crommie

Market Tracker

- Reaction score

- 9

If your in the stock funds as I am, it is decission time again. Should one be nimble and jump to safety after yesterday's reversal and today's negative start or should one be patient and wait for this bull run to resume it's upward push? In May, I was TOO patient and road the longest red day streak in years to a loss.  Then on August 2nd, I was TOO nimble and jumped at the first sign of trouble only to have the market jump back up the next day!

Then on August 2nd, I was TOO nimble and jumped at the first sign of trouble only to have the market jump back up the next day!

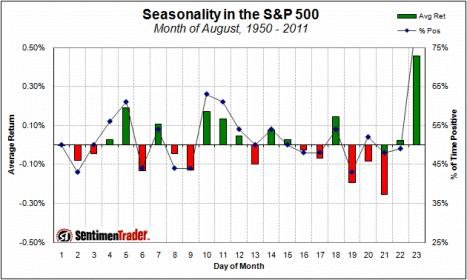

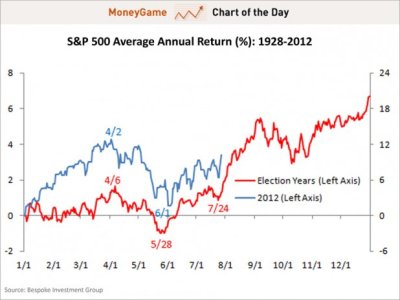

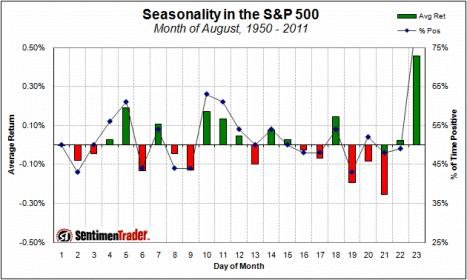

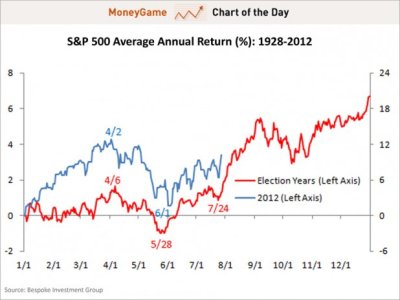

From a TA perspective, it is probably smart to step aside for a while. From a IFT limit perspective (none left except to safety) I want to be in the market next week. This is because of seasonallity and headlines. For seasonallity, see these two charts previously shared by MrJohnRoss and Tom. Look at the last trading day of August on both charts!

For headlines, there will be a lot of Leaders meeting in Europe later this week and over the weekend. Lately, when the PMs and Presidents talk, good headlines are produced. They don't want to look bad on the international stage... Then next week we will have the FOMC meeting in Jackson Hole with an announcement on Friday the 31st followed up by, and probably overshadowed by, the ECB meeting/announcement on Sept 1st. I definately don't want to be in the garage while that parade goes by! So, I am staying on the band wagon, in the bull parade, cheering for the EU, FOMC, and ECB to lead us to higher highs! :nuts::nuts::nuts:

Then next week we will have the FOMC meeting in Jackson Hole with an announcement on Friday the 31st followed up by, and probably overshadowed by, the ECB meeting/announcement on Sept 1st. I definately don't want to be in the garage while that parade goes by! So, I am staying on the band wagon, in the bull parade, cheering for the EU, FOMC, and ECB to lead us to higher highs! :nuts::nuts::nuts:

Good Luck Everyone!

From a TA perspective, it is probably smart to step aside for a while. From a IFT limit perspective (none left except to safety) I want to be in the market next week. This is because of seasonallity and headlines. For seasonallity, see these two charts previously shared by MrJohnRoss and Tom. Look at the last trading day of August on both charts!

For headlines, there will be a lot of Leaders meeting in Europe later this week and over the weekend. Lately, when the PMs and Presidents talk, good headlines are produced. They don't want to look bad on the international stage...

Good Luck Everyone!