Investors were bracing for the stock market's reaction after the Moody's downgrade of the US credit rating by Moody's, and while things started sharply on the downside, it wasn't quite as bad as it could have been, and of course by the end of the day we saw green in many of the indices. All three of the major indices closed in positive territory, but the S&P 500 and Nasdaq were on the fence until the very final minutes of trading. Small caps lagged and the I-fund led as the dollar tumbled on the Moody's news.

The Moody's downgrade to the US credit rating turned out to be much ado about nothing. Well, maybe that's going too far but my question yesterday was whether the market priced this in already? The bond market saw yields rising or swinging wildly over the last year, and of course since inflation took off in 2021, plus the tariffs and the entire debt situation is not news to anyone. But a headline like that is going to cause some volatility. Investors just weren't blindsided.

Yields and the dollar reacted early as well, but both of them closed well off their opening levels - yields off their highs and the dollar off the lows.

My theory of a stronger dollar in the second quarter isn't exactly giving me any instant gratification, and if anything the chart looks a little sluggish after failing at the 200-day and 50-day EMAs recently. There is some rising support that could still hold, but that may turn out to be the bottom of a bear flag.

This is one reason why I am more of a fan of technical analysis than fundamentals. The Fed liquidity, which should be hitting the economy and the markets about now, should be strengthening the dollar, but the chart looks a little more negative. I will feel better about my theory if and when UUP gets back above 28.25 and 28.75.

Back to yields - the 10-year Treasury Yield has basically been in a range since mid-2022, after inflation exploded it in 2022. The trouble with that is it could be a huge bull flag, meaning higher yields in the long-term. Or it could be a large head and shoulders top? We don't really want to see higher yields and obviously the fundamentals will play a role with tariffs, tax cuts and even deregulation adding the potential inflation concerns, but any slowdown in the economy would send yields lower. It's a tough call. Is this a top of a bull flag forming? And of course this really matters and will dictate the direction of the stock market as well.

Speaking of, the S&P 500 (C-fund) closed just north of flat yesterday, mocking the disturbing drop in the US credit rating. It's also interesting how light the trading volume was on a day that could have been panicky. One conspiracy theory for the downgrade was that institutional investors had missed the boat on the rally off the lows and they needed something to pull it back down again. Clearly however, the indices have come a long way and there's a couple of open gaps that may still have to be dealt with below, so there are still good arguments for both sides in the short-term. Longer term... the chart looks pretty good.

The Dow Transportation Index is in an interesting situation as it has been moving sideways for the last week and it is quite sticky in that 15,000 area. The 200-day EMA is above for a possible test but the open gap and recent flat top could be a draw to the downside. It's a market leader and very sensitive to the economic data, so the next direction will be telling for the broader market.

Bitcoin is near its all-time highs again and as we have said before, when investors are interested in taking on risk, bitcoin tends to do well, and the S&P 500 often follows.

The DWCPF (S-fund) was down yesterday but it closed at the highs of the day and that's impressive considering the news coming into the day. That March peak held as support and the ascending channel is still very much intact. If yields do start making their way higher, this may be one to avoid, otherwise it is performing well.

ACWX (I-fund) took off as the dollar rolled over. This one has been tough to stop and again my theory that the dollar is going higher has not been paying off, and I had sold some I-fund a couple of weeks ago because of my theory. Fortunately the US stocks have been outperforming the I-fund since that sale, but this doesn't look dead yet.

BND (bonds / F-fund) opened lower but once again the bottom of the range continues to hold as support.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

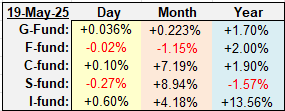

| Daily TSP Funds Return More returns |

The Moody's downgrade to the US credit rating turned out to be much ado about nothing. Well, maybe that's going too far but my question yesterday was whether the market priced this in already? The bond market saw yields rising or swinging wildly over the last year, and of course since inflation took off in 2021, plus the tariffs and the entire debt situation is not news to anyone. But a headline like that is going to cause some volatility. Investors just weren't blindsided.

Yields and the dollar reacted early as well, but both of them closed well off their opening levels - yields off their highs and the dollar off the lows.

My theory of a stronger dollar in the second quarter isn't exactly giving me any instant gratification, and if anything the chart looks a little sluggish after failing at the 200-day and 50-day EMAs recently. There is some rising support that could still hold, but that may turn out to be the bottom of a bear flag.

This is one reason why I am more of a fan of technical analysis than fundamentals. The Fed liquidity, which should be hitting the economy and the markets about now, should be strengthening the dollar, but the chart looks a little more negative. I will feel better about my theory if and when UUP gets back above 28.25 and 28.75.

Back to yields - the 10-year Treasury Yield has basically been in a range since mid-2022, after inflation exploded it in 2022. The trouble with that is it could be a huge bull flag, meaning higher yields in the long-term. Or it could be a large head and shoulders top? We don't really want to see higher yields and obviously the fundamentals will play a role with tariffs, tax cuts and even deregulation adding the potential inflation concerns, but any slowdown in the economy would send yields lower. It's a tough call. Is this a top of a bull flag forming? And of course this really matters and will dictate the direction of the stock market as well.

Speaking of, the S&P 500 (C-fund) closed just north of flat yesterday, mocking the disturbing drop in the US credit rating. It's also interesting how light the trading volume was on a day that could have been panicky. One conspiracy theory for the downgrade was that institutional investors had missed the boat on the rally off the lows and they needed something to pull it back down again. Clearly however, the indices have come a long way and there's a couple of open gaps that may still have to be dealt with below, so there are still good arguments for both sides in the short-term. Longer term... the chart looks pretty good.

The Dow Transportation Index is in an interesting situation as it has been moving sideways for the last week and it is quite sticky in that 15,000 area. The 200-day EMA is above for a possible test but the open gap and recent flat top could be a draw to the downside. It's a market leader and very sensitive to the economic data, so the next direction will be telling for the broader market.

Bitcoin is near its all-time highs again and as we have said before, when investors are interested in taking on risk, bitcoin tends to do well, and the S&P 500 often follows.

The DWCPF (S-fund) was down yesterday but it closed at the highs of the day and that's impressive considering the news coming into the day. That March peak held as support and the ascending channel is still very much intact. If yields do start making their way higher, this may be one to avoid, otherwise it is performing well.

ACWX (I-fund) took off as the dollar rolled over. This one has been tough to stop and again my theory that the dollar is going higher has not been paying off, and I had sold some I-fund a couple of weeks ago because of my theory. Fortunately the US stocks have been outperforming the I-fund since that sale, but this doesn't look dead yet.

BND (bonds / F-fund) opened lower but once again the bottom of the range continues to hold as support.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.