Pre-Bell  Brief

Brief

Time: 31-Oct-2025 06:45 (ET)

Key Takeaway

Key Takeaway

• Big-tech earnings pop has U.S. futures pointing higher, but cash still has to absorb Thursday’s broad SPX/Nasdaq selloff. [1][2]

• Ongoing federal shutdown means key U.S. data can slip or publish in fragments, so traders will lean harder on private nowcasts. [3][14][15]

• TSP funds all printed 30-Oct; G-Fund glide for November still looks small but positive after exclusion rules. [7]

What Moved Overnight

What Moved Overnight

• U.S. futures: SPX +0.6% pre-cash as strong AAPL and AMZN guidance calmed the megacap wobble. [2]

• Europe: opened softer after yesterday’s U.S. tech dump, with desks noting shutdown-related U.S. data uncertainty. [1][14]

• Asia: mixed to lower even after U.S.–China trade optics improved, which tells you earnings > geopolitics today. [1][15]

How the Prior Session Closed

How the Prior Session Closed

• U.S. stocks slid as post-Fed enthusiasm faded: SPX −0.99%, IXIC −1.6%, DJI −0.2%; selling was heaviest in earnings laggards and AI-spend names. [8]

• Rates and dollar stayed firm, keeping pressure on duration trades and defensives; cash desks flagged forced de-risking into the close. [1]

• Shutdown-delayed data left traders “flying a bit blind,” so the equity move tracked earnings tapes more than macro prints. [3][14]

• Top SPX Winner: CHRW (C.H. Robinson Worldwide) +19.71% (Industrials: Air Freight & Logistics) [9]

• Bottom SPX Loser: CMG (Chipotle Mexican Grill) −18.18% (Consumer Discretionary: Restaurants) [10]

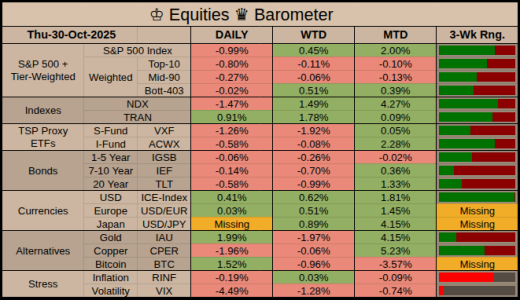

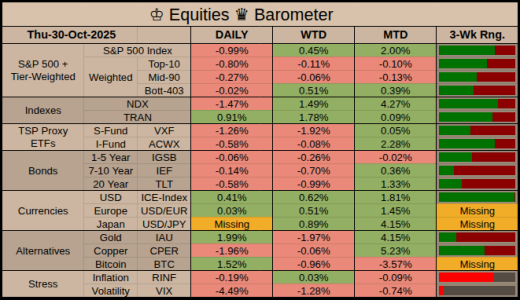

♔ Equities & ♛ Barometer

• Prior Session: SPX fell on earnings shocks while yields edged higher, VIX firmed, and DXY held near recent highs. [1][18]

• WTD: Risk tone still net-positive thanks to earlier megacap beats, but leadership narrowed into dollar/quality winners. [1][2]

• MTD: Indexes remain up for October, yet shutdown noise and tariff chatter kept buyers selective. [14][15]

• 3-Week: Momentum improved as earnings breadth stayed decent, dollar stopped rising fast, and vol stayed contained. [1][18]

TSP Stats

TSP Stats

G-Fund Estimated Forward Returns • +0.0115% per session [7]

• 5 Sessions: +0.058% • November: +0.22% • 3 Months: +0.73% • 1 Year: +2.95%

FCSI Past-5 Sessions

• F-Fund −0.50% • C-Fund +0.45% • S-Fund −1.96% • I-Fund −0.11% [7]

Today's 1st Hour of Trading, What to Watch For

Today's 1st Hour of Trading, What to Watch For

• 10/31 FRI 08:30 — [Macro] PCE/income/spending: release timing subject to shutdown; use private trackers if no official print hits. [3][14][15]

• 10/31 FRI 10:00 — [Earnings] AMZN, AAPL call spillover: watch for options-market follow-through into tech-weighted ETFs. [2][22]

• 10/31 FRI 13:00 — [Auction] 2y FRN, 5y & 7y note settlements: size and bid-to-cover matter after Fed’s QT-end signal. [5][2]

Upcoming Headlines (5-Day Window, ET)

Upcoming Headlines (5-Day Window, ET)

