-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Exnavyew's Account Talk

- Thread starter exnavyew

- Start date

exnavyew

TSP Pro

- Reaction score

- 361

Note: I've personally saved this link because the data is updated daily (minus weekends).

Just FYI.

Just FYI.

DreamboatAnnie

TSP Legend

- Reaction score

- 849

Great chart link. Thank you!!!

exnavyew

TSP Pro

- Reaction score

- 361

exnavyew

TSP Pro

- Reaction score

- 361

Sheesh.

Contact Gold Corp. (CGOL)

Other OTC - Other OTC Delayed Price. Currency in USD

0.0700+0.0698 (+34,900.00%)At close: 3:59PM EDT

https://finance.yahoo.com/quote/CGOL?p=CGOL

Contact Gold Corp. (CGOL)

Other OTC - Other OTC Delayed Price. Currency in USD

0.0700+0.0698 (+34,900.00%)At close: 3:59PM EDT

https://finance.yahoo.com/quote/CGOL?p=CGOL

exnavyew

TSP Pro

- Reaction score

- 361

exnavyew

TSP Pro

- Reaction score

- 361

Bleak picture. Time to short the market?

https://www.yahoo.com/finance/news/...retail-sales-coronavirus-covid-161034344.html

https://www.yahoo.com/finance/news/...retail-sales-coronavirus-covid-161034344.html

- Reaction score

- 821

Bleak picture. Time to short the market?

https://www.yahoo.com/finance/news/...retail-sales-coronavirus-covid-161034344.html

You read the report and it sounds like everyone is surprised at the negative numbers. Why are you surprised when these businesses are closed and everyone is stuck at home. Now you are seeing protesters wanting to open up their state. I bet they don't have a friend or relative affected by the virus. Yes, people are suffering economically and that stinks, but if our politicians don't do it right the death toll will be worse and the economy will be worse than it is now. I love the folks that say lets get back to normal and just deal with the ones that die, so what.

Sorry, off my soapbox. I guess I just had to vent.

Whipsaw

Market Veteran

- Reaction score

- 239

I get annoyed as more and more this virus seems very similar to a bad flu, some are effected worse than others and that is a small percentage. Healthy folks need to get back to work, deal with the virus if they get it. Immunity needs to build within our population, there's no way to avoid it; a vaccine will accelerate that, but there is no way to not get it. So far, excess capacity has been built into the hospitals, but its going unused due to bogus models and estimates on impact.

DreamboatAnnie

TSP Legend

- Reaction score

- 849

TNA would be one ETF that tracks the Russel 2000 index (RUT), but TNA is leveraged 3x, so gains and losses are multiplied by that. The inverse is TZA.

There is also another ETF... Blackrock iShares Russel 2000 ETF (symbol IWM).

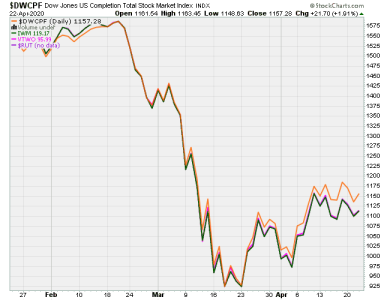

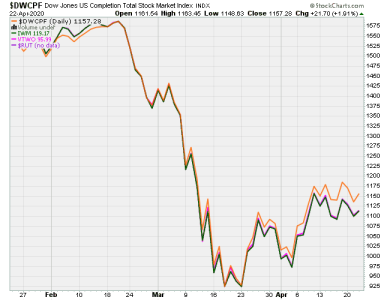

Here is comparison. You can see all three are different, but the DWCPF index and Russell 2000 IWM ETF are pretty close. Vanguard also has an ETF that tracks it.

There is also another ETF... Blackrock iShares Russel 2000 ETF (symbol IWM).

Here is comparison. You can see all three are different, but the DWCPF index and Russell 2000 IWM ETF are pretty close. Vanguard also has an ETF that tracks it.

Last edited:

exnavyew

TSP Pro

- Reaction score

- 361

TNA would be one ETF that tracks the Russel 2000 index (RUT), but TNA is leveraged 3x, so gains and losses are multiplied by that. The inverse is TZA.

There is also another ETF... Blackrock iShares Russel 2000 ETF (symbol IWM).

Here is comparison. You can see all three are different, but the DWCPF index and Russell 2000 IWM ETF are pretty close. Vanguard also has an ETF that tracks it.

View attachment 45978

Thanks a lot DBA!!! :arms:

DreamboatAnnie

TSP Legend

- Reaction score

- 849

Your welcome! And I couldn't help myself...Here is comparison of DWCPF (S fund) plus TWO ETFs that track the Russell 2000, Blackrock's IWM and Vanguards VTWO. Curiosity...just had to see how close they track. Only DWCPF is different. The two ETFs are on top of each other. I tried to compare RUT as well but no data shown??? In any case, those ETFs track DWCPF very closely!:smile:

Attachments

Last edited:

exnavyew

TSP Pro

- Reaction score

- 361

With the COVID pandemic I expected the market to go down in general. (Missed it in March maybe?) It sure seems like Wall Street is disconnected from Main Street and I keep looking for an explanation when I ran across the article below which is only partially helpful. COVID isn't going away soon so I'm still waiting for the 'crash'.

[h=1]Opinion: Why it’s not so crazy that stocks are rising even though 26 million people are out of work[/h]

https://www.marketwatch.com/story/w...t-of-work-2020-04-23?siteid=yhoof2&yptr=yahoo

[h=1]Opinion: Why it’s not so crazy that stocks are rising even though 26 million people are out of work[/h]

https://www.marketwatch.com/story/w...t-of-work-2020-04-23?siteid=yhoof2&yptr=yahoo

exnavyew

TSP Pro

- Reaction score

- 361

rangerray

TSP Pro

- Reaction score

- 209

Yep.

exnavyew

TSP Pro

- Reaction score

- 361

The market seems to have a mind of it's own so am clueless how this news will be received. FWIW:

[h=1]First quarter 2020 GDP: U.S. economy contracted for the first time in six years[/h]

https://www.yahoo.com/finance/news/...-activity-coronavirus-pandemic-155756514.html

[h=1]First quarter 2020 GDP: U.S. economy contracted for the first time in six years[/h]

https://www.yahoo.com/finance/news/...-activity-coronavirus-pandemic-155756514.html

exnavyew

TSP Pro

- Reaction score

- 361

Dude

[h=1]Shell cuts dividend for first time since second world war[/h]

https://finance.yahoo.com/m/3dc5d590-1a32-36a6-a027-aff86cbc2353/shell-cuts-dividend-for-first.html

[h=1]Shell cuts dividend for first time since second world war[/h]

https://finance.yahoo.com/m/3dc5d590-1a32-36a6-a027-aff86cbc2353/shell-cuts-dividend-for-first.html

Similar threads

- Replies

- 0

- Views

- 146