That's four down trading days in a row. Normally, I'd expect at least a relief bounce at this point, but I'm not so sure it'll be that simple. Seems a lot of folks are playing contrarian against the Hindenburg Omen, but it doesn't matter how much we tip the boat to one side or the other or for what reason, an overcrowded trade is an overcrowded trade.

I don't really know if that's the case here, but I'm certainly not comfortable when "everyone" knows a ringer when they see it. Especially when I've a sell signal.

And the news just isn't getting any better. July existing home sales dropped a severe 27% month-over-month to an annualized rate of 3.8 million units. That's the worst showing since records began in 1999.

Here's the charts:

Lower still. Two sells.

Yesterday, NAHL and NYHL looked as if they might be poised to signal a bounce for today, but the losses today certainly drove home the point of how weak this market actually is. Two more sells.

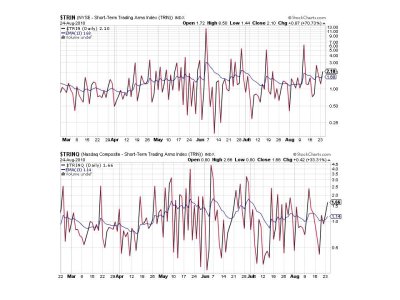

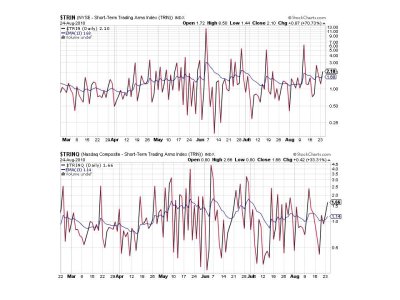

TRIN and TRINQ are showing oversold conditions and are both on a sell.

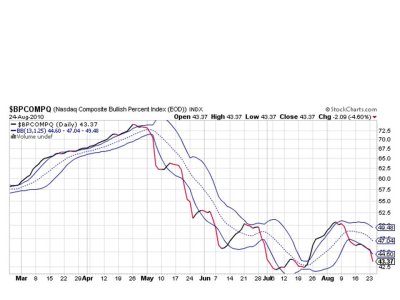

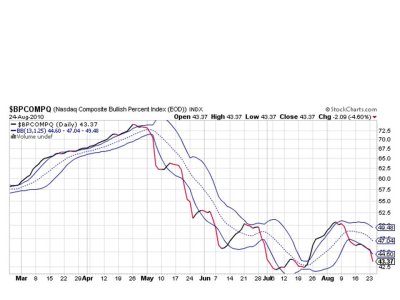

After hugging that lower bollinger band the past few days, BPCOMPQ put a little air between it and that lower line...to the downside and still on a sell.

So all signals are flashing sells and while I am well aware we are due for a relief rally, there's nothing that says it will happen on any given day. I have no reason to be optimistic looking at these charts and I anticipate more weakness in spite of any rally that may materialize.

Still holding 100% G.

I don't really know if that's the case here, but I'm certainly not comfortable when "everyone" knows a ringer when they see it. Especially when I've a sell signal.

And the news just isn't getting any better. July existing home sales dropped a severe 27% month-over-month to an annualized rate of 3.8 million units. That's the worst showing since records began in 1999.

Here's the charts:

Lower still. Two sells.

Yesterday, NAHL and NYHL looked as if they might be poised to signal a bounce for today, but the losses today certainly drove home the point of how weak this market actually is. Two more sells.

TRIN and TRINQ are showing oversold conditions and are both on a sell.

After hugging that lower bollinger band the past few days, BPCOMPQ put a little air between it and that lower line...to the downside and still on a sell.

So all signals are flashing sells and while I am well aware we are due for a relief rally, there's nothing that says it will happen on any given day. I have no reason to be optimistic looking at these charts and I anticipate more weakness in spite of any rally that may materialize.

Still holding 100% G.