• 10/31 FRI 11:00 — [Macro] Chicago/regionals or private PMIs may stand in for delayed federal series. [3][15]

• 11/03 MON 11:00 — [Macro] Factory Orders (Sep) still on calendar, but Census may slip if shutdown extends. [11][13][14]

• 11/04 TUE 08:30 — [Macro] U.S. trade balance (Sep) and JOLTS: treat as tentative, markets already leaning on private labor gauges. [11][12][14]

• 11/04 TUE 09:55 — [Macro] Redbook weekly sales: extra weight while consumers face tariffs and paused federal pay. [4][5][12]

• 11/05 WED — [Fed] Fedspeak window ahead of December: use it to triangulate the second cut or a long hold. [6][15]

Off in the Distance (+5 Days Out)

Off in the Distance (+5 Days Out)

• 11/07 FRI 08:30 — Nonfarm Payrolls (Oct): at risk of delay, but market will trade ADP/private series if BLS is dark. [14][16]

• 11/13 THU 09:30 — CPI (Oct): still the key inflation waypoint before December FOMC. [17]

• Mid-Nov — Treasury 10y/30y supply and refunding follow-up: duration traders will want clean demand after shutdown. [5]

• 01-Dec — Fed QT formally ends per October decision: keeps balance-sheet tone market-friendly into year-end. [15]

▶ Citation Block

[1] 31-Oct-2025: marketwatch.com: U.S. markets overview

[2] 31-Oct-2025: reuters.com: Futures rise on Apple, Amazon forecasts

[3] 31-Oct-2025: apnews.com: Shutdown delays key U.S. data

[4] 31-Oct-2025: investing.com: Economic calendar

[5] 31-Oct-2025: treasury.gov: U.S. Treasury auctions

[6] 31-Oct-2025: cmegroup.com: CME FedWatch Tool

[7] 30-Oct-2025: tsptalk.com: TSP share prices and daily changes

[8] 30-Oct-2025: investopedia.com: Markets news, Oct. 30, 2025

[9] 31-Oct-2025: finance.yahoo.com: C.H. Robinson Worldwide (CHRW)

[10] 31-Oct-2025: finance.yahoo.com: Chipotle stock falls after guidance cut

[11] 31-Oct-2025: marketwatch.com: U.S. economic calendar

[12] 31-Oct-2025: tradingeconomics.com: United States calendar

[13] 31-Oct-2025: investing.com: U.S. Factory Orders (Sep)

[14] 30-Oct-2025: reuters.com: Federal shutdown could cost up to $14B

[15] 30-Oct-2025: kiplinger.com: This week’s economic calendar

[16] 31-Oct-2025: investing.com: U.S. Nonfarm Payrolls

[17] 31-Oct-2025: investing.com: U.S. Consumer Price Index (CPI) YoY

[18] 31-Oct-2025: marketwatch.com: U.S. Dollar Index (DXY)

[19] 03-Oct-2025: theguardian.com: U.S. ‘flying blind’ without jobs data

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Time: 31-Oct-2025 06:45 (ET)

• Big-tech earnings pop has U.S. futures pointing higher, but cash still has to absorb Thursday’s broad SPX/Nasdaq selloff. [1][2]

• Ongoing federal shutdown means key U.S. data can slip or publish in fragments, so traders will lean harder on private nowcasts. [3][14][15]

• TSP funds all printed 30-Oct; G-Fund glide for November still looks small but positive after exclusion rules. [7]

• U.S. futures: SPX +0.6% pre-cash as strong AAPL and AMZN guidance calmed the megacap wobble. [2]

• Europe: opened softer after yesterday’s U.S. tech dump, with desks noting shutdown-related U.S. data uncertainty. [1][14]

• Asia: mixed to lower even after U.S.–China trade optics improved, which tells you earnings > geopolitics today. [1][15]

• U.S. stocks slid as post-Fed enthusiasm faded: SPX −0.99%, IXIC −1.6%, DJI −0.2%; selling was heaviest in earnings laggards and AI-spend names. [8]

• Rates and dollar stayed firm, keeping pressure on duration trades and defensives; cash desks flagged forced de-risking into the close. [1]

• Shutdown-delayed data left traders “flying a bit blind,” so the equity move tracked earnings tapes more than macro prints. [3][14]

• Top SPX Winner: CHRW (C.H. Robinson Worldwide) +19.71% (Industrials: Air Freight & Logistics) [9]

