Nordic

TSP Analyst

- Reaction score

- 17

- AutoTracker

It's funny but all the Geopolitical, Fed, economic etc. news is always there. There is always something to worry about. Thats why I like using technicals. It simplifies things. Also, I have decided that using too many technical parameters just confuses things. So, I use just a few simple ideas to make my decisions on.

The other stuff is interesting and I follow it but now its just background noise to me.

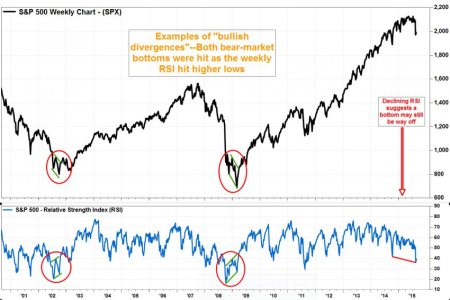

I will be looking for a lower low but a higher RSI to trigger a buy. This creates a divergence and usually indicates things are turning around. Be aware though that we are now in what my system defines as a bear market (50 dma is below the 200). Bias is now to the downside so I usually only buy 50% unless its very compelling.

We just have to be patient. I think we will get it this month. Maybe around the Fed meeting.

Agree with being patient while the Fed thing plays out in a couple of weeks. What you just said reminded me of what was in this article:

‘Bearish divergence’ is warning investors not to buy the dip in the stock market - MarketWatch