It was a mixed day in equities, but considering how the market started out and the way it came back I would have to view the action as bullish. Options expiration week is coming up next week so the volatility we've been seeing is probably the set-up for that.

The Seven Sentinels continue to suggest more gains are coming. Here's today's charts:

As expected, both NAMO and NYMO continue to push higher, but still off the highs we typically saw during last year's rallies. This is bullish.

NAHL and NYHL are beginning to show some life and may start moving higher on any follow through action to the upside.

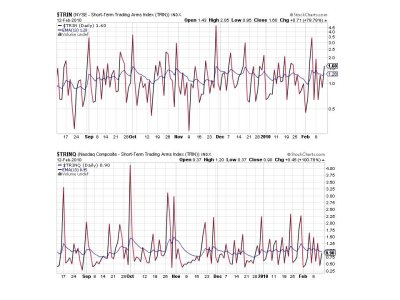

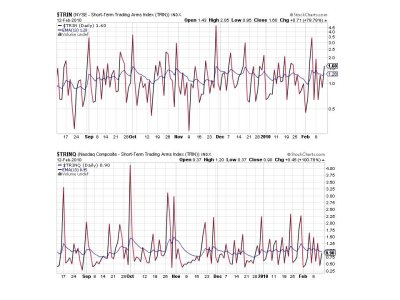

TRIN flipped to a sell, while TRINQ remained on a buy. Both are close to their 6 day EMAs. No concern here.

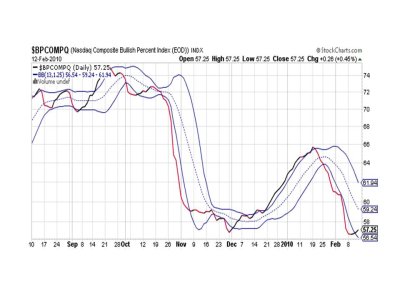

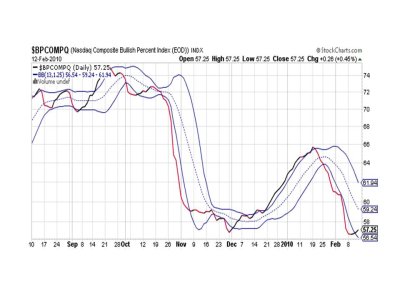

BPCOMPQ ebbed a bit higher today and also suggests more upside in the coming days.

I'll post Top 15 and Top 50 charts this weekend.

So 6 of 7 signals remain on a buy, which keeps the system on a buy. So far this buy signal is playing out very well. The mixed action we had today should have kept the day traders guessing all day, probably leaving many flat going into the holiday weekend. The economic news coming out of the media has been decidedly bearish, which should keep a lid on bullishness and thus push valuations higher. I know that may seem strange to some folks, but the market likes to climb a wall of worry, and we have a nice one right now. See you this weekend.

The Seven Sentinels continue to suggest more gains are coming. Here's today's charts:

As expected, both NAMO and NYMO continue to push higher, but still off the highs we typically saw during last year's rallies. This is bullish.

NAHL and NYHL are beginning to show some life and may start moving higher on any follow through action to the upside.

TRIN flipped to a sell, while TRINQ remained on a buy. Both are close to their 6 day EMAs. No concern here.

BPCOMPQ ebbed a bit higher today and also suggests more upside in the coming days.

I'll post Top 15 and Top 50 charts this weekend.

So 6 of 7 signals remain on a buy, which keeps the system on a buy. So far this buy signal is playing out very well. The mixed action we had today should have kept the day traders guessing all day, probably leaving many flat going into the holiday weekend. The economic news coming out of the media has been decidedly bearish, which should keep a lid on bullishness and thus push valuations higher. I know that may seem strange to some folks, but the market likes to climb a wall of worry, and we have a nice one right now. See you this weekend.