-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DreamboatAnnie's Account Talk

- Thread starter DreamboatAnnie

- Start date

DreamboatAnnie

TSP Legend

- Reaction score

- 851

DBA, did you bail today? Good exit if you did, I need to look at tomorrow... :smile:

Sorry...just now seeing this. I exited on Tuesday 4/26. Wish I had exited Monday or Thursday....eeeeee... But glad to be out...:smile: Will likely stay out for awhile... Too much uncertainty. Unable to make sense of Market moves. I need to regroup. :1244:

DreamboatAnnie

TSP Legend

- Reaction score

- 851

DreamboatAnnie

TSP Legend

- Reaction score

- 851

Here are minute charts for last week. That was a nasty afternoon drop on Friday.

After the NOON cut offs, the market's action changed greatly on most days.

For S fund

Monday afternoon-Up a lot, closed up a lot without drop in last hour of trading

Tuesday afternoon - Down , but initially went up before rollercoastering to much lower point

Wednesday afternoon - up and down some but ended lower but did not hit the day's lows

Thursday afternoon - continued to shoot up with drop in last hour but still with very good gains at COB

Friday afternoon - steadily dropped during afternoon all the way to close

It just seems like overall selloff... It is ugly. Some are buying in....maybe longer-term investors???

After the NOON cut offs, the market's action changed greatly on most days.

For S fund

Monday afternoon-Up a lot, closed up a lot without drop in last hour of trading

Tuesday afternoon - Down , but initially went up before rollercoastering to much lower point

Wednesday afternoon - up and down some but ended lower but did not hit the day's lows

Thursday afternoon - continued to shoot up with drop in last hour but still with very good gains at COB

Friday afternoon - steadily dropped during afternoon all the way to close

It just seems like overall selloff... It is ugly. Some are buying in....maybe longer-term investors???

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 851

DreamboatAnnie

TSP Legend

- Reaction score

- 851

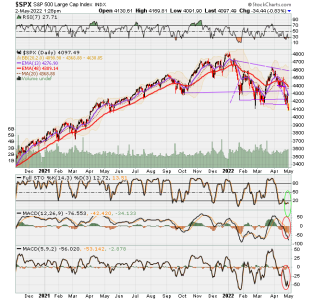

Here are COB charts for yesterday. Ugly! Will see how it goes this coming week. We had single day bounces, but then get taken out. Tough market to navigate.

View attachment 54186

View attachment 54187

View attachment 54188

View attachment 54189

View attachment 54186

View attachment 54187

View attachment 54188

View attachment 54189

DreamboatAnnie

TSP Legend

- Reaction score

- 851

Historical TSP statements/documents no longer on TSP after May transition. Just noticed TSP site says that you should:

"Download historical documents: Documents and messages currently available in My Account will not transfer to the new system. You may want to download your historical statements and save any messages so you have easy access to them in your records. If you need any historical statements after the transition, you’ll be able to call the ThriftLine and request to have them mailed to you. Statements that post after the transition will be available to you in My Account going forward." [Emphasis added]

https://www.tsp.gov/new-tsp-features/?utm_source=website&utm_medium=banner&utm_campaign=getexcited1

Transition starts May 16 and no IFTs after NOON ET, 5/26 (Thursday) until the first week in June (specific date not given).

https://www.tsp.gov/new-tsp-features/key-transition-dates/#Investments

"Download historical documents: Documents and messages currently available in My Account will not transfer to the new system. You may want to download your historical statements and save any messages so you have easy access to them in your records. If you need any historical statements after the transition, you’ll be able to call the ThriftLine and request to have them mailed to you. Statements that post after the transition will be available to you in My Account going forward." [Emphasis added]

https://www.tsp.gov/new-tsp-features/?utm_source=website&utm_medium=banner&utm_campaign=getexcited1

Transition starts May 16 and no IFTs after NOON ET, 5/26 (Thursday) until the first week in June (specific date not given).

https://www.tsp.gov/new-tsp-features/key-transition-dates/#Investments

DreamboatAnnie

TSP Legend

- Reaction score

- 851

Good morning, I can't post the daily charts this morning, but you may view a version of my charts via Permalinks (click to view & can bookmark if you like to view anytime as they do automatically update).

FYI- have heard talking heads say the market will continue down (overall) for several more months. Hummm....one person said Fed will likely announce more (on Wednesday) about how/when they plan to unwind the balance sheet at $95B per month and that they would need to do that for 8 years, after having pumped liquidity into the market 8 years. I do believe I've heard that is likely to start in June. (source: Varney's guest, Dennis Gartman of Akron Endowment) He said he was in cash 77% and Varney seemed surprised. I am not surprised. But...he is definitely in the Bear camp.

Best wishes to Everyone* !!! :smile:

From post 4264, page 356

FYI- have heard talking heads say the market will continue down (overall) for several more months. Hummm....one person said Fed will likely announce more (on Wednesday) about how/when they plan to unwind the balance sheet at $95B per month and that they would need to do that for 8 years, after having pumped liquidity into the market 8 years. I do believe I've heard that is likely to start in June. (source: Varney's guest, Dennis Gartman of Akron Endowment) He said he was in cash 77% and Varney seemed surprised. I am not surprised. But...he is definitely in the Bear camp.

Best wishes to Everyone* !!! :smile:

From post 4264, page 356

Here are updated Permachart links to view clean 3-month daily charts that TSP funds track. You can save/bookmark each link to see updated charts updated when you click on them. Best wishes to everyone on your investments! :smile:

Updated PermaLinks

C fund ($SPX)

https://schrts.co/tIMJATFM

S fund ($DWCPF)

https://schrts.co/MmtXFVEx

I fund (EFA)

https://schrts.co/CBKEHICu

F fund (AGG)

https://schrts.co/ZPwHJjDZ

DreamboatAnnie

TSP Legend

- Reaction score

- 851

Your Awesome!!!  Thank You Epic!

Thank You Epic!

DreamboatAnnie

TSP Legend

- Reaction score

- 851

DreamboatAnnie

TSP Legend

- Reaction score

- 851

Lol... gosh Whipsaw, if it were only so easy I would give me self lots and lots of lumps! Soooo.....how many lumps would you like?????? :cheesy:

Wait... You gotta view this one...fuller version... Love the end! Yep I feel like that some times!

No! Bad! Bad charts! Bad, bad charts! :twak: :smashfreakB:

There, now maybe they'll stop. :nuts:

Wait... You gotta view this one...fuller version... Love the end! Yep I feel like that some times!

DreamboatAnnie

TSP Legend

- Reaction score

- 851

hey...whatchaknow...will wonders ever cease? Market turned around! It closed UP! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 851

felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

Charts as of a few mins ago.

View attachment 54230

View attachment 54231

View attachment 54232

View attachment 54233

Staying put for now since already deep in the manure. While market conditions suck…not being able to make fund moves May 16 thru first week of June sucks more. Risk remains on but plan some safety move with real funds before that deadline. Pricing the agressive Wednesday moves is already in so maybe some profit or gains to be made back here??

I was noticing that consumer sector rotation to more risk aversion this morning such as the seminconductor sector. Perhaps a glimmer of hope of a rebound.