OPEX is often a volatile trading session, and usually on high volume. Today's trading was not particularly volatile at all and volume was well below average.

There wasn't much news of note either. I suppose the most interesting thing to happen was gold hitting an all-time high of close to $1264. It fell back after reaching that level, but it was notable nonetheless.

The Seven Sentinels didn't change much given the lackluster action today. Here's the charts:

Still have two buys here, and the signals remain near their respective 6 day EMAs.

Same there. Two buys, but very close to their trigger points.

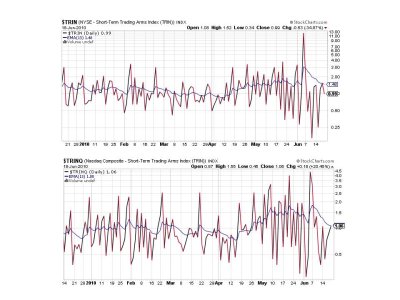

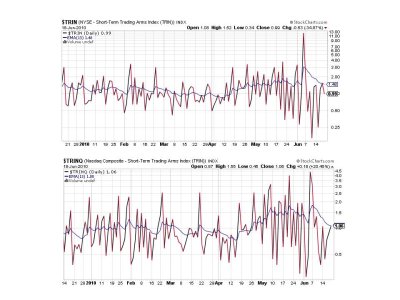

Two more buys with TRIN and TRINQ.

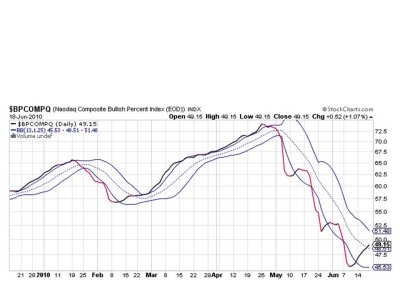

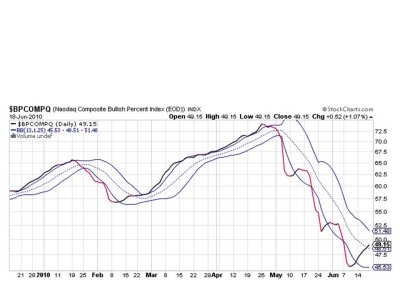

BPCOMPQ remains on a buy as well.

So all signals continue to flash buys, which keeps the system on a buy.

Monday should be another interesting trading day being it is post OPEX. Weakness is likely, but any selling pressure will probably be contained and maybe even bought intraday. The Intermediate Term remains up.

I'll be posting some tracker charts later this weekend. See you then.

There wasn't much news of note either. I suppose the most interesting thing to happen was gold hitting an all-time high of close to $1264. It fell back after reaching that level, but it was notable nonetheless.

The Seven Sentinels didn't change much given the lackluster action today. Here's the charts:

Still have two buys here, and the signals remain near their respective 6 day EMAs.

Same there. Two buys, but very close to their trigger points.

Two more buys with TRIN and TRINQ.

BPCOMPQ remains on a buy as well.

So all signals continue to flash buys, which keeps the system on a buy.

Monday should be another interesting trading day being it is post OPEX. Weakness is likely, but any selling pressure will probably be contained and maybe even bought intraday. The Intermediate Term remains up.

I'll be posting some tracker charts later this weekend. See you then.