DreamboatAnnie

TSP Legend

- Reaction score

- 909

Good morning! Has anyone noticed not being able to Like posts??? :worried:

Hum.... well... I DID IT!! :laugh: I am now 100%G. I hope the nice start up this morning stays that way throughout the day and continues going up. I will likely end with loss on this last buy in. I entered market with 60% on 9/9 and then increased to 100% 9/19 in attempt to cut loss (thinking it might go up again!)---primarily in S fund with a little in C and I. But oh well.... will live to fight another day... dang it!

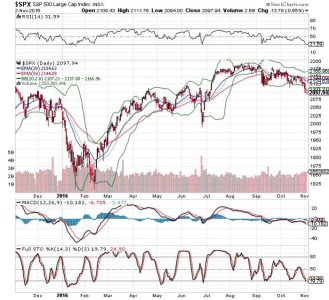

I am thinking this is a nice little dead cat bounce, and I think there might be a few more up and downs like that, but with the crossover of 20 day EMA below 50 day EMA on the C fund (SPX) chart and with the two other's 20 EMA lines closing on the 50, and just historically looking at this cross over and what happens afterward, I am fairly certain this continues down over the next couple months. Of course, no one can know for sure what will happen in the future, but I am comfortable with this decision to exit---even with a little loss. I still have another IFT left this month to re-enter... maybe at a bottom and probably at a lower point---for ONLY a day or two (very short in and outs from this point on for awhile). Will see....

Hope you are having a GREAT Day and Have a nice weekend! Best Wishes on your Investments!!!!!!! :smile:

Hum.... well... I DID IT!! :laugh: I am now 100%G. I hope the nice start up this morning stays that way throughout the day and continues going up. I will likely end with loss on this last buy in. I entered market with 60% on 9/9 and then increased to 100% 9/19 in attempt to cut loss (thinking it might go up again!)---primarily in S fund with a little in C and I. But oh well.... will live to fight another day... dang it!

I am thinking this is a nice little dead cat bounce, and I think there might be a few more up and downs like that, but with the crossover of 20 day EMA below 50 day EMA on the C fund (SPX) chart and with the two other's 20 EMA lines closing on the 50, and just historically looking at this cross over and what happens afterward, I am fairly certain this continues down over the next couple months. Of course, no one can know for sure what will happen in the future, but I am comfortable with this decision to exit---even with a little loss. I still have another IFT left this month to re-enter... maybe at a bottom and probably at a lower point---for ONLY a day or two (very short in and outs from this point on for awhile). Will see....

Hope you are having a GREAT Day and Have a nice weekend! Best Wishes on your Investments!!!!!!! :smile: