As I mentioned yesterday, I didn't expect it to take too long before the market rallied back. It took about one hour to be exact, right after a short bout of volatility.

The only significant selling pressure came at 1000 EST when the new home sales data for January showed a 11.2% month-over-month decline. The selling lasted all of 30 minutes.

On another note, Fed Chairman Ben Bernanke revealed that the FOMC continues to anticipate a moderate pace of economic recovery and that inflation is expected to remain subdued. Of course he also reiterated that the Fed will need to begin to tighten monetary conditions to prevent inflationary pressures. I think we've already seen evidence of that when they raised the overnight lending rate.

The dollar saw some volatility today, as it was down as much as 0.7% before settling at a much more modest loss of 0.1% at the close of trading.

Of course today's action strengthened the current Seven Sentinels buy signal. Here's the charts:

NAMO tagged its 6 day EMA and NYMO flipped back to a buy.

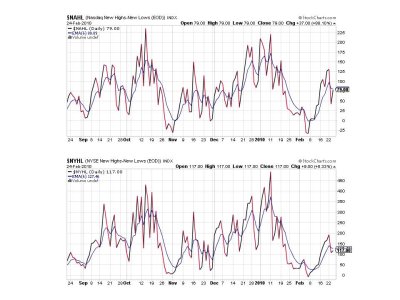

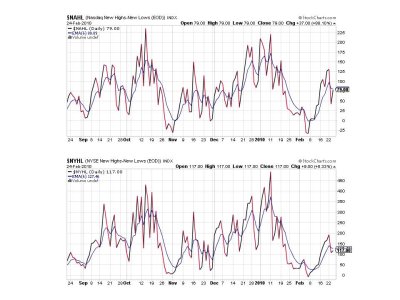

Both NAHL and NYHL remain on sells, but they are very close to their 6 day EMAs and could flip back to a buy on any upside follow through.

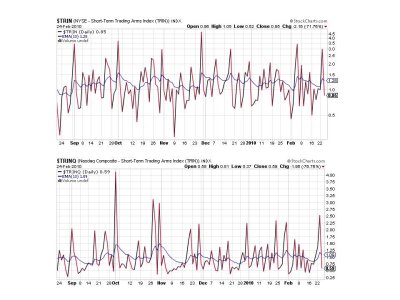

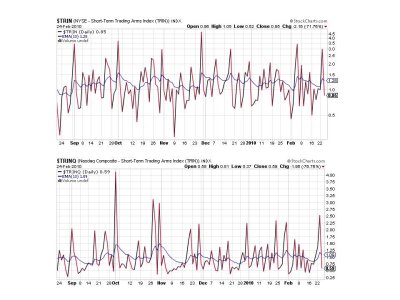

Yesterday I said that TRIN and TRINQ were at extreme readings, which typically means a reversal could happen quickly and that's what we got.

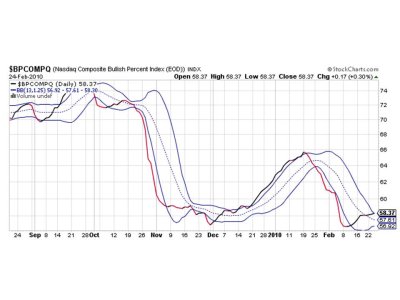

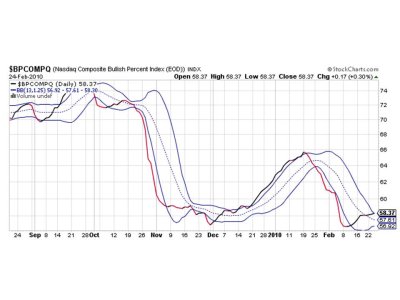

BPCOMPQ touched the upper bollinger band, which doesn't mean much other than it's slowly ebbing higher. But a sell signal could be given if it reverses course and recrosses that upper BB to the downside.

Yesterday we had only signal on a buy (BPCOMPQ), but that this didn't change the system's buy status. Today we have flipped four of those sell signals back to buys. That's 5 of 7 in buy mode, which keeps the system on a buy. I still see no reason to expect a system reversal any time in the very short term, so holding stocks is probably a good play right now.

That's it for this evening, see you tomorrow.

The only significant selling pressure came at 1000 EST when the new home sales data for January showed a 11.2% month-over-month decline. The selling lasted all of 30 minutes.

On another note, Fed Chairman Ben Bernanke revealed that the FOMC continues to anticipate a moderate pace of economic recovery and that inflation is expected to remain subdued. Of course he also reiterated that the Fed will need to begin to tighten monetary conditions to prevent inflationary pressures. I think we've already seen evidence of that when they raised the overnight lending rate.

The dollar saw some volatility today, as it was down as much as 0.7% before settling at a much more modest loss of 0.1% at the close of trading.

Of course today's action strengthened the current Seven Sentinels buy signal. Here's the charts:

NAMO tagged its 6 day EMA and NYMO flipped back to a buy.

Both NAHL and NYHL remain on sells, but they are very close to their 6 day EMAs and could flip back to a buy on any upside follow through.

Yesterday I said that TRIN and TRINQ were at extreme readings, which typically means a reversal could happen quickly and that's what we got.

BPCOMPQ touched the upper bollinger band, which doesn't mean much other than it's slowly ebbing higher. But a sell signal could be given if it reverses course and recrosses that upper BB to the downside.

Yesterday we had only signal on a buy (BPCOMPQ), but that this didn't change the system's buy status. Today we have flipped four of those sell signals back to buys. That's 5 of 7 in buy mode, which keeps the system on a buy. I still see no reason to expect a system reversal any time in the very short term, so holding stocks is probably a good play right now.

That's it for this evening, see you tomorrow.