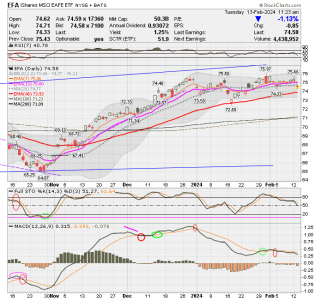

Hi KB, My moves this year have been based on when MACD crosses above or below its signal lines.

Moves this year:

1/2 - 100G

1/23 - 70G, 10C, S20 (SPX had crossed positive and S fund looked like it was about to cross positive)

2/1 - moved to I10, 30F and moved out of S and C because of MACD cross downs (at noon cutoff--C fund later whipsawed and reversed later in day for C fund--uggh). Exiting S fund was a good move.

2/6 - moved 25% to C, 75%G. C fund is only one that had positive MACD. I noted yesterday that S fund is looking like it will be crossing positive but no IFT left to move in. Today S fund is still looking to be good to go as well as C fund.

I have been reconsidering whether I should continue with this strategy and pretty much decided that there must be more than MACD considered. So, I am back to an older strategy of looking at overall picture: RSI, Slow Stochastic, MACD, BB mid-point slope, and 7 versus 13 EMA cross overs.

LOL... yes, sometimes I do feel like I am chasing my tail.

Weren't you just in the s fund a week ago. Feels like chasing a tail moshing backnin already.