The market started off weak, but fought to regain positive territory early in the trading session before another bout of selling pressure took it down to its lows of the day just prior to noon (EST). From there it chopped its way higher during the afternoon session before a late day decline took it off its highs of the day in the final minutes before the closing bell.

Gains were uneven with the DOW only posting a 0.14% advance, while the Nasdaq was the leader posting a 1.09% gain thanks in large measure to technology stocks.

Just like yesterday, volume was quite low.

There were several data points released earlier in the trading session. Retail sales for October rose 0.5%, which eclipsed expectations for a 0.4% gain. Excluding autos, sales were up 0.6%, which handily beat estimates of 0.2%.

Producer prices in October dropped 0.3%, which was a bit more than forecasts calling for a 0.2% decline. Core prices came in flat, which was close to estimates looking for a 0.1% increase.

The November Empire State Manufacturing Survey came in at 0.6, which beat estimates that were anticipating a negative number. October's ESM survey was -8.5, so there was improvement.

Here's today's charts:

NAMO moved back to a buy condition, while NYMO remained on a sell.

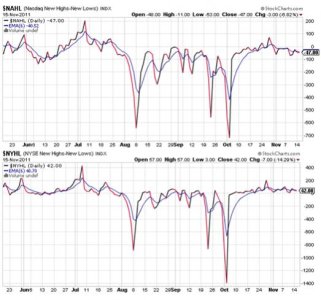

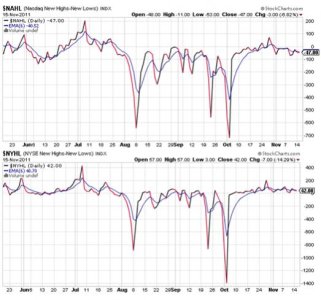

Both NAHL and NYHL remained in sell conditions.

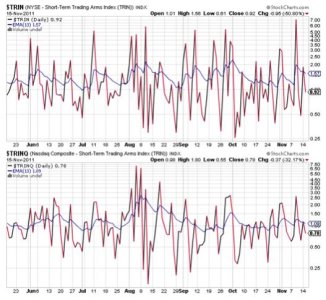

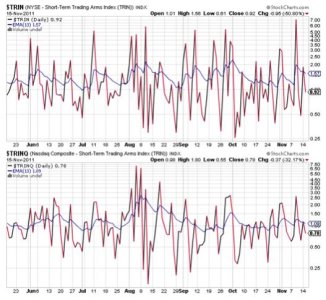

TRIN and TRINQ dropped lower and flipped to buys in the process.

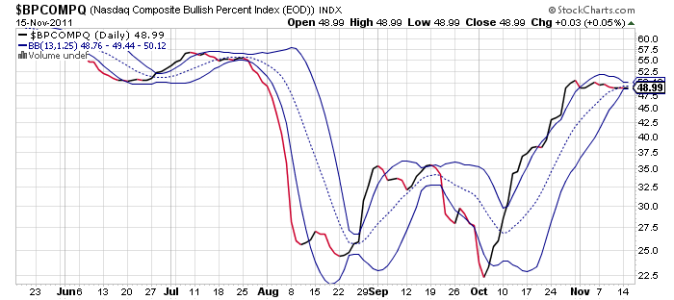

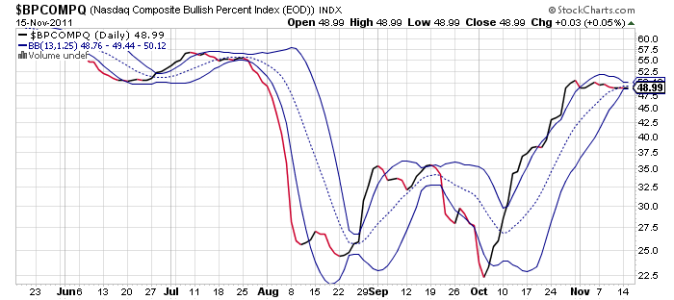

BPCOMPQ tracked mostly sideways, again, and remains in a sell condition. The bollinger bands keep tightening around that signal, which is raising the odds for a breakout move one way or the other soon.

So the signals are back to a mixed condition after yesterday's unconfirmed sell signal. Officially, the system remains on a buy.

I don't have much to add here as the market appears to be stuck in neutral. I'd like to think the three unconfirmed sells the system has had in the previous three weeks is a precursor to an official sell signal, but support is holding so far. I know some think we could see a fake out to the downside, and I tend to agree with that. A fake out would probably flip the seven sentinels to an official intermediate term sell condition, but I wouldn't bet the farm on a large decline going into the holiday period. Not that we couldn't have one, but I really don't get the impression this market is ready to roll over. In fact, I'm inclined to think its coiling for a big move higher instead.

I did take a modest position in stocks today as I moved 20% of my G fund holdings into the S fund. I'm willing to move more on weakness, but I'll cap my position at no more than 50% stocks. I've got my eye on the longer term market now and want to be ready execute a buy and hold trading plan in the months ahead. And for that I need to keep some cash on the sidelines.

Gains were uneven with the DOW only posting a 0.14% advance, while the Nasdaq was the leader posting a 1.09% gain thanks in large measure to technology stocks.

Just like yesterday, volume was quite low.

There were several data points released earlier in the trading session. Retail sales for October rose 0.5%, which eclipsed expectations for a 0.4% gain. Excluding autos, sales were up 0.6%, which handily beat estimates of 0.2%.

Producer prices in October dropped 0.3%, which was a bit more than forecasts calling for a 0.2% decline. Core prices came in flat, which was close to estimates looking for a 0.1% increase.

The November Empire State Manufacturing Survey came in at 0.6, which beat estimates that were anticipating a negative number. October's ESM survey was -8.5, so there was improvement.

Here's today's charts:

NAMO moved back to a buy condition, while NYMO remained on a sell.

Both NAHL and NYHL remained in sell conditions.

TRIN and TRINQ dropped lower and flipped to buys in the process.

BPCOMPQ tracked mostly sideways, again, and remains in a sell condition. The bollinger bands keep tightening around that signal, which is raising the odds for a breakout move one way or the other soon.

So the signals are back to a mixed condition after yesterday's unconfirmed sell signal. Officially, the system remains on a buy.

I don't have much to add here as the market appears to be stuck in neutral. I'd like to think the three unconfirmed sells the system has had in the previous three weeks is a precursor to an official sell signal, but support is holding so far. I know some think we could see a fake out to the downside, and I tend to agree with that. A fake out would probably flip the seven sentinels to an official intermediate term sell condition, but I wouldn't bet the farm on a large decline going into the holiday period. Not that we couldn't have one, but I really don't get the impression this market is ready to roll over. In fact, I'm inclined to think its coiling for a big move higher instead.

I did take a modest position in stocks today as I moved 20% of my G fund holdings into the S fund. I'm willing to move more on weakness, but I'll cap my position at no more than 50% stocks. I've got my eye on the longer term market now and want to be ready execute a buy and hold trading plan in the months ahead. And for that I need to keep some cash on the sidelines.