DreamboatAnnie

TSP Legend

- Reaction score

- 909

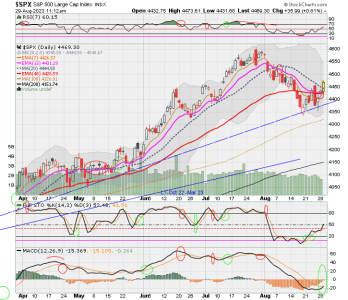

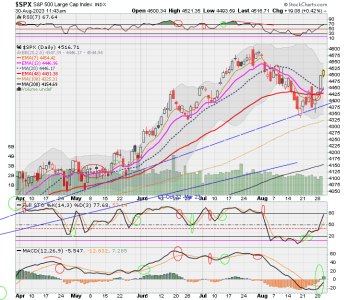

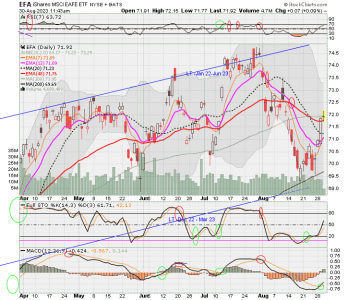

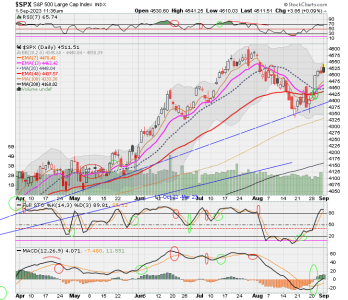

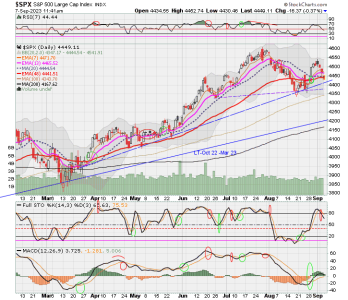

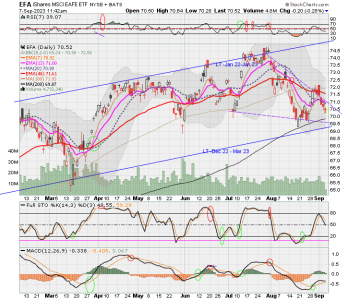

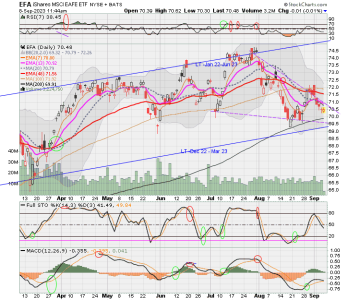

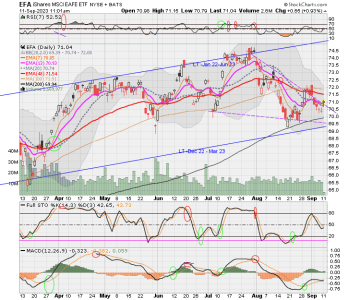

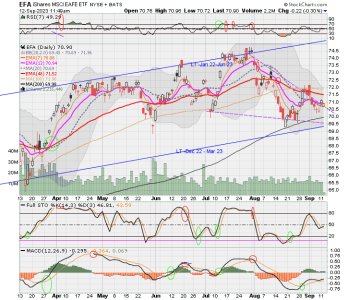

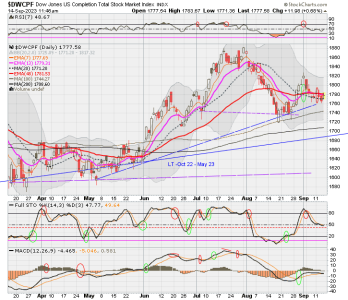

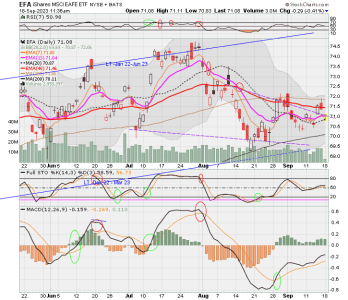

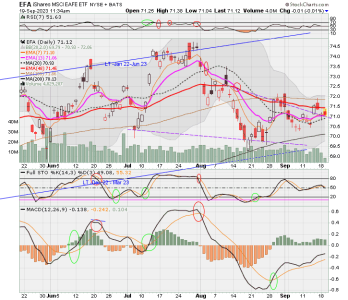

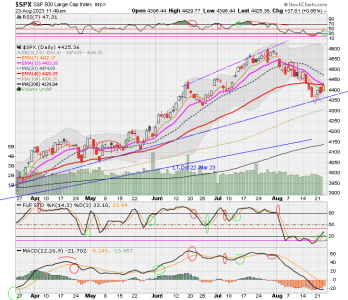

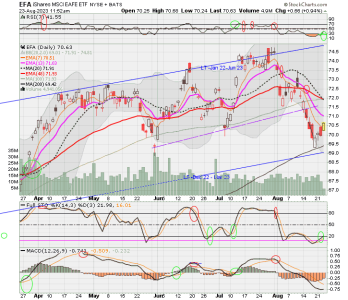

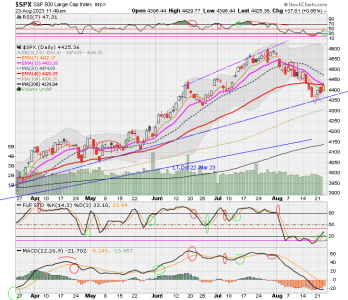

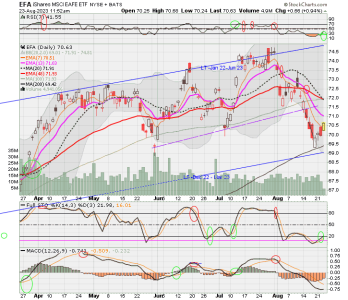

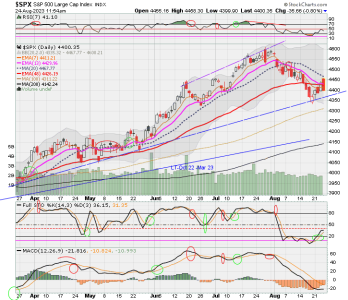