• Bottom SPX Loser: CMG (Chipotle Mexican Grill) −18.18% (Consumer Discretionary: Restaurants) [10]

♔ Equities & ♛ Barometer

• Prior Session: SPX fell on earnings shocks while yields edged higher, VIX firmed, and DXY held near recent highs. [1][18]

• WTD: Risk tone still net-positive thanks to earlier megacap beats, but leadership narrowed into dollar/quality winners. [1][2]

• MTD: Indexes remain up for October, yet shutdown noise and tariff chatter kept buyers selective. [14][15]

• 3-Week: Momentum improved as earnings breadth stayed decent, dollar stopped rising fast, and vol stayed contained. [1][18]

G-Fund Estimated Forward Returns • +0.0115% per session [7]

• 5 Sessions: +0.058% • November: +0.22% • 3 Months: +0.73% • 1 Year: +2.95%

FCSI Past-5 Sessions

• F-Fund −0.50% • C-Fund +0.45% • S-Fund −1.96% • I-Fund −0.11% [7]

• 10/31 FRI 08:30 — [Macro] PCE/income/spending: release timing subject to shutdown; use private trackers if no official print hits. [3][14][15]

• 10/31 FRI 10:00 — [Earnings] AMZN, AAPL call spillover: watch for options-market follow-through into tech-weighted ETFs. [2][22]

• 10/31 FRI 13:00 — [Auction] 2y FRN, 5y & 7y note settlements: size and bid-to-cover matter after Fed’s QT-end signal. [5][2]

• 10/31 FRI 11:00 — [Macro] Chicago/regionals or private PMIs may stand in for delayed federal series. [3][15]

• 11/03 MON 11:00 — [Macro] Factory Orders (Sep) still on calendar, but Census may slip if shutdown extends. [11][13][14]

• 11/04 TUE 08:30 — [Macro] U.S. trade balance (Sep) and JOLTS: treat as tentative, markets already leaning on private labor gauges. [11][12][14]

• 11/04 TUE 09:55 — [Macro] Redbook weekly sales: extra weight while consumers face tariffs and paused federal pay. [4][5][12]

• 11/05 WED — [Fed] Fedspeak window ahead of December: use it to triangulate the second cut or a long hold. [6][15]

• 11/07 FRI 08:30 — Nonfarm Payrolls (Oct): at risk of delay, but market will trade ADP/private series if BLS is dark. [14][16]

• 11/13 THU 09:30 — CPI (Oct): still the key inflation waypoint before December FOMC. [17]

• Mid-Nov — Treasury 10y/30y supply and refunding follow-up: duration traders will want clean demand after shutdown. [5]

• 01-Dec — Fed QT formally ends per October decision: keeps balance-sheet tone market-friendly into year-end. [15]

▶ Citation Block

[1] 31-Oct-2025: marketwatch.com: U.S. markets overview

[2] 31-Oct-2025: reuters.com: Futures rise on Apple, Amazon forecasts

[3] 31-Oct-2025: apnews.com: Shutdown delays key U.S. data

[4] 31-Oct-2025: investing.com: Economic calendar

[5] 31-Oct-2025: treasury.gov: U.S. Treasury auctions

[6] 31-Oct-2025: cmegroup.com: CME FedWatch Tool

[7] 30-Oct-2025: tsptalk.com: TSP share prices and daily changes

[8] 30-Oct-2025: investopedia.com: Markets news, Oct. 30, 2025

[9] 31-Oct-2025: finance.yahoo.com: C.H. Robinson Worldwide (CHRW)

[10] 31-Oct-2025: finance.yahoo.com: Chipotle stock falls after guidance cut

[11] 31-Oct-2025: marketwatch.com: U.S. economic calendar

[12] 31-Oct-2025: tradingeconomics.com: United States calendar

[13] 31-Oct-2025: investing.com: U.S. Factory Orders (Sep)

[14] 30-Oct-2025: reuters.com: Federal shutdown could cost up to $14B

[15] 30-Oct-2025: kiplinger.com: This week’s economic calendar

[16] 31-Oct-2025: investing.com: U.S. Nonfarm Payrolls

[17] 31-Oct-2025: investing.com: U.S. Consumer Price Index (CPI) YoY

[18] 31-Oct-2025: marketwatch.com: U.S. Dollar Index (DXY)

[19] 03-Oct-2025: theguardian.com: U.S. ‘flying blind’ without jobs data

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.