Boghie

Market Veteran

- Reaction score

- 374

Fat Tails and Mighty Black Swans...

To All,

Some have asked me about my references to the 'Black Swan' and 'Fat Tails'. I will attempt to summarize the concept from Nassim Taleb's great book 'Fooled by Randomness'. So here goes...

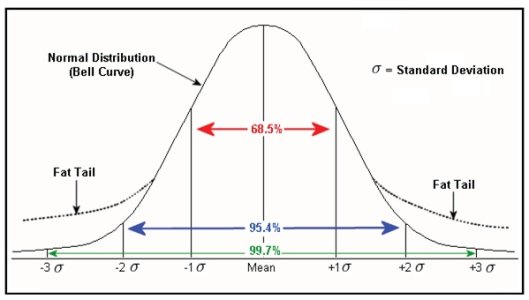

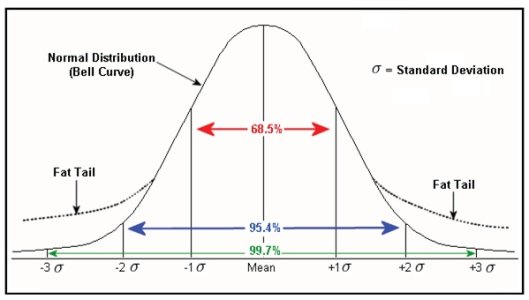

First of all, you don't really look for 'Black Swans', you look for 'Fat Tails'. Black Swans are the result of misunderstood statistical modeling of financial events. Basically, some Quant or analyst doesn't factor in the proper risk for some investment. The following is a comparison of a standard bell curve with one that has a much higher expectation of outlying events (Fat Tails):

When I yammer about 'Risk' this is it. I am using the 'Standard Deviation' of plotted numbers. I think the actual 'Risk' I gather from Quicken adjusts a bit with other data - but the result isn't that different from just using a standard deviation.

Basically, one can expect that any single event (an investment return) in any single time slice (a year) to fall withing a standard deviation in either the negative direction or the positive direction from the center point (average annual return in this case). For the S&P500 (our 'C Fund') from 1957 to now the numbers are as follows:

This means that one can expect a normal annual return of -6.36% through +28.60% in any single year centering on 11.12%. One can expect returns in this range 68.5% of the time in a normal bell curve. Thus, BirchTree is rich because he is playing the numbers. He is right, but he accepts a lot of risk. What is that risk.

It is the risk that the bell curve has 'Fat Tails' with the end result that 'Black Swans' fly overhead and drop a mighty turd right on your head. Yuk, almost as bad as the Pox...

For example, three standard deviations from the center point should be extremely rare - about 0.3%. But, we had one in 2008 and I think we had a double deviation in 2002. Were our models correct. Nope. The models did not account for the dot.Com risk or the debt risk of those two events. In the first, folks bought up dot.Coms on the belief that we were in a new economy and were no longer held down by valuations and earnings. In the second Black Swan event, folks learned that bad debt affects debt instruments far more than they thought they could. Thus, the outliers were both more expected and more destructive than the brainiacs thought. Not understanding the risk resulted in a Fat Tail distribution of risk which resulted in a Black Swan taking flight and crapping on our heads.

And both the 'Fat Tails' and the 'Black Swans' are obvious after they occur.

That is the beauty of it all. It is also the frustrating element of it all. And, it is the reason that folks like Ric Edelman and Ray Lucia and others place your assets in a myriad of asset classes. It is also why BirchTree comes out ahead. He just waits out the Fat Tails and allows the market to normalize. If you do not panic during unlikely crashes you can make lots of mullah by grabbing assets from the panicers. Those $7 to $10 'C Fund' shares that were available during the panic have made me mucho dollars. I can't imagine BT - but then again he retired in that period so his contributions ended.

Now, do you have to take the full risk during periods of extreme danger or volatility? Nope. You can distribute your assets through the various asset classes and play on the margins. Right now, for example, an unknown Fat Tail event seems more likely to me than earlier this year (or, for that matter, than for the past few years). Why be in one fund? Sitting 100% in the 'S Fund' means you accept the risk of much more prevalent tails based on weird events (for example, one might guess that small to mid-size corporations might be hammered more by the 'Fiscal Cliff' than huge multinationals). Do you want to be all out and sitting in the 'F Fund'? Yowser, not even worth discussing. How about sitting 100% in the 'C Fund' - lots of banks and financials in that one? How about the lovely 'I Fund', yowser. Lots of external sources of variance playing instruments they have no experience in.

So, that leaves the 'G Fund'. Resulting in losing the gains we made this year and in 2009. Resulting in an 'Alpo Meal Deal Retirement Program'.

