for charts to stall or pullback at double tops. However there is a lot of support below because of the month long consolidation we just went through, so any pullback may be modest. The gap that opened on Tuesday morning now becomes a possible pullback target if the double top is going to add some pressure.

Another concern is how bullish I sound. The more people you start hear talking like I am talking right now, that's when we should be worried. But I haven't really been hearing that too broadly yet.

If anything it has been the opposite, and depending on party affiliation, sentiment can be quite bearish. Again, that's not a bad thing. Check out this Gallop poll that came out a few days ago...

When we see any sentiment-type charts with this much skepticism, it tends to mean that there is plenty of cash on the sidelines to continue to feed the markets. It was the republicans that were very bearish in 2023 and the C-fund (S&P 500) gained 26% that year. In 2019, the last time the democrats were extremely bearish, the C-fund (S&P 500) gained 31%.

The 10-year Treasury Yield fell again, and this time closed near the lows of the day making it two closes below the red channel that we have been watching for many weeks. Like the tariff tantrum, the military action in the Middle East contributed to the break down. Now we need to see if it holds this time. The prior two breakdowns climbed back up just as quickly as they fell. The market doesn't need it to come down, but keeping it from rising is better than falling.

The dollar also fell again and here it is testing the lower end of its two month double, now triple, bottom low. It looks like it wants to fall further and with liquidity the way it is, it just may do it this time. I don't know how great that is for the US financial system strength, but it is good news for stocks and other assets.

Oil fell sharply again yesterday - right back into the area it was before the heightened Middle East military action. It looks like there is support in the 63 - 64 area, but if this can stay below 70, the stock market shouldn't get too concerned, however the stock market is always looking for a catalyst and the ups and downs in oil over the next couple of weeks could become part of the catalyst again.

The Dow Transportation Index bounce strongly off its 50-day EMA again this week as it looks to break above that resistance in the 15,250 area. However, FedEx was down after reporting earnings last night and that may add some pressure here today.

Consumer Confidence came in weaker than expected, 93.0 vs. 99.0 expected, and 98.4 the prior month. I'm sure the volatility in the Middle East played a part. On Thursday we'll get a GDP estimate, and on Friday key inflation data in the PCE Prices and Personal Income and Spending reports. PCE is the Fed's favorite inflation indicator.

The DWCPF / S-fund gave us the fake out on on the downside on Monday morning, then the reversal later that day, and yesterday the rebound continued and it made a multi-month closing high. As I mentioned yesterday, these formations often breakout after the fake out on the opposite side.

A longer-term view shows a breakout above descending resistance off the all-time highs.

The ACWX (I-fund) had a big day thanks to that 0.51% decline the dollar yesterday, and of course the rally in global stocks following the cease fire and sharp decline in oil prices.

BND (bonds / F-fund) had a big day and it is in the process of filling in a gap that opened back in early April. The support below looks firm but this could now start to consolidate for a while between 72.75 and 73.75.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.