-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DreamboatAnnie's Account Talk

- Thread starter DreamboatAnnie

- Start date

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Hi Pmaloney! I do like Chris Ciovacco and videos have lots of information that I have taken notes on to create comparison charts for various market sectors. But that Ovaltine will definitely need to be spiked with something strong. Missed out on so many $$$ this Summer, I need a stiff drink to help me make it through... .either that or just use the glass to catch all my tears!! :17:

pmaloney

TSP Analyst

- Reaction score

- 22

Yes, I know what you mean. I watch Ciovacco every weekend and combined with other experiences I have chastised myself every time I have missed a nice rally when I thought it was prudent to get out for a while but that is definitely not true in this market (at least not yet). I do respect his logic as much as I respect the more conservative views of others and I think a lot of this has to do with having faith in good signs and times but being a watchman for the bad times.

I thank the Lord for all his blessings but a good Whiskey med before bed is good too! :smile:

I thank the Lord for all his blessings but a good Whiskey med before bed is good too! :smile:

- Reaction score

- 869

Going to the 3 month S Fund chart in my last post, or picture below. What I like about the latest MACD setting (3,39,3) is that the crossover from negative to positive happens a little earlier (8/22) than the default MACD setting (12,26) (crosses ~8/29) followed by PMO (~8/30). But on the backend for possible exit, the 3,39,3 setting looks like it could get you out too early, or at least in this particular case because you can clearly see that MACD default and PMO clearly are in positive territory. So maybe just need to keep looking at all indicators to confirm. Have not performed back testing, but I am going to study it.

But wow... look at that embedded reading in the Full Stochastic... S fund flying high and not seeing any wavering on that Stochastic.

View attachment 42319

That's the good and bad with the "S" fund. When it's flying high it's one heck of a ride, but be ready for the big drop (were you find yourself a little weightless). Sticky pants always at the ready.

DreamboatAnnie

TSP Legend

- Reaction score

- 909

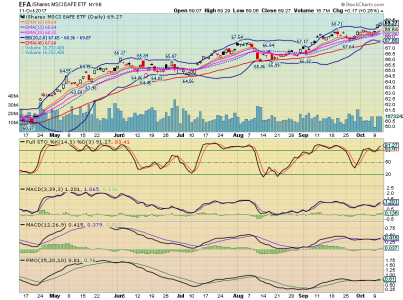

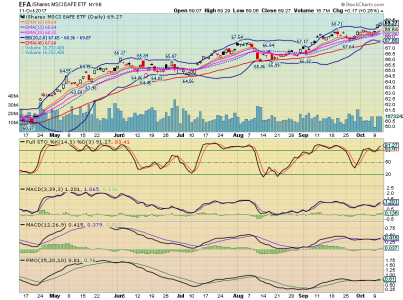

Here are 6 Month Daily charts. Just as I did with the 1 Month and 3 Month charts posted yesterday, I have added in a few extra EMAs and MACD setting that I am starting to study.

The EMAs of 13 and 48.5 were added because I saw an article with back testing that showed this was one of the best combinations for long term entry/exits.

6 MONTH DAILY CHARTS

S Fund ($DWCPF)

$DWCPF - SharpCharts Workbench - StockCharts.com

C Fund ($SPX)

$SPX - SharpCharts Workbench - StockCharts.com

I Fund (EFA)

EFA - SharpCharts Workbench - StockCharts.com

F Fund (AGG)

AGG - SharpCharts Workbench - StockCharts.com

Hoping you have a Great Evening and Best Wishes on Your Investments!!!!!!!! :smile:

The EMAs of 13 and 48.5 were added because I saw an article with back testing that showed this was one of the best combinations for long term entry/exits.

6 MONTH DAILY CHARTS

S Fund ($DWCPF)

$DWCPF - SharpCharts Workbench - StockCharts.com

C Fund ($SPX)

$SPX - SharpCharts Workbench - StockCharts.com

I Fund (EFA)

EFA - SharpCharts Workbench - StockCharts.com

F Fund (AGG)

AGG - SharpCharts Workbench - StockCharts.com

Hoping you have a Great Evening and Best Wishes on Your Investments!!!!!!!! :smile:

Mcqlives

Market Veteran

- Reaction score

- 24

I haven't heard of that one before...what's the tell? Looking at some charts I can see a "buy" correlation in the last half of August but what would be the corresponding "Sell"? A wider range for the specific index? If so how wide a range? Right now it is only about an eigth of a point spread on the C....

DreamboatAnnie

TSP Legend

- Reaction score

- 909

I haven't heard of that one before...what's the tell? Looking at some charts I can see a "buy" correlation in the last half of August but what would be the corresponding "Sell"? A wider range for the specific index? If so how wide a range? Right now it is only about an eigth of a point spread on the C....

Hi Mcqlives, This EMA crossover is meant to be for long term investing. Looking at a 1-year daily chart, the last time the 13 EM (on C fund/SPX) fell below 48.5 was prior to the election in Nov 2016. Right at that point, it crossed above the 13 day EMA and it has never dropped below it. With that methodology, one would have been invested the entire time up to today. Even in August, when the exit signal was close, the crossover never actually happened. The 13 daily EMA was within a hairs breath of occurring but actually didn't so no sell signal happened. So its still running on a buy going back to Nov 2016.

I wish I had been using that long term methodology for at least part of my investment strategy.

Here are a couple charts...hope you can view them.

