Last week, the market logged five advances in as many days on its way to a 5.4% weekly gain. This week, the market logged losses in four of five trading days and ended the week lower by 6.5%.

Such wide swings speak to the headline risk of global economic developments as well as the emotional turmoil of the trader psyche.

This week's performance was the seventh weekly loss in nine weeks. And while TSPTalk declared that a bear market had begun last month, not all traders were as convinced. But September appears to be challenging that opposing view as additional technical indications mount on the bear side. And that may be the context to keep in mind. We are trending lower, albeit in volatile fashion.

Yesterday, the 10-Year Note's yield moved to an all-time low of 1.7%. It gave up some of those gains today as its yield closed above 1.80% on today's trading.

And gold had a steep 5.6% drop today to $1645 per ounce, which has some traders wondering whether if its time to start buying again.

Here's today's charts:

NAMO and NYMO bounced a bit today, but remain in sell conditions.

Big bounce today for NAHL and NYHL. Both managed to flip back to buys.

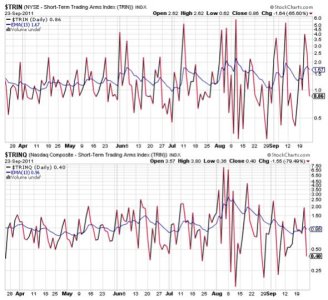

TRIN and TRINQ both flipped back to buys today and do not suggest we are overbought. However, TRINQ's 13 day EMA is at the lower end of its 6 month range, which may be problematic for this market in the weeks ahead. In other words, I don't know if this signal can maintain this level for much longer. The implication here is a bearish one moving forward.

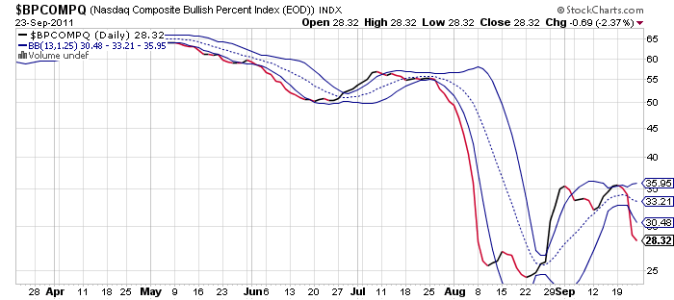

BPCOMPQ ebbed a bit lower today and remains firmly in a sell condition.

The signals are mixed today after yesterday's official sell signal was given. And next week marks the last trading week of the quarter, which is often bullish. But I'm not so sure I'd make a big bullish bet that today's bounce will carry over in any large measure next week. I suspect it may be too obvious an entry. I'm thinking we set new lows next week, which could carry over into October. The question though, is whether sentiment is bearish enough to support this market in the short term. Our sentiment survey certainly suggests it is, but is it enough given the seemingly deteriorating state of the global economy? The Fed is implementing operation twist, but how much manipulation can this market take before it falls on its own weight?

As I mentioned yesterday, I took a very modest position in stocks at the close yesterday (6% total) with the rest remaining in the F fund. I am trying to gauge whether this market can move back up from here before committing any more funds (I still have 1 IFT). We bounced today, but I want to see how trading shapes up early on next week as my trading strategy could vary depending on what the market does.

Stop by Sunday evening for the tracker charts. See you then.