ravensfan

Market Veteran

- Reaction score

- 292

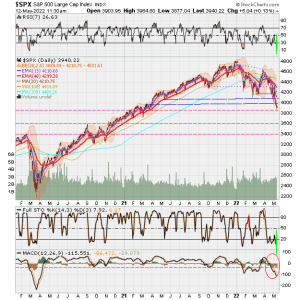

Gotta love the way the chart turns up just before noon, and then down it goes! :suspicious:

That's just to keep us suckers thinking there's hope.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Gotta love the way the chart turns up just before noon, and then down it goes! :suspicious:

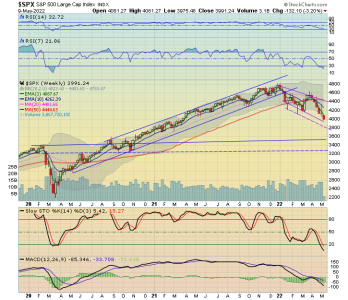

Longer term daily charts. Yes, tough to see but just looking at overall market levels.

For C chart, I added in a few more (pink dashed) lines in attempt to spot areas of support as market moves down towards the pre-pandemic high. Look to be 3850, 3600, 3400.

Ifva bounce happens, I doubt it would go much above 4300-4400. Need to check Fibonacci retracement on this last leg down.

View attachment 54341

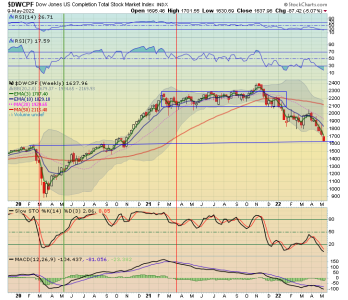

S fund has now gone below the Pre-pandemic high with today's action.

View attachment 54342

HA! And just like that it reverses..right after noon cut off! Coincidence???

Hummm... The market is just all over the place and we do not have ability to react quickly enough... 4-hour gap between decision (noon) and processing/price at COB, without ability to back out before COB.

View attachment 54358

View attachment 54359