-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

EricDeLee's account talk

- Thread starter EricDeLee

- Start date

rcknfrewld

TSP Pro

- Reaction score

- 8

I got in and out of the I fund this week...went half in one day, other half the next day and then sold for a 3% gain the next day...that's chump change though with my account not quite 6 figures... i try and talk myself into going long in the I because it has plenty of room to breathe...but I always chicken out...the market will always go up over time, but not in this rocket ride fashion...birch is always gonna preach to buy because in the long term he is right...the market might crash 30% and he will say buy and he will be right because over time the market eventually makes new highs...the key is to recognize a possible top and move to safety...and then jump back in when you feel a bottom... the thing is you never, in the moment, realize what the top or bottom is...only in hindsight can you pinpoint those moments...birch's strategy of buy and hold can be ridiculed and laughed at...you might say that his method is an easy way to avoid making hard choices, when to buy when to sell when to buy back again, but if you think about it, he has made the most difficult decision you can make, being disciplined...the hardest thing to be in the markets and in life, is disciplined...from my experiences the disciplined are rewarded...

EricDeLee

Market Tracker

- Reaction score

- 2

I got in and out of the I fund this week...went half in one day, other half the next day and then sold for a 3% gain the next day...that's chump change though with my account not quite 6 figures...

Okay... How do you go about making a move like that to sell for a gain. How does that work? In your case, you gained 3% in a few days and then jumped back to safety?

Do I understand it correctly that had I done the following I could have reaped an additional profit: started the month 100 S Fund. On the 11th, do an IFT for 100% I Fund, then if it posts a quick gain, two days later or so, jump back in and do another IFT to move all back into S Fund.

I suppose that's a guessing game, but a way to guarantee you capture that percentage gain, like you did ... Right?

rcknfrewld

TSP Pro

- Reaction score

- 8

if you are going to jump in and out of the I fund do some research...read all of ebbnflow's account...he knows about the I fund and fair value...ideally you want to buy the I on a down day with negative fair value...then hopefully it will bounce back the next day or two with an up day with positive fair value...if you track the I fund for a while you will get a feel for how the fund will end up that day...it's tough to pick your spot because you only get one chance to do it...move to I then back to G...2 IFT right there...also click on that MSCI link on ebbnflow's account posts...

EricDeLee

Market Tracker

- Reaction score

- 2

if you are going to jump in and out of the I fund do some research...read all of ebbnflow's account...he knows about the I fund and fair value...ideally you want to buy the I on a down day with negative fair value...then hopefully it will bounce back the next day or two with an up day with positive fair value...if you track the I fund for a while you will get a feel for how the fund will end up that day...it's tough to pick your spot because you only get one chance to do it...move to I then back to G...2 IFT right there...also click on that MSCI link on ebbnflow's account posts...

But essentially, you could do the following (which is like 3 IFTs) right?

1st of the month, you are still invested 100% S Fund

5th of the month, you do IFT for 100% I Fund

8th of the month, I fund goes up, you pop a 2% increase and do an IFT for 100% back to S Fund.

18th of the month, things look rocky. You throw everything into the G Fund and squat and hold until the outlook is better.

Rinse and spit, retry later on.

If I read right, you could esentially throw everything back to the G Fund, as long as you are not increasing any other of the funds. It allows a saftey net to hide under in case choppers are flying overhead. Or at least thats how I read it. With that strategy, you could gain a percentage (or likewise lose a percentage) until you pop over to the I Fund, hope you make a quick percentage there, pop back to the S Fund, reap a percentage, and then hide in G Fund land to 'safegaurd' the increases you may have earned for that month.

EricDeLee

Market Tracker

- Reaction score

- 2

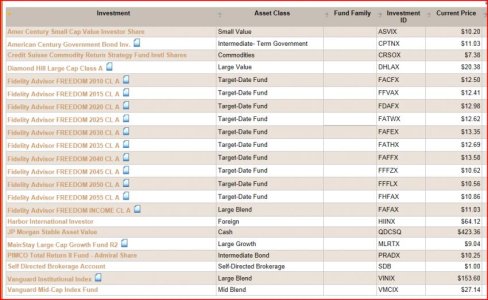

This portion is NOT TSP stuff. But my wife's account for her job that's been basically just sitting there. She contributes all of the time, but she had 75% sitting in JP MORGAN Stable Asset Value, and then 25% in American Century GOVT Bond Inv. The latter is failing for her.

I want to apply that elsewhere, as well as get some of that 'safe money' working for her (the 75% that is just sitting there and hanging out).

