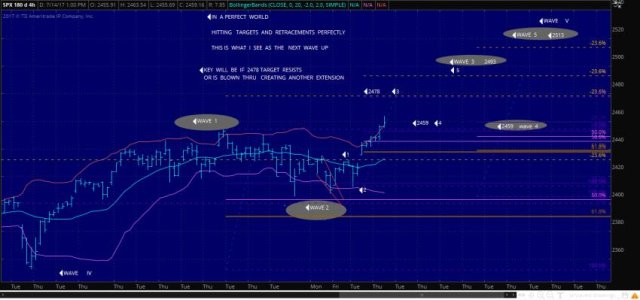

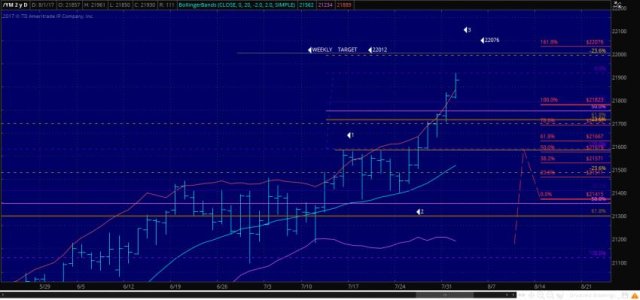

What an interesting week. If SPX exceeds 2454 tomorrow, it's likely to hit north of 2470. But part of me thinks this could be a bull trap. Why, I don't know. Perhaps we because we haven't gone north of 2456 which occurred around June 21st. This market has incrementally moved up since the pullback to 2416 and has sucked in buyers. All the blogs I'm reading are VERY BULLISH. Also the SPX closed above 2438 which is bullish. The Trend Is Your Friend and all that. So, if we pull back, looking at resistance at 2428 and 2411. If we exceed 2456, looks like new ATH's are possible.

FS