Aside from the DOW's modest gain today, the big board markets closed down in volatile trade.

Early this morning August housing starts jumped 10.5% to an annualized rate of 598,000, while building permits increased 1.8% to an annualized rate of 569,000. I'm not so sure that was good news given the sad state of the housing market; especially all that inventory sitting around with more entering the market with each foreclosure. I'm sure there was some spin to it, but I haven't dug down into the numbers.

But the biggest news of the day was the Fed's FOMC announcement. It was widely expected that the Fed would keep rates steady, and that's exactly what they did. So the fed funds rate stays unchanged between 0.00% to 0.25%. They also didn't reveal any new insight into their previous line of thinking. They said that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

They also stated they are prepared to provide additional accommodation if needed. And that's when bonds added to their gains and volatile trade began in the stock market.

The dollar was pounded for a 1.0% loss today, which kept the I fund afloat (relatively speaking).

So where do we go from here? I don't get the impression that this market is about to reverse its trend too quickly so don't get too bearish just yet. I suspect a lot of folks who missed out on the previous run higher are looking for an entry point, and I'm sure da boyz would love to start selling them some of their shares, so I'm looking for sideways action for now. If more bears can get converted to the bullish side we might be able to head back down the ladder, but I think there's more work to do in that department.

Here's today's charts:

NAMO and NYMO still look bullish even if they did flip to sells today. There's a good chance we track sideways and/or trend higher yet.

NAHL and NYHL still look good too. NYHL did just barely flip to a sell today, but that's not notable at this point.

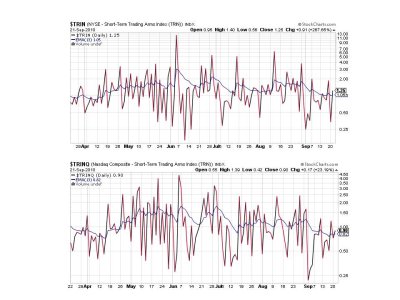

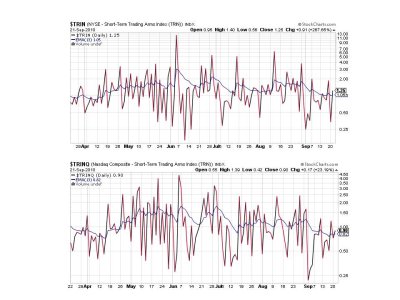

Two sells here with TRIN and TRINQ, but not by much.

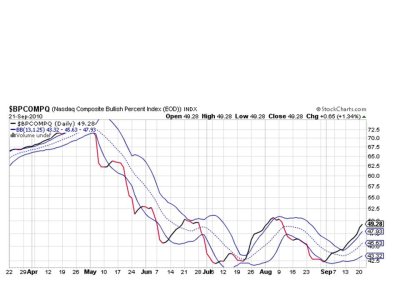

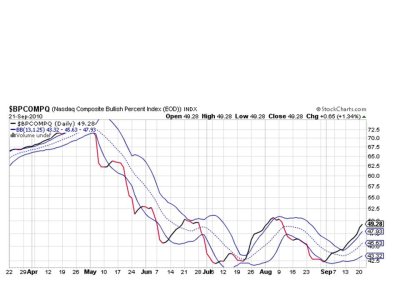

BPCOMPQ continues to walk up that ladder and remains on a buy.

So we have 2 of 7 signals remaining on a buy, but none of the 5 sell signals are robust and it will take much more selling pressure to turn BPCOMPQ.

I am currently 100% F fund and I'm not looking for an entry point into stocks, regardless of the buy condition from the sentinels. I am of the opinion that risk is too high now for stock exposure and that bonds will continue to offer respectable returns with much less risk.

Early this morning August housing starts jumped 10.5% to an annualized rate of 598,000, while building permits increased 1.8% to an annualized rate of 569,000. I'm not so sure that was good news given the sad state of the housing market; especially all that inventory sitting around with more entering the market with each foreclosure. I'm sure there was some spin to it, but I haven't dug down into the numbers.

But the biggest news of the day was the Fed's FOMC announcement. It was widely expected that the Fed would keep rates steady, and that's exactly what they did. So the fed funds rate stays unchanged between 0.00% to 0.25%. They also didn't reveal any new insight into their previous line of thinking. They said that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

They also stated they are prepared to provide additional accommodation if needed. And that's when bonds added to their gains and volatile trade began in the stock market.

The dollar was pounded for a 1.0% loss today, which kept the I fund afloat (relatively speaking).

So where do we go from here? I don't get the impression that this market is about to reverse its trend too quickly so don't get too bearish just yet. I suspect a lot of folks who missed out on the previous run higher are looking for an entry point, and I'm sure da boyz would love to start selling them some of their shares, so I'm looking for sideways action for now. If more bears can get converted to the bullish side we might be able to head back down the ladder, but I think there's more work to do in that department.

Here's today's charts:

NAMO and NYMO still look bullish even if they did flip to sells today. There's a good chance we track sideways and/or trend higher yet.

NAHL and NYHL still look good too. NYHL did just barely flip to a sell today, but that's not notable at this point.

Two sells here with TRIN and TRINQ, but not by much.

BPCOMPQ continues to walk up that ladder and remains on a buy.

So we have 2 of 7 signals remaining on a buy, but none of the 5 sell signals are robust and it will take much more selling pressure to turn BPCOMPQ.

I am currently 100% F fund and I'm not looking for an entry point into stocks, regardless of the buy condition from the sentinels. I am of the opinion that risk is too high now for stock exposure and that bonds will continue to offer respectable returns with much less risk.