This is what she has available. I'm guessing rearranging the funds to invest in the Amer Century Small Cap Value Inv Share, and Diamond Hill Large Cap Class A. But I am doing this based soley off of what the performance looks like recently. Either way I got to get her away from the bonds. The VanGuard stuff at the bottom looks ok as well.

What's your suggestions? Smart girl started her stuff after the 2008 crash...

I want to apply that elsewhere, as well as get some of that 'safe money' working for her (the 75% that is just sitting there and hanging out).

This is what she has available. I'm guessing rearranging the funds to invest in the Amer Century Small Cap Value Inv Share, and Diamond Hill Large Cap Class A. But I am doing this based soley off of what the performance looks like recently. Either way I got to get her away from the bonds. The VanGuard stuff at the bottom looks ok as well.

What's your suggestions? Smart girl started her stuff after the 2008 crash...

EricDeLee

Market Tracker

- Reaction score

- 2

yes... that is true. And more shares is what you really want. So... I guess the perfect win scenerio in that case is that the S Funds take a hit on those magical days you can predict that the I Fund will jump, then you can jump back to the S Fund, possibly without worrying about buying at a higher price. I'm sure that's just a simplified way of thinking though.But of course every time you buy back in at a higher price you now own fewer shares.

EricDeLee

Market Tracker

- Reaction score

- 2

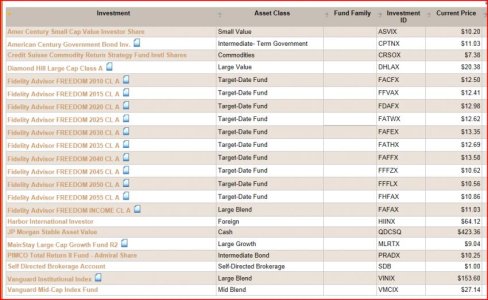

I readjusted the Wife's account to Amer Century Small Cap Value Investor Share, Diamond Hill Large Cap Class A, Fidelity Advisor FREEDOM INCOME CL A, and Vanguard mid-cap index fund.

I put a heavy emphasis on the diamond Hill stock, as it has been exploding for a while now. I figure I can ride the gains a while to see what happens and if I can regain the percentage points she lost sitting in bonds.

As for myself, I'm still 10% C Fund and 90% S Fund. I was going to hop to I Fund to try to catch a percentage point or two, but then decided, that's not the game I want to play right now. Not until I understand this a bit better.

I put a heavy emphasis on the diamond Hill stock, as it has been exploding for a while now. I figure I can ride the gains a while to see what happens and if I can regain the percentage points she lost sitting in bonds.

As for myself, I'm still 10% C Fund and 90% S Fund. I was going to hop to I Fund to try to catch a percentage point or two, but then decided, that's not the game I want to play right now. Not until I understand this a bit better.

EricDeLee

Market Tracker

- Reaction score

- 2

I have jumped to a 3.51% increase (well... Around a month ago I was at -6.25%, so I guess I've jumped almost 10%). I'm happy with that and curious if I am just going to stick it out with this buy and hold method or now, or cash in some earnings before August hits. I'm already a week past when I was going to pull out of the S Funds due to talk of what the market 'normally' does in Mid-July. I'm hesitant to pull out now as one of the big dogs (Apple) are reporting their 3rd Quarter numbers after the bell tomorrow. Will it be a boost for the ol' S&P 500... Or will it suffer a tad? I'm eyeballing Netflix today and seeing what it did immediately after the bell kinda has me wondering.

The wife's account did better than mine. That is expected though. Do any of you have any experience with DHLAX? The earnings seem to be outstanding this year.

Her account also allows you to enter into the actual market with a portion of the funds. I'm too green to do that right now. Although there appears to be a few really nice stocks out their. Cool hand mentioned one in his account talk, and I noticed a few other movers that did well this year, but its too late to cash in on (I think). Stuff like Tesla and Bestbuy seemed to already get huge earnings. You would have to think that BestBuy could jump up a bit between Oct-Dec. that would be my guess. Maybe buy when thy go down in August (if they go down a bit)

The wife's account did better than mine. That is expected though. Do any of you have any experience with DHLAX? The earnings seem to be outstanding this year.