What to do, what to do? Spread your wealth around our funds in a scientific manner and rebalance as things go awry. And, largely stay IN THE MARKET for the VAST majority of time. Having some assets not moving in the negative direction during a correction/crash buffers you and gives you much more time to figure out whether you are in a Black Swan event or in a standard market volatility move. Finally, contribute ONLY to the equity funds and increase those contributions when things are really bad. And, do not support folks who want to spread your wealth around to lops (low output people) and losers. You and your family and maybe your friends and relatives will need your support.

To All,

Some have asked me about my references to the 'Black Swan' and 'Fat Tails'. I will attempt to summarize the concept from Nassim Taleb's great book 'Fooled by Randomness'. So here goes...

First of all, you don't really look for 'Black Swans', you look for 'Fat Tails'. Black Swans are the result of misunderstood statistical modeling of financial events. Basically, some Quant or analyst doesn't factor in the proper risk for some investment. The following is a comparison of a standard bell curve with one that has a much higher expectation of outlying events (Fat Tails):

When I yammer about 'Risk' this is it. I am using the 'Standard Deviation' of plotted numbers. I think the actual 'Risk' I gather from Quicken adjusts a bit with other data - but the result isn't that different from just using a standard deviation.

Basically, one can expect that any single event (an investment return) in any single time slice (a year) to fall withing a standard deviation in either the negative direction or the positive direction from the center point (average annual return in this case). For the S&P500 (our 'C Fund') from 1957 to now the numbers are as follows:

Average Return: 11.12%

Average Risk: 17.48%

IRR: 9.62%

Average Risk: 17.48%

IRR: 9.62%

This means that one can expect a normal annual return of -6.36% through +28.60% in any single year centering on 11.12%. One can expect returns in this range 68.5% of the time in a normal bell curve. Thus, BirchTree is rich because he is playing the numbers. He is right, but he accepts a lot of risk. What is that risk.

It is the risk that the bell curve has 'Fat Tails' with the end result that 'Black Swans' fly overhead and drop a mighty turd right on your head. Yuk, almost as bad as the Pox...

For example, three standard deviations from the center point should be extremely rare - about 0.3%. But, we had one in 2008 and I think we had a double deviation in 2002. Were our models correct. Nope. The models did not account for the dot.Com risk or the debt risk of those two events. In the first, folks bought up dot.Coms on the belief that we were in a new economy and were no longer held down by valuations and earnings. In the second Black Swan event, folks learned that bad debt affects debt instruments far more than they thought they could. Thus, the outliers were both more expected and more destructive than the brainiacs thought. Not understanding the risk resulted in a Fat Tail distribution of risk which resulted in a Black Swan taking flight and crapping on our heads.

And both the 'Fat Tails' and the 'Black Swans' are obvious after they occur.

That is the beauty of it all. It is also the frustrating element of it all. And, it is the reason that folks like Ric Edelman and Ray Lucia and others place your assets in a myriad of asset classes. It is also why BirchTree comes out ahead. He just waits out the Fat Tails and allows the market to normalize. If you do not panic during unlikely crashes you can make lots of mullah by grabbing assets from the panicers. Those $7 to $10 'C Fund' shares that were available during the panic have made me mucho dollars. I can't imagine BT - but then again he retired in that period so his contributions ended.

Now, do you have to take the full risk during periods of extreme danger or volatility? Nope. You can distribute your assets through the various asset classes and play on the margins. Right now, for example, an unknown Fat Tail event seems more likely to me than earlier this year (or, for that matter, than for the past few years). Why be in one fund? Sitting 100% in the 'S Fund' means you accept the risk of much more prevalent tails based on weird events (for example, one might guess that small to mid-size corporations might be hammered more by the 'Fiscal Cliff' than huge multinationals). Do you want to be all out and sitting in the 'F Fund'? Yowser, not even worth discussing. How about sitting 100% in the 'C Fund' - lots of banks and financials in that one? How about the lovely 'I Fund', yowser. Lots of external sources of variance playing instruments they have no experience in.

So, that leaves the 'G Fund'. Resulting in losing the gains we made this year and in 2009. Resulting in an 'Alpo Meal Deal Retirement Program'.

What to do, what to do? Spread your wealth around our funds in a scientific manner and rebalance as things go awry. And, largely stay IN THE MARKET for the VAST majority of time. Having some assets not moving in the negative direction during a correction/crash buffers you and gives you much more time to figure out whether you are in a Black Swan event or in a standard market volatility move. Finally, contribute ONLY to the equity funds and increase those contributions when things are really bad. And, do not support folks who want to spread your wealth around to lops (low output people) and losers. You and your family and maybe your friends and relatives will need your support.