Can you explain a little what the slow stochastics represent? I am looking for signals that the S fund will drop out of its current trend upwards in the band and if I understand your comment below, you believe that would be when the stochastic drops below 80? Thanks for all the work on these charts!

Hi Flalaw97,

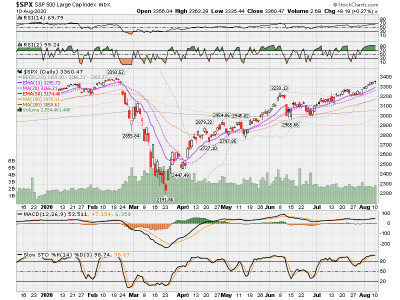

The Stochastics are identified as a leading indicator for market pricing and trend, or so I have read. I like that, but its not perfect and it can and does whipsaw at times. In my own experience, I think it does give a little indication of where market might be going...but one can never be certain. So many factors affect the market! Often its very news or Fed-driven! I attached links to very good articles on Stochastics that gives good explanation on how some use it.

If you look at 6 months or a year or years of price action on chart, look at how the Stochastic and MACD move in relation to price. In my observations, I have seen where price getting below 20 and then moving back up can provide a nice entry point while drops below 80, after market has been in uptrend, offers strong indication its time to exit. But again, its not perfect and yet many consider this as good method for trading.

In making trading decisions I often consider MACD, RSI, Stochastics, Bollinger Bands, Moving Averages, Points of Support and Resistance though I do not draw those lines on my charts. I look at multi-year weekly, monthly charts for perspective, but mainly use daily charts and some Candle formations in addition to the news.

I have studied Stochastics enough to place some reliance on it for my personal trading, while also considering other factors stated previously. I do not rely on it 100%. For example, today, my decision to reduce exposure to I Fund was because while it has broken out above resistance, and it will likely go up another day or two or more, I saw the gap up and decided I needed to pocket some of the gain. I did see Stochastics but it did not weigh in on that decision. Each person has their own strategy or method for trading and tolerance for risk. My tolerance is very low as I am close to retirement. It factors in to my decisions greatly!

Disclaimer: Please do not take anything I say as trading advice as I am definitely a novice.

I suggest watching Ira Epstein's end of day financial videos, and read as much as possible about different methods folks use to read the indicators.

Here are a couple good articles on Stochastics. Happy Reading! Best wishes to you Flawlaw97!! :smile:

https://www.investopedia.com/articles/technical/073001.asp

https://tradingsim.com/blog/slow-stochastics/

PS. I have also used double cross strategy where both MACD and Slow Sto have crossed above their signal lines. Here is an article on that. But because Slow Stochastic often starts moving up with price before MACD crosses upward, you do often lose out on gains fir the few days it takes for MACD to cross up to give the dual signal for entry.

https://www.investopedia.com/articles/trading/08/macd-stochastic-double-cross.asp