The bulls were unable to mount much of an answer to yesterday's market rout. The major averages finished mixed overall with the Nasdaq up 0.2%, while the S&P 500 dropped 0.1%.

Earlier in the day it looked as though a catalyst was forming that had the potential to drag the market down significantly as financials were getting hit hard. They eventually reversed early losses and finished the day higher by 0.2%, but what got the market's attention was that Goldman Sachs had been served with a subpoena by the Manhattan prosecutor. And then Bank of America, Citigroup, and Wells Fargo got whacked after Moody's announced the companies were being placed on review for a possible downgrade as a result of Government support returning to pre-crisis levels. Unlike Goldman Sachs, which still ended the day significantly lower, these three banks managed to end the day in the green.

Treasuries largely gave back all of yesterday's impressive gains today after Moody's warned the U.S. credit rating could be cut if no imminent progress is made on debt ceiling talks. I suspect today's reversal will short lived however.

More potentially market moving data is on tap for tomorrow morning (nonfarm payrolls, nonfarm private payrolls, unemployment rate, hourly earnings, average workweek, and ISM Services).

Here's today's charts:

Not much movement today for NAMO and NYMO since today's action was largely flat. NAMO is right at its trigger point, while NYMO is just under its 6 day EMA, which keeps it on a sell.

NAHL and NYHL both remain on sells.

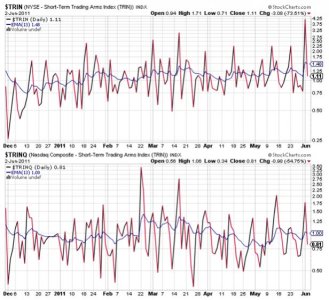

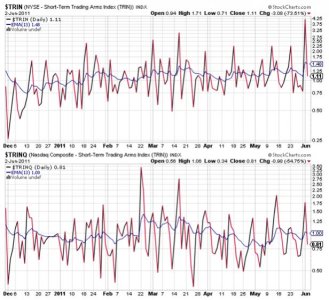

Both TRIN and TRINQ have already worked off that short term oversold condition and flipped to a buy today, but they are sporting largely neutral readings.

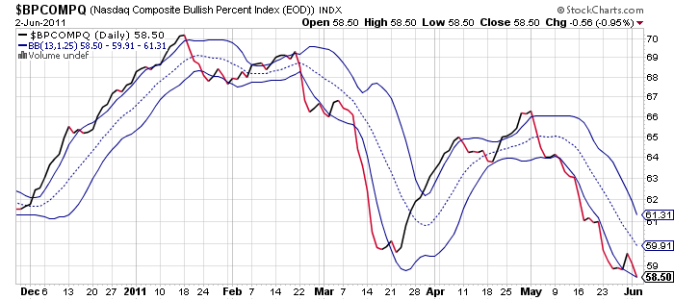

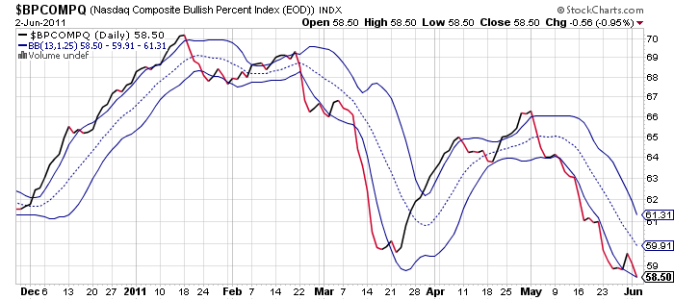

BPCOMPQ does remain in a buy condition, but it's sitting right on that lower bollinger band. It certainly seems to be suggesting we're heading lower.

Today's action certainly had a bearish feel to it as the bulls weren't able to get a rally going that would stick and it was everything they could do just to get back near the neutral line. I continue to expect lower prices yet and if this market holds true to form that low should come around OPEX. But this is a tricky month with QE2 expiring by the 30th and economic data continues to disappoint. No doubt the Fed will have something to say about their plans post-QE2 and that's what the market will probably key on. For now I remain in the F fund.

Earlier in the day it looked as though a catalyst was forming that had the potential to drag the market down significantly as financials were getting hit hard. They eventually reversed early losses and finished the day higher by 0.2%, but what got the market's attention was that Goldman Sachs had been served with a subpoena by the Manhattan prosecutor. And then Bank of America, Citigroup, and Wells Fargo got whacked after Moody's announced the companies were being placed on review for a possible downgrade as a result of Government support returning to pre-crisis levels. Unlike Goldman Sachs, which still ended the day significantly lower, these three banks managed to end the day in the green.

Treasuries largely gave back all of yesterday's impressive gains today after Moody's warned the U.S. credit rating could be cut if no imminent progress is made on debt ceiling talks. I suspect today's reversal will short lived however.

More potentially market moving data is on tap for tomorrow morning (nonfarm payrolls, nonfarm private payrolls, unemployment rate, hourly earnings, average workweek, and ISM Services).

Here's today's charts:

Not much movement today for NAMO and NYMO since today's action was largely flat. NAMO is right at its trigger point, while NYMO is just under its 6 day EMA, which keeps it on a sell.

NAHL and NYHL both remain on sells.

Both TRIN and TRINQ have already worked off that short term oversold condition and flipped to a buy today, but they are sporting largely neutral readings.

BPCOMPQ does remain in a buy condition, but it's sitting right on that lower bollinger band. It certainly seems to be suggesting we're heading lower.

Today's action certainly had a bearish feel to it as the bulls weren't able to get a rally going that would stick and it was everything they could do just to get back near the neutral line. I continue to expect lower prices yet and if this market holds true to form that low should come around OPEX. But this is a tricky month with QE2 expiring by the 30th and economic data continues to disappoint. No doubt the Fed will have something to say about their plans post-QE2 and that's what the market will probably key on. For now I remain in the F fund.