PessOptimist

Market Veteran

- Reaction score

- 67

Thank you for the link. Now I know I didn't know.

PO

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Thank you for the link. Now I know I didn't know.

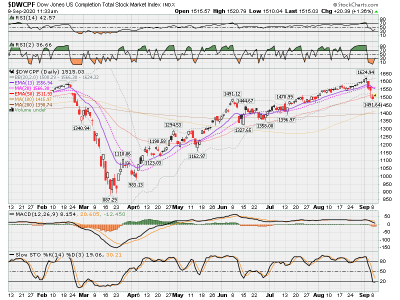

I didn't see this coming... though you have been reducing exposure. Does the afternoon rally change your view? My plan is to hold in S through the first and then rebalance. It seems we keep climbing the wall of worry - my concern being a double top type of outcome... no indication as yet.

dBA, I feel your pain. I’m not saying I am following your strategy exactly but it motivated me to look in to some things and get my self out of total G fund at 6 basis points. (.625%) My paltry 20% in S gives me ups and downs of hundreds or sometimes thousand per day in the balance. G fund increase is really inconsequential. Starting to worry about past days of 5% drops like in March. Maybe time to get out too. Relax and earn .625% and be happy that I have earned enough as of today to cover all withdrawals though October for this year. I have a way to go to cover last years. Unless of course tomorrow is that 5-6% down day. Then I am screwed and you are not.Hi Whipsaw, I exited because:

S fund -before cutoff, did not look like it would re-embed..but it did in afternoon. ...ugghhh

C Fund...was embedded and has stayed embedded...only had 10% in there and formation of candle looked indecisive before cut off so decided to just exit, but I think I am just tired of looking at market...need a rest ...4 days until IFTs replenish.....uggh

But, the original exit strategy is to exit when 13 EMA drops below 20 SMA (mid-point) of Bollinger bands. Its STILL going. I have now entered and exited twice since this run started....double ugghhh...eeeeeeeee.......gosh, eventually, I need to get in when 13 first crosses above 20 and bite my fingers until a cross down actually happens! don't tell anyone, but I don't think DBA can do it...

don't tell anyone, but I don't think DBA can do it...

I think this longer-term Strategy is good, but DBA is very very bad!

Best Wishes to you and Everyone!

PS. I am happy with my balance!

I think we are getting way too technical in to this. Please correct me if I am wrong but “imbedded” has to do with the K and D lines of the slow stochastic merging? Usually a red and blue line. Meaning D red and K blue? Imbedded is good but unembedding is bad? If D goes below K, time to leave maybe?

No one ever accused me of being the brightest knife in the drawer.

PO

Hi Whipsaw!!! Yes, I couldn't agree more.... oh gosh...if you don't get in right at the bottom, it is very hard to exit using 13/20 cross over. I used to try using 3/5 cross over but it was too tight. I dunno... so I have kinda been using the "get out little by little" method to lessen the blow...still hunting for better exit methodology or at least something that I can be more confident about... that is some of the reason I start to drift out of trades. It's just safer. uggh :blink:DBA, it is challenging; the only issue i have with the long range plan is eating the 6-7% that it will take for the 13 EMA to cross the 20 SMA. Otherwise, its all good!