Thoughts on Zeroing Out Various Tax Increases...

So we plebians in Kalefornea are faced with an approved tax increase, potential tax increases on autos, and various Federal tax increases. It is time to number crunch them. So Here goes:

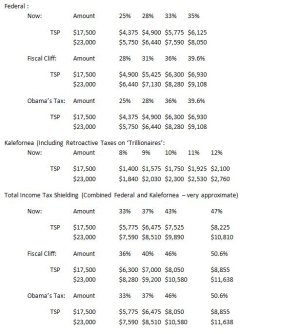

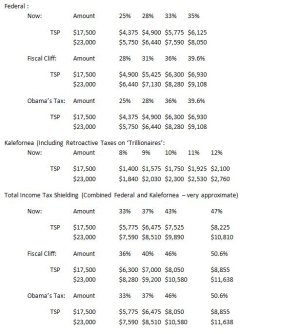

Most of us are ‘middle class’ and thus fall in the current 25% and 28% marginal tax rates (the middle two rates). Under both the current rates and “Obama’s Tax The Plutocrats Right Now but We Know that will Not Cover Our Spending so that ‘28%’ bracket better be ready” plan you can shield $5,775 in the 25%/8% rate or $7,590 if you are 50+. As a positive thinker I like to think that investing $17,500 will only cost me $11,725 in take home income – or about $450 per pay period.

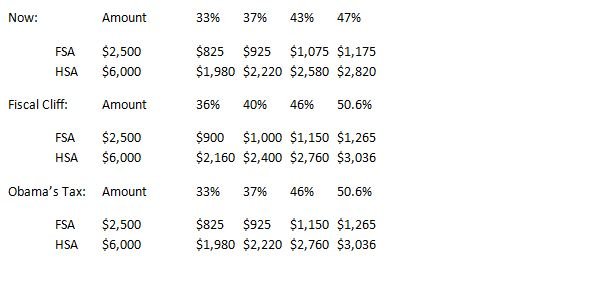

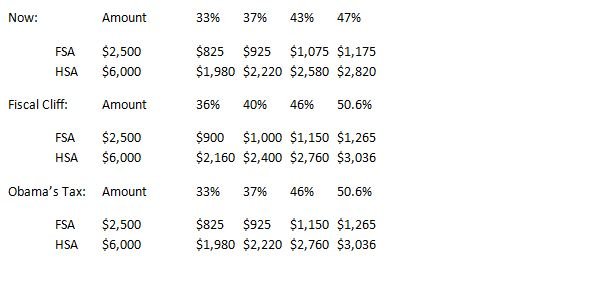

But, that is not all!!! You can shield an additional $2,500 in your FSA or $6,000 (I think) in the HSA:

Kalefornea’s tax increase has already been implemented. I am not in one of the brackets that were created, but I am affected by the property tax and the sales tax. It is estimated that I will pay an additional $150 in taxes of one type or another. Since I am in Kalefornea’s 8% income tax bracket I will need to shield $1,875 in income. I have already increased my CFT contribution by $260/year, leaving !,615 to be shielded. I can increase my FSA, move to an HSA, improve my FEHB, increase charitable giving, or increase TSP contributions to match that.

I think I will pretty much max out my FSA out because my lovely wife and I will need spectacles next year. That will consume an additional $1,000 - leaving $615 to be shielded.

I can wait on the remaining tax management till I see what the ignits in Congress and the Administration come up with. Here are the scenarios – with an understanding that Kalefornea already kicked me:

- No Change (Current): $615 (probably more) more to charity because it will provide the best benefit to society and make me feel better. This will result in the Federal government getting $470 less from me for no reason. Oh well, too bad.

- Fiscal Cliff: I need to shield an additional $4,500 on top of the ~1,200 adjustment made on behalf of Kalefornea. That will require an additional pre-tax withholding of $12,500. I don’t think I can do all that – and I know I cannot fit all that under the 401(k) limits – but I will increase my TSP contributions to the full $17,500. Maybe I can fill the rest with a charitable contribution. Maybe I should review the HSA option. I should think positively: It will only field like $8,000 to me!!! Regretfully, this will result in Kalefornea losing $1,000 in revenue for no reason. And, just think of what taking $14,375 out of the economy will do for the Kalefornea and the national recovery. Oh well, too bad. Hope others are with me!!!

- Obama’s Tax: I will add a couple of points to my TSP and maybe a bit more to charity just to spite Obama and Moonbeam. I want them to feel it. Hope others are with me!!!