DreamboatAnnie

TSP Legend

- Reaction score

- 909

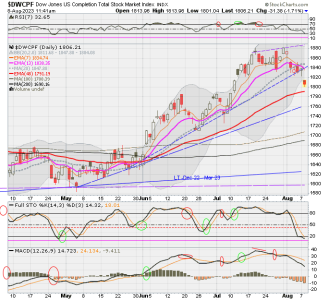

Entry... 20%C 20%I...for now. MACD still negative but RSI and Slo:smile:w Sto turning up. Ended up going 30C n 20I. Best wishes to all!

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Ouch, it looks like the S&P 500's %K line is at it's lowest percentage range since last September.