Boghie

Market Veteran

- Reaction score

- 374

Man, if I was a Young Pup I'd be moving 'all in'. There is a lot of frightened dumb money moving. Tasty

Settled tariffs for all our major trading partners excepting Canada and kinda Mexico. Mexico is bending the knee, Canada is calling so often we don't bother answering the phone.

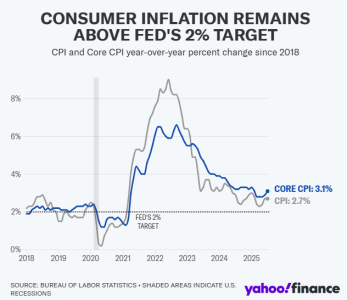

In the end, has anyone seen the crushing effect of tariffs? The FED estimates that tariffs were responsible for 0.08% of the 2.70% annualized inflation. So, without the bone crushing tariffs inflation would have been 2.62%. Dumping that stupid EV mandate will reduce inflation significantly more than that.

BTW, I am NOT a fan of tariffs. They are inflationary - but it is 'Simple Jack' thinking to believe it is a 1 to 1 bite to the consumer. All you have to do is offset the 15% increase (or likely less than that since it is likely that the exporter eats some of it) in costs with a 15% decrease in costs. Tariffs are also NOT applied anywhere except at point of entry. There are a LOT of things that go into pricing (likely the majority of the pricing) that are NOT tariffed.

Settled tariffs for all our major trading partners excepting Canada and kinda Mexico. Mexico is bending the knee, Canada is calling so often we don't bother answering the phone.

In the end, has anyone seen the crushing effect of tariffs? The FED estimates that tariffs were responsible for 0.08% of the 2.70% annualized inflation. So, without the bone crushing tariffs inflation would have been 2.62%. Dumping that stupid EV mandate will reduce inflation significantly more than that.

BTW, I am NOT a fan of tariffs. They are inflationary - but it is 'Simple Jack' thinking to believe it is a 1 to 1 bite to the consumer. All you have to do is offset the 15% increase (or likely less than that since it is likely that the exporter eats some of it) in costs with a 15% decrease in costs. Tariffs are also NOT applied anywhere except at point of entry. There are a LOT of things that go into pricing (likely the majority of the pricing) that are NOT tariffed.