felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

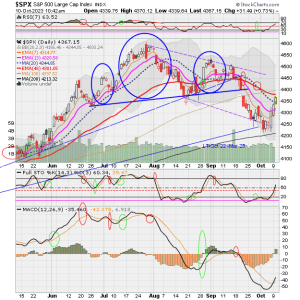

Feels different this time…expect a bounce tomorrow but a selloff same day. That is the new feeling I’m getting. If it happens…we got more downside as energy, food, and housing damper market spirits. Sniffing the economy…sensing a sharp turnaround is afoot. Strikes and elevated oil may be the nail in the coffin for recession(if it has not already begun).