Epic

TSP Pro

- Reaction score

- 365

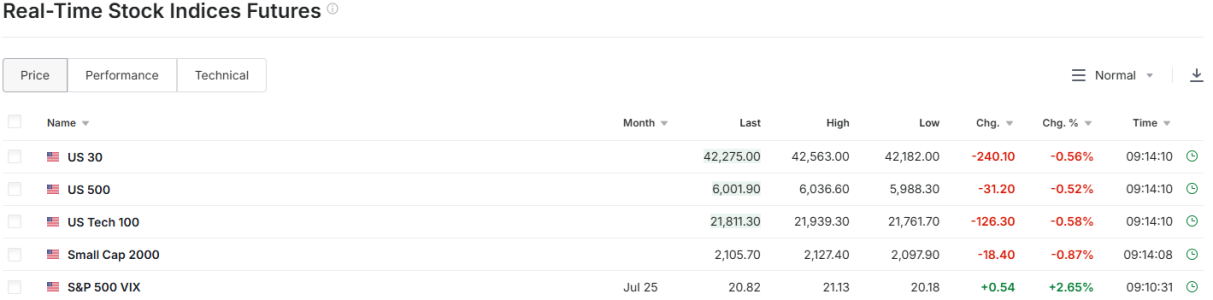

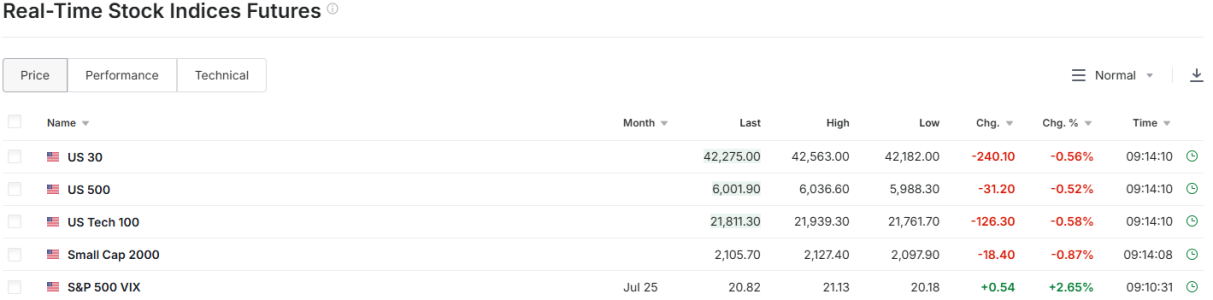

Futures this morning...... Good Luck everyone !!!

www.investing.com

www.investing.com

Stock Market Futures - Investing.com

Discover real-time streaming rates in our comprehensive stock futures table, covering global futures markets, including US stock futures.