-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BigJohn's Account Talk

- Thread starter BigJohn

- Start date

BigJohn

TSP Strategist

- Reaction score

- 9

When I see a day like Thursday I always think that "this is a perfect day for Big John to buy in"

And I would have...but for being in travel status an unable to log in.

If today's red numbers hold for another 15 minutes, it is into the S fund I go.

Best of luck to all...

JTH

TSP Legend

- Reaction score

- 1,158

Hello all...haven't posted in a while, hope everyone is doing well.

I see you're having another great year, are you thinking of jumping in on the next slaughter?

BigJohn

TSP Strategist

- Reaction score

- 9

I see you're having another great year, are you thinking of jumping in on the next slaughter?

I am staying on the sidelines for a while. I don't trust this market and don't believe the seasonal trend (Santa Rally) is a lock. I had a gut feeling today would start good and end ugly, had this one right. Me and my gut (which has grown over the last year) are waiting for the dust to settle.

BigJohn

TSP Strategist

- Reaction score

- 9

My gut's feeling for today: C and S (never have had a clue about the I) peak in the green around .5% by lunch time, end up closing .5ish in the red. I think we will have a nice 1-1.5% upswing one day this week, only to lose it by the end of the week. I have never read a chart in my life, so take this with a big grain of salt. Good Luck!

BigJohn

TSP Strategist

- Reaction score

- 9

My gut's feeling for today: C and S (never have had a clue about the I) peak in the green around .5% by lunch time, end up closing .5ish in the red. I think we will have a nice 1-1.5% upswing one day this week, only to lose it by the end of the week. I have never read a chart in my life, so take this with a big grain of salt. Good Luck!

Gut's call is pretty good so far...

JTH

TSP Legend

- Reaction score

- 1,158

Gut's call is pretty good so far...

If it starts with "Here, hold my beer" then you're good to go!

BigJohn

TSP Strategist

- Reaction score

- 9

My gut's feeling for today: C and S (never have had a clue about the I) peak in the green around .5% by lunch time, end up closing .5ish in the red. I think we will have a nice 1-1.5% upswing one day this week, only to lose it by the end of the week. I have never read a chart in my life, so take this with a big grain of salt. Good Luck!

My gut is on fire!

BigJohn

TSP Strategist

- Reaction score

- 9

Jumped in at the right time, good to be lucky every once and a while.

Not that anyone asked, but here is my investment strategy...I even came up with a witty name: The Oliver Stone method.

Having watched the markets for the last 5 years I have come to one conclusion: the whole system is corrupt and rife with manipulation. How many times have we seem solid, objective data that almost demands an upward trend only to result in red numbers? How many times have we seen absolutely NO REASON for the market to climb...and yet it does. You can go back and chart yourself to death to explain why each occurred, but you might as well throw a dart at the financial section of your local paper (does anyone still get newspapers?) in my humble opinion.

I need to cut this short...just spotted a black helicopter circling and me with my aluminum foil helmet at the cleaners.

Not that anyone asked, but here is my investment strategy...I even came up with a witty name: The Oliver Stone method.

Having watched the markets for the last 5 years I have come to one conclusion: the whole system is corrupt and rife with manipulation. How many times have we seem solid, objective data that almost demands an upward trend only to result in red numbers? How many times have we seen absolutely NO REASON for the market to climb...and yet it does. You can go back and chart yourself to death to explain why each occurred, but you might as well throw a dart at the financial section of your local paper (does anyone still get newspapers?) in my humble opinion.

I need to cut this short...just spotted a black helicopter circling and me with my aluminum foil helmet at the cleaners.

BigJohn

TSP Strategist

- Reaction score

- 9

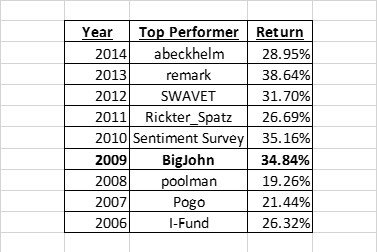

In 2008 or 2009 (not sure which, getting old screwing with my long term memory) I was the top overall performer. I wasn't particularly brilliant, quite on the contrary...I had my $ in the S fund on January 1 and let it ride for the entire year ending up with a 30+% gain. I didn't really check on it to be completely honest. So why do I bring this up now? I normally would step out on a day like this and pocket a couple of days worth of nice gains. Every financial genius/talking head has forecast this year to be volatile in the markets, which makes me think it won't be. Do I take the 2008-2009 approach and let it ride or stick to my trading strategery and pocket gains in the tradition of "pigs get fat, hogs get slaughtered." I don't know...

Best of Luck to all...

BigJohn

Best of Luck to all...

BigJohn

Cactus

TSP Pro

- Reaction score

- 38

Must have been 2009. 2008 is the year you would have lost 38% in the S Fund.  That brings up my suspicions about these large V-Shaped snapback rallies we've been having lately. I'm afraid they are conditioning us to catch the falling knife and to continue to ride it down because we don't want to miss these unexpected rallies that payout the most of their return in the first two days. When will that end? How low will you go? Strange you mentioned 2008 -- not exactly a Buy-N-Hold year.

That brings up my suspicions about these large V-Shaped snapback rallies we've been having lately. I'm afraid they are conditioning us to catch the falling knife and to continue to ride it down because we don't want to miss these unexpected rallies that payout the most of their return in the first two days. When will that end? How low will you go? Strange you mentioned 2008 -- not exactly a Buy-N-Hold year.

In 2008 or 2009 (not sure which, getting old screwing with my long term memory) I was the top overall performer. I wasn't particularly brilliant, quite on the contrary...I had my $ in the S fund on January 1 and let it ride for the entire year ending up with a 30+% gain. I didn't really check on it to be completely honest. So why do I bring this up now? I normally would step out on a day like this and pocket a couple of days worth of nice gains. Every financial genius/talking head has forecast this year to be volatile in the markets, which makes me think it won't be. Do I take the 2008-2009 approach and let it ride or stick to my trading strategery and pocket gains in the tradition of "pigs get fat, hogs get slaughtered." I don't know...

Best of Luck to all...

BigJohn

(Full year participants in the AT)

BigJohn

TSP Strategist

- Reaction score

- 9

Must have been 2009. 2008 is the year you would have lost 38% in the S Fund.That brings up my suspicions about these large V-Shaped snapback rallies we've been having lately. I'm afraid they are conditioning us to catch the falling knife and to continue to ride it down because we don't want to miss these unexpected rallies that payout the most of their return in the first two days. When will that end? How low will you go? Strange you mentioned 2008 -- not exactly a Buy-N-Hold year.

You aren't joking about 2008...when I let it ride in the S fund and ate a 30+% loss.

Similar threads

- Replies

- 2

- Views

- 531