FogSailing

Market Veteran

- Reaction score

- 61

Best of luck with the markets Annie and congrats on TSP Poker! Nice job there!!

With respect to the markets, one of the questions is what happens to oil. If it continues to tank I think things go south. Also there is another Full Moon this Saturday I believe. Basically, stock prices tend to be higher around the time of the New Moon each month and reach a temporary low point around the time of the Full Moon; at least that's the theory. Also I think Yellen and Fischer speak this week which tends to be hawkish for the dollar. Final thing on the radar is anything doing with the election. The markets will be skittish regarding any rumors, etc. But the Wall of Worry can be profitable to those willing to deal with all that anxiety. For me, it's about capital preservation and see what happens in October.

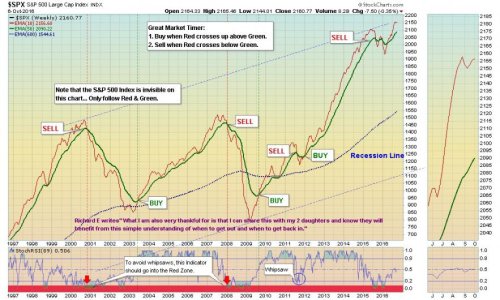

I'm still thinking 2200 in the near future but can't read the tea leaves to see if it is this week or in October. Look at Bquat's chart...things are coming to a head but which way it breaks is up in the air.

Final thought for the bullish....last week of the month heading into Q4 would seem to be a good time for markets to rally...just to add a contrarian view to counter the above jibber jabber..

FS

With respect to the markets, one of the questions is what happens to oil. If it continues to tank I think things go south. Also there is another Full Moon this Saturday I believe. Basically, stock prices tend to be higher around the time of the New Moon each month and reach a temporary low point around the time of the Full Moon; at least that's the theory. Also I think Yellen and Fischer speak this week which tends to be hawkish for the dollar. Final thing on the radar is anything doing with the election. The markets will be skittish regarding any rumors, etc. But the Wall of Worry can be profitable to those willing to deal with all that anxiety. For me, it's about capital preservation and see what happens in October.

I'm still thinking 2200 in the near future but can't read the tea leaves to see if it is this week or in October. Look at Bquat's chart...things are coming to a head but which way it breaks is up in the air.

Final thought for the bullish....last week of the month heading into Q4 would seem to be a good time for markets to rally...just to add a contrarian view to counter the above jibber jabber..

FS

Last edited: