More choppy sideways action and another mixed close. Market chop has eventually given way to rallies during the month January, so I'm beginning to think this market is waiting for a catalyst to move higher once again. We could use some selling pressure, but buying opportunities have been largely pounced on during intraday trading. We TSPers have had little opportunity to get positioned lower; assuming one has any IFTs.

The Greece situation hasn't changed and Portugal is standing by for its time in the spotlight. Market participants seem to be largely bored by the whole thing, but don't be lulled into a sense of complacency. The time will probably come when the market will suddenly be concerned all over again.

Two data points were released today. The latest Chicago PMI came in at 60.2, which was lower than last month's 62.5 reading. Economists were looking for a number closer to 62.8. The Consumer Confidence Index for January dropped to 61.1 from December's 64.8 reading. That too was below estimates.

Let's take a look at the charts:

NAMO and NYMO remain on sells.

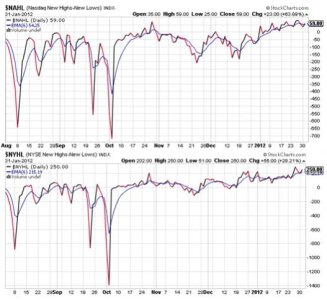

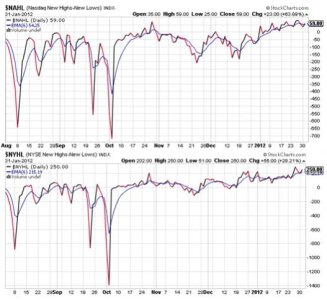

NAHL and NYHL managed to flip back to buys. Given the low volatility of these signals it's not surprising to see the reading flip back and forth.

TRIN remained on a sell (barely), while TRINQ flipped to a sell (barely). No help here.

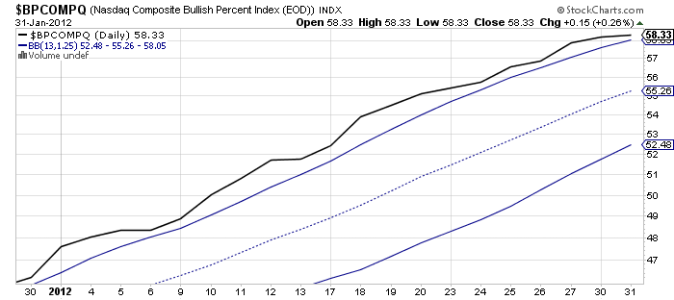

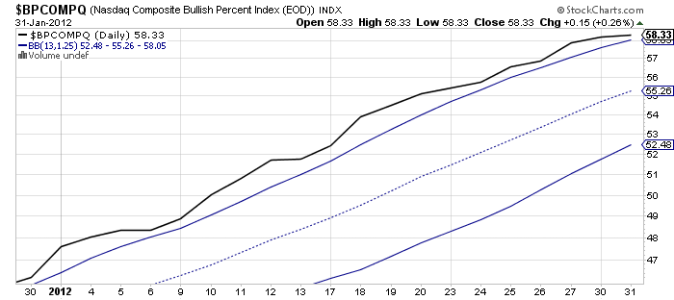

BPCOMPQ continues to follow that upper bollinger band and remains on a buy.

So the signals remain mixed, which keeps the Seven Sentinels in a buy condition.

There are times when the market just isn't saying much and the past few days has been one of those times.

Tomorrow is the first of February and I'll be interested to see how many sidelined TSPers begin to take positions in the new month. I'm looking for a buying opportunity myself, but I'm not in a hurry to get invested and will exercise some patience in picking my spot.

The Greece situation hasn't changed and Portugal is standing by for its time in the spotlight. Market participants seem to be largely bored by the whole thing, but don't be lulled into a sense of complacency. The time will probably come when the market will suddenly be concerned all over again.

Two data points were released today. The latest Chicago PMI came in at 60.2, which was lower than last month's 62.5 reading. Economists were looking for a number closer to 62.8. The Consumer Confidence Index for January dropped to 61.1 from December's 64.8 reading. That too was below estimates.

Let's take a look at the charts:

NAMO and NYMO remain on sells.

NAHL and NYHL managed to flip back to buys. Given the low volatility of these signals it's not surprising to see the reading flip back and forth.

TRIN remained on a sell (barely), while TRINQ flipped to a sell (barely). No help here.

BPCOMPQ continues to follow that upper bollinger band and remains on a buy.

So the signals remain mixed, which keeps the Seven Sentinels in a buy condition.

There are times when the market just isn't saying much and the past few days has been one of those times.

Tomorrow is the first of February and I'll be interested to see how many sidelined TSPers begin to take positions in the new month. I'm looking for a buying opportunity myself, but I'm not in a hurry to get invested and will exercise some patience in picking my spot.