DA END>>>

The top 3 reasons include, loss of income, excessive obligations, and unemployment. Basically the job market! You will not solve housing without having a solid employment base. Some people have asked me why doesn’t Wall Street and the government see this? They do. They just don’t care. Their assumption is that if Wall Street is raining, somehow some little drops will sprinkle on the poor typical American. Ask the 27 million unemployed and underemployed how happy they are that the S&P 500 is now up 62 percent from the March low. Lagging indicator? To the point of lagging you out of a decade.

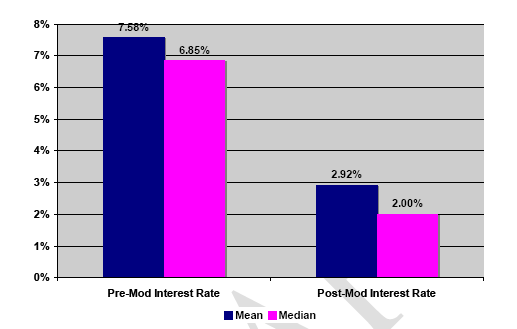

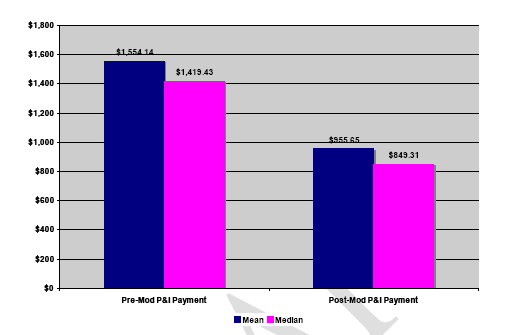

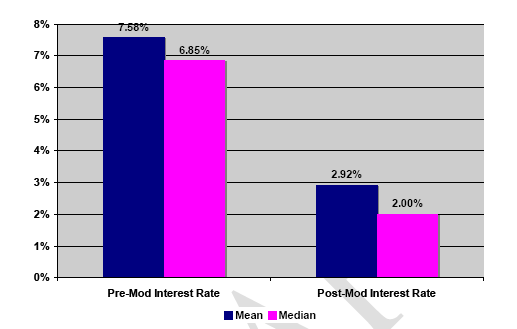

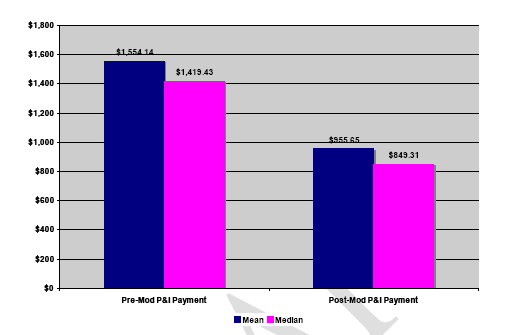

And let us look at the data of what is being done. This is the actual ruse of the HAMP mods. It is extend…

And pretend…

The loan rate is only low for a fixed time. The principal is fully intact allowing banks to claim these loans at full face value which is a crock. Without the HAMP government subsidy, these loans would need to be foreclosed. I have no problem working with homeowners only if the banks fit the bill. Yet they are so corrupt and cynical that they want the money for the mods to come from the government! Bail us out and then pay for the mods. What a load of insanity. Seriously? Enough of this and let the trials begin. It looks like a couple of hedge fund gurus are being taken down with more to follow. I’ve sent letters to Congress, called up representatives, and some agree but the sense I got from many is “what can I do?.”

Also looking at the extend and pretend, you can’t modify property taxes and insurance. These are based on the assessed value of the home which according to the bank is still up in the peak ranges. What horrible policy.

The OCC and OTS have some more data in other types of modifications:

The same kind of pattern emerges as the 1,711 HAMP mods. That is, extend the term and pretend to lower the rate for a few years. You can also capitalize some of the principal on the back end rendering many of these

option ARM-lites. That is why the re-default rates are through the roof. I imagine the HAMP re-default rates will be equally high. You saw the reason for payment problems. You didn’t see, “because my payment was too high” but more employment based. For those that saw reductions in their income, what if they lose their job? This is basically underwriting ala 2005 again.

People ask then what is really the solution? I’ve said it many times but you can’t have an economy without job growth. This sounds obvious but it would appear to be off the radar for Wall Street and our government. If you focus on the job situation, then housing will right itself. Notice that 1991 recession and foreclosures? What happened? Well we had the technology boom and added 20 million jobs over the decade. That was a bubble and that burst but you can see that yes, you can have an economy that runs outside of housing. But this decade housing was the economy. And the government and Wall Street basically want that industry back. Well it isn’t coming back. They need to figure out what to do.

And there is nothing wrong with renting! In fact, it is a shame that there is no actual initiative encouraging renting. Some of these people in distress will do much better to downsize. They are even telling the HAMP mod survey that they are financially strained. Maybe renting a lower priced home will help. Nothing wrong with that until you land on your feet again. Yet this notion that everyone deserves to own a home is largely a reason we are in this mess. Wall Street exploited this “American” desire and people ate it up. In fact, the dream was no longer to own a modest home but to own some oversized McMansion and drive a gigantic V-10 tank that got 8 miles per gallon. When did the American Dream become a Marvel Comic?

Some suggestions are to bring back our industrial base to the U.S. Make ourselves more competitive. Flipping homes to one another while quant jocks play Halo on one screen and do billion dollar trades on another Bloomberg Terminal is not a real economy. It basically strips the value out of the real economy. These banks posting record profits?

JP Morgan making $3.6 billion last quarter. Really? Most of it was through their i-banking and private equity division. If they want to act like a hedge fund so be it but they have zero access to the

Fed and U.S. Treasury. Instead, they are a primary dealer.

Healthcare is a big part of our economy and will remain that way with over 70 million baby boomers entering retirement age. Surely we can create some jobs in this arena. At least it is better than installing granite countertops in every home and adding Jacuzzis and pretending we are keeping up with technological innovations of other countries. In large part, housing has become a major distraction. It is a cultural neurosis like Tulip Mania or watching UFOs on TV taking away a kid but in the end, it is all fake. The equity in these California homes was fake. The Wall Street profits were a sham. So until we can return to a real economy, focusing on housing only serves as a form of therapy.