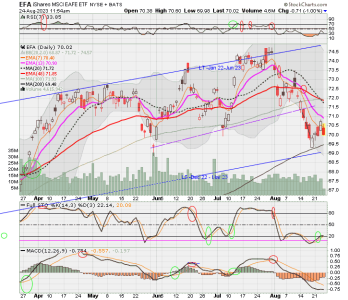

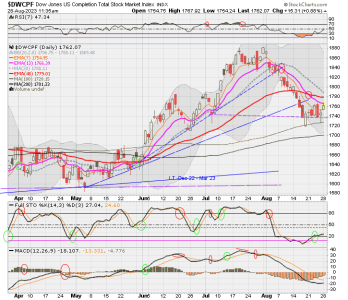

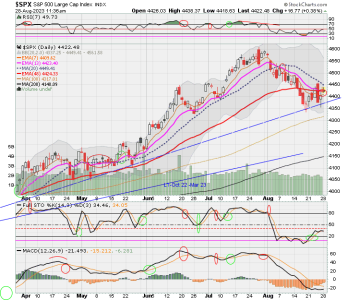

Charts before cutoff :smile: Note.. I have no IFTs, so I could not get in even if I wanted to. In any case, it's looking like a nice bounce. But MACD not yet crossed above its signal line though it looks to be headed that way. I am watched the whipsaw zone line (red dashed just under 50 in Stochastic). But RSI and Stochastic looking great!

So, per my strategy that's a buy signal... F fund crossed up a few days ago. F and C are above whipsaw zone. S Fund getting close. But no IFT... Dang

So, per my strategy that's a buy signal... F fund crossed up a few days ago. F and C are above whipsaw zone. S Fund getting close. But no IFT... Dang