That's what this market has been. An emotional whipsaw. I'm primarily speaking about sentiment and the tendency for the market to get beared up almost every time the market looks poised for a decline. And the bears have been wrong to a fault.

I thought we'd see some follow-through action to the downside today, and we did for about 20minutes. And then the market began its upward march, closing with some nice gains in all three TSP equity funds.

And then the market began its upward march, closing with some nice gains in all three TSP equity funds.

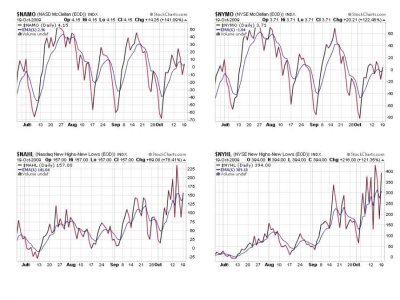

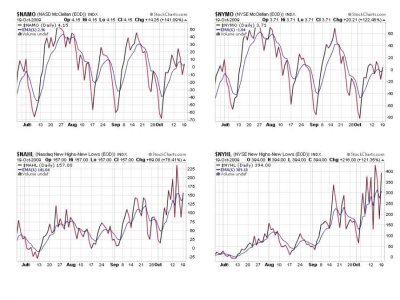

Here's today's charts:

All four of these signals are back to flashing buys. I can't help but think we are still breaking out to the upside, especially when I look at the NYSE, and specifically the NYHL signal.

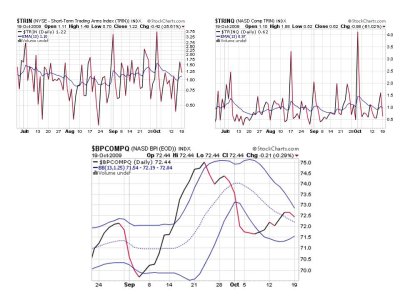

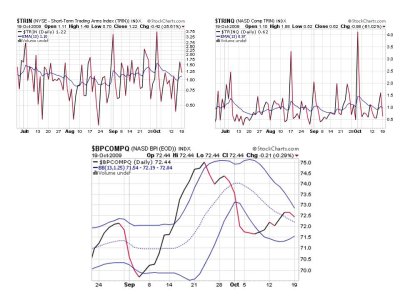

TRIN improved, but is still in a sell condition, while TRINQ flashed a buy today. BPCOMPQ is basically stationary, but the bollinger bands are starting to tighten. I would think if a breakout is in the cards that this signal may reach 80 and beyond, especially if things get silly to the upside in a parabolic move as we head towards the holidays.

So we are have 6 buy signals and only 1 sell, which keeps the system on a buy. Since many of those signals are close to their moving averages, we could still see a sell signal with any volatile action to the downside, so complacency is not an option.

Our Top 25% has only gotten more bullish after today, buy how much more bullish can you get when over 86% of the total position is in equities.

See you tomorrow.

I thought we'd see some follow-through action to the downside today, and we did for about 20minutes.

Here's today's charts:

All four of these signals are back to flashing buys. I can't help but think we are still breaking out to the upside, especially when I look at the NYSE, and specifically the NYHL signal.

TRIN improved, but is still in a sell condition, while TRINQ flashed a buy today. BPCOMPQ is basically stationary, but the bollinger bands are starting to tighten. I would think if a breakout is in the cards that this signal may reach 80 and beyond, especially if things get silly to the upside in a parabolic move as we head towards the holidays.

So we are have 6 buy signals and only 1 sell, which keeps the system on a buy. Since many of those signals are close to their moving averages, we could still see a sell signal with any volatile action to the downside, so complacency is not an option.

Our Top 25% has only gotten more bullish after today, buy how much more bullish can you get when over 86% of the total position is in equities.

See you tomorrow.