DreamboatAnnie

TSP Legend

- Reaction score

- 909

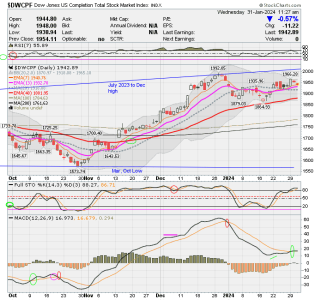

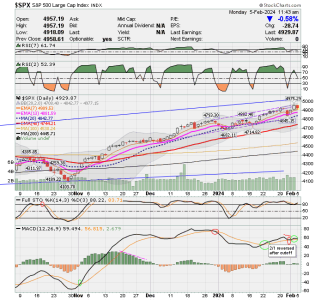

charts before noon cut off... a bit early today. SPX has MACD crossing positive, which is an entry signal. However, I am getting ready to run out the door... so very doubt ful I can transact today. I do not like that it is already at 80 on Slow Sto.. and upper BB. HUmm... will look again tomorrow. I also do not like to transact on week when Fed speaks... it is this week right or is it next week??? In any case, I will looking again tomorrow. DWCPF also is starting to look promising with a reverse crest developing in MACD.

Best wishes to all!

Best wishes to all!