Her account also allows you to enter into the actual market with a portion of the funds. I'm too green to do that right now. Although there appears to be a few really nice stocks out their. Cool hand mentioned one in his account talk, and I noticed a few other movers that did well this year, but its too late to cash in on (I think). Stuff like Tesla and Bestbuy seemed to already get huge earnings. You would have to think that BestBuy could jump up a bit between Oct-Dec. that would be my guess. Maybe buy when thy go down in August (if they go down a bit)

EricDeLee

Market Tracker

- Reaction score

- 2

Wild swing today regarding the S-fund. I had already submitted IFTs for a jump to safety, with a gamble to I fund as well. Before 11 or so... I changed my mind, and cancelled them. Well... I actually changed to 100% SFund. Still worried about normal lows for the season, but this isn't a normal market is it?

I watched the futures show bad times ahead, watched everything tank this morning and then rise back from the ashes. I believe there was a 2% swing when it was all said and done. What's next?

I still worry about some pullback later in August and September. But I have full confidence from that point forward

I watched the futures show bad times ahead, watched everything tank this morning and then rise back from the ashes. I believe there was a 2% swing when it was all said and done. What's next?

I still worry about some pullback later in August and September. But I have full confidence from that point forward

EricDeLee

Market Tracker

- Reaction score

- 2

I am still sticking to my fund here and staying 100% S fund. Not sure it it is wise or August but figured ill just leave it for now.

Got a question for some of you out there. Do you manage your gains by tossing them to safety? What I mean is that someone was falling about the "one chip" method, or at least that's how I look at it. They stated that they what they would do is the following: (Round easy numbers used for simplicity)

say the guy has $10k in his TSP account. At the end of the month, regardless of his distribution in his account, he'd look at what percentage was gained. Lets say he just earns 1%. That's $10 earned. Basically he throws that 1% into the G Fund and leaves the $10k in his other funds. Next month he earns 2% ($20). Tosses that in the old G Fund and has now locked away 3% earnings. Spit and rinse. He keeps using the $10k plus whatever he adds each month as a contribution.

To me that is the old gambler equivalent of placing a casino chip in you pocket for every two or three you earn at the blackjack table. Is this a method some use here to lock in percentages on your real account? Seems to be an "ok" method... Unless you start streaking backwards I suppose.

My question to him was if you gain 9% that year, do you simply leave it there for good and add next year's percentage to that? He said he does. And was able to quickly recover from his ex taking half of his tsp account when they got divorced. I'm curious as to you opinions

Got a question for some of you out there. Do you manage your gains by tossing them to safety? What I mean is that someone was falling about the "one chip" method, or at least that's how I look at it. They stated that they what they would do is the following: (Round easy numbers used for simplicity)

say the guy has $10k in his TSP account. At the end of the month, regardless of his distribution in his account, he'd look at what percentage was gained. Lets say he just earns 1%. That's $10 earned. Basically he throws that 1% into the G Fund and leaves the $10k in his other funds. Next month he earns 2% ($20). Tosses that in the old G Fund and has now locked away 3% earnings. Spit and rinse. He keeps using the $10k plus whatever he adds each month as a contribution.

To me that is the old gambler equivalent of placing a casino chip in you pocket for every two or three you earn at the blackjack table. Is this a method some use here to lock in percentages on your real account? Seems to be an "ok" method... Unless you start streaking backwards I suppose.

My question to him was if you gain 9% that year, do you simply leave it there for good and add next year's percentage to that? He said he does. And was able to quickly recover from his ex taking half of his tsp account when they got divorced. I'm curious as to you opinions

Birchtree

TSP Talk Royalty

- Reaction score

- 143

We are in the strongest bull market in 65 years - don't piddle - keep every share working in your favor. Balances can be likle the tide because they will flow out and flow back in - but staying long for the best opportunity to make further gains is the best strategy.

EricDeLee

Market Tracker

- Reaction score

- 2

I've been reading a ton of information regarding dividends and Roth accounts. Diving into dividend yield ratios, comparing and contrasting the differences of taking the dividend payouts, and the opposite and just participating in DRIPS. Lots of interesting stuff.

Tying this all in together with my plan for paying everything off early, I can see where I need to readjust the plan and I can essentially do both. I can max the TSP, and still invest $5k a year into a Roth to work on dividends.

Quick question to all: When do you have to start drawing out of your TSP? Is there an age where it all has to be removed? Or am I getting that mixed with the Roth? I thought I saw something about having to withdraw everything by 65 or 70. I'll be retired 44 from Active duty. Then will transition for another 10 years into another federal job (if I am lucky to do so) while I wait for my wife to retire. Between 55 and 59 1/2... Aside from my pensions and her pension (which will be higher than mine). What's a good plan for extra cash? I don't think I can touch the TSP without penalties. Same may go for the earnings on the ROTH. But I'd hate to rob from the principal of the Roth, as it seems like it would be like taking a step backwards.

Her pension and my pension together will be about 85% of our current take home. Just trying to figure out the buffer for a few years or the way around the penalties. I guess I could always elect to take dividend earnings rather than participating in DRIPS.

Tying this all in together with my plan for paying everything off early, I can see where I need to readjust the plan and I can essentially do both. I can max the TSP, and still invest $5k a year into a Roth to work on dividends.

Quick question to all: When do you have to start drawing out of your TSP? Is there an age where it all has to be removed? Or am I getting that mixed with the Roth? I thought I saw something about having to withdraw everything by 65 or 70. I'll be retired 44 from Active duty. Then will transition for another 10 years into another federal job (if I am lucky to do so) while I wait for my wife to retire. Between 55 and 59 1/2... Aside from my pensions and her pension (which will be higher than mine). What's a good plan for extra cash? I don't think I can touch the TSP without penalties. Same may go for the earnings on the ROTH. But I'd hate to rob from the principal of the Roth, as it seems like it would be like taking a step backwards.

Her pension and my pension together will be about 85% of our current take home. Just trying to figure out the buffer for a few years or the way around the penalties. I guess I could always elect to take dividend earnings rather than participating in DRIPS.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Here is something to consider. Your AGI (adjusted gross income) will become your albatross and you'll be paying taxes out the nose forever. Work in some flexibility of your income sources going forward. Your pensions will provide a constant income whether you need them or not and you'll always pay higher tax rates. There is so much hidden tax associated with Obamacare all based on AGI. Dividends outside a tax deffered program are taxed at 15% currently. You never have to take money out of a Roth IRA and it becomes a good way to leave money to an heir - the payout then is based on life cycle and is usually low which means the Roth IRA could live on in perpetuity while growth exceeds payouts. My wife for example chose a defined contribution retirement program where she maintains the risk for growth - last quarter she took in +$54K in gains - she will be required at 70 to take a required minimum distribution - same as your TSP account. You must work in some flexibility to protect future sources of income from over taxation. My daughter selected an employer based Roth 401K plan for her retirement - all tax free. If you open a Roth IRA get one for the wife too - remember individual stocks pay dividend 4 times per year - mutual funds only pay once per year. There are even some stocks that pay monthly dividends. Reinvest your dividends when they are paid - don't worry about pricing.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Oh, and the best plan for extra cash - build a savings account or keep some in a check book - savings are not taxed when used. Now, capital gains provide an enormous tax saving because you never have to take them if you're not inclined. And when you do they are taxed at 15% for long term holdings. If you pass on your capital gains there is a step up in basis rule that eliminates all past growth from taxes. And, remember there are no tax reporting requirements when you invest with a Roth IRA. Now days the IRS knows eveytime you flush because of 1099 requirements - there is no legal place to hide money - but there is still flexibility.

EricDeLee

Market Tracker

- Reaction score

- 2

I already live in Michigan (I'm active duty here). So I plan to retire here ( no taxes for military folks here). I'm already extending my retirement out two more years (by doing that, I bump my retirement pension up 5%) . May stay longer if need be, but the better money is to transition to another federal position here, and continue to contributing for another ten years into TSP. or at least I think that's what I should do.

Birch.... Thank you again for more information. I am not diving into dividend quite yet. But I may soon. I've got to read some more. But I'm not going to sit on my rear too long. I'm already making a few plans to start that ROTH. Btw... You mentioned to open one for my wife. I ant do it can i? Wouldn't she need to? Or is it just a $5k limit on each Roth account per year.

Birch.... Thank you again for more information. I am not diving into dividend quite yet. But I may soon. I've got to read some more. But I'm not going to sit on my rear too long. I'm already making a few plans to start that ROTH. Btw... You mentioned to open one for my wife. I ant do it can i? Wouldn't she need to? Or is it just a $5k limit on each Roth account per year.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Just to keep the record straight my wife gained +$54K in the first quarter in her FRS defined contribution plan and only +$11K in the second quarter. She had a very nice bump up in July and we're hoping for gains that will approach the first quarter in the current (third) quarter. She is 100% in an SPX index fund with no plans to exit that strategy anytime soon. With potential growth going forward she may never have to touch principle only wear down new growth. Can you imagine this bull racing to Dow 20,000 and beyond? I surely can.

Similar threads

- Replies

- 0

- Views

- 66

- Replies

- 0

- Views

- 80

- Replies

- 0

- Views

- 117

- Replies

- 0

- Views

- 102