DreamboatAnnie

TSP Legend

- Reaction score

- 854

Added to position ...now at 60%C, 40%I fund. :smile:

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

I just increased yesterday, so I am gonna Stay. I know this is not gambling but I do feel like I am playing dice so I am just gonna let em roll....

Best wishes to you all!

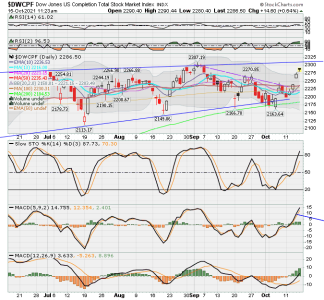

View attachment 51553

Yep Felix and Cedar, I was tempted to take some off the table, but just stayed in. Will see what next week brings us.

While I don't have money in S Fund, I do wonder why S Fund dropped at end of day while C and I funds were unaffected?????? Need to read business news to see if anything jumps out. Hummm...

Best wishes to you and everyone! :smile:

. Actually kept 30C and 10-I fund. :smile:Reducing exposure... 25 C. 10 i