View attachment Chart - C fund - August 2017.pdf

View attachment 1-year C fund as of 10-5-2017.pdf

The more volatile S fund fell below back in October 2016 crossed back up in November for a buy, and then dropped in August 2017 for a sell, but recovered in first week or so in September 2017 for short buy opportunity and now its skyrocketing. Definitely embedded at this time.

So when to enter is the big question. I am inclined to just get in for 50% since it is beyond the buy signal and ride it out long term. I think for my other 50% I will try shorter term method. I have not been following my other strategy .. for quite some time. Mainly re-evaluating ... so I should be entering soon. Just trying to get something solid in mind before I proceed so I can have enough confidence to pull the trigger even when fear grips at me. :worried: I think a solid strategy that I truly believe in is the cure for my issues. :nuts:

Best wishes to you and everyone!!!!! :smile:

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Thanks mcqlives, your too kind. Wish i could follow through but i just keep thinking the world is going to end!!! Ugghhh...lol.

Best wishes !!!!!!!!!!!! :smile:

Best wishes !!!!!!!!!!!! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Well.. I still wish to enter but not seeing an entry. I do wish to wait for a slight pull back. Still playing around with several MACD settings. So far, not sure on which is the best MACD.

Here is one link on DWCPF, but will likely change it in a few days. Best wishes to everyone!!!!!!!! :smile:

$DWCPF - SharpCharts Workbench - StockCharts.com

Here is one link on DWCPF, but will likely change it in a few days. Best wishes to everyone!!!!!!!! :smile:

$DWCPF - SharpCharts Workbench - StockCharts.com

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Moving into the I Fund 25% plus 10% into F Fund. Seeing MACD crossover on both....

Best wishes to everyone on our investments!!!!!! :smile:

Best wishes to everyone on our investments!!!!!! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Here are charts for I fund and F fund. I see a positive crossover on MACD 3,39,3. Will see how this works out.

EFA - SharpCharts Workbench - StockCharts.com

AGG - SharpCharts Workbench - StockCharts.com

Still not fully confident on current methodology, as I still need to do quite a bit of back testing and still adjusting my "rules" as I do back tests. Might be able to complete that by the end of the weekend, but not sure.

Will be watching for 13 EMA to cross below 48.5 for an exit on any chart, and MACD 3,39,3 positive cross over for entry. Of course, still using Full Stochastic but to a lesser extent. It just helps with confirmation. I am sure a slight pull back will occur.... but I tend to think it will be more as a result of an unexpected news event than to the economy. Obviously, no tax plan would cause a lot of angst in the market .... and I would very disappointed in Congress! I hope I do not have to go on the Warpath in 2018!!!! :blink:

I hope I do not have to go on the Warpath in 2018!!!! :blink:

Good evening and Best Wishes on Your Investments!!!!!!!!! :smile:

EFA - SharpCharts Workbench - StockCharts.com

AGG - SharpCharts Workbench - StockCharts.com

Still not fully confident on current methodology, as I still need to do quite a bit of back testing and still adjusting my "rules" as I do back tests. Might be able to complete that by the end of the weekend, but not sure.

Will be watching for 13 EMA to cross below 48.5 for an exit on any chart, and MACD 3,39,3 positive cross over for entry. Of course, still using Full Stochastic but to a lesser extent. It just helps with confirmation. I am sure a slight pull back will occur.... but I tend to think it will be more as a result of an unexpected news event than to the economy. Obviously, no tax plan would cause a lot of angst in the market .... and I would very disappointed in Congress!

Good evening and Best Wishes on Your Investments!!!!!!!!! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

I have not yet posted about Tom Petty and his passing away early last week. Such an awesome musician and unique voice...and musical vocal phrasing. I was so very sad to hear of it....I love many of his songs, as I'm sure many of you do too.

My favorite song is Here Comes My Girl. 1979. A great year in my life and the song always brings back great memories and makes me feel young...though even now I feel very young at heart!!! I like the part where he says, " watch her walk....uh". Absolutely perfect and so very sexy! Oh.... Gotta love the feathers and shags! Peace to you brother!

My favorite song is Here Comes My Girl. 1979. A great year in my life and the song always brings back great memories and makes me feel young...though even now I feel very young at heart!!! I like the part where he says, " watch her walk....uh". Absolutely perfect and so very sexy! Oh.... Gotta love the feathers and shags! Peace to you brother!

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Listening to oldies... Love this somg!

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Oh gosh... More Tom Petty... Refugee..its the only Tom

Petty song I've ever done at karaoke. Such a cool song!

Petty song I've ever done at karaoke. Such a cool song!

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Okay..must hear this one too. Sitting here with sister sipping a diet coke with Gentleman Jack and 3 cherries.... Awesome song!! Come on Tom...rock me! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Heart! Oh yeah,...your a magic man!  . Great live version!

. Great live version!

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Humm... What next? I love this one... linger baby! I'm such a fool for you!

DreamboatAnnie

TSP Legend

- Reaction score

- 909

More Tom Petty! Stevie and Tom were friends for decades...she wouldnt let him go!

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Sara... Your the poet in my heart! Never change!

Wait a minute, baby

Stay with me awhile

Said you'd give me light

But you never told me about the fire......

...

Undoing the laces....

Stevie is such an awesome songwriter!!!

Wait a minute, baby

Stay with me awhile

Said you'd give me light

But you never told me about the fire......

...

Undoing the laces....

Last edited: