Yesterday I was fairly non-committal on which way the market might go in the short term. Not so today. I had anticipated a choppy market, but also said that the right catalyst would either drive this market higher, or send it back down to test the previous low. But which way would that be? We got our answer today in spades as volume spiked overwhelmingly in favor of declining issues.

Weakness began in the Asian markets with many of those market falling more than 1%, which isn't that bad considering the volatility we've seen. But in Europe, the selling was more of a rout, as major bourses such as Germany's DAX fell 6.0%, and France's CAC dropped 5.4%. The culprit was continued fear of the overall fragility of global economic conditions.

And the data continues to support those fears. Today, initial jobless claims moved back over the 400,000 level to post an increase of 408,000, which was a bit higher than expected.

For July, consumer prices were up 0.5%, which raised the specter of inflation as economists were looking for only a 0.2% increase. Core prices did meet expectations however, as they came in at 0.2%.

Perhaps the most damaging bit of data was the August Philadelphia Fed Survey, which fell a precipitous -30.7. Expectations were for a much more modest 1.0. Such a negative number points to a very significant contraction in general business conditions. The previous month this survey was 3.2.

July existing home sales dropped to 4.67 million, which was well under expectations of 4.87 million.

July leading Indicators were the only positive today, as they showed an increase of 0.5%, which bested expectations for a 0.2% increase. Unfortunately, this report doesn't carry nearly the weight of the previous four data points and so was relatively meaningless to a market shocked by the negative import of the overall data.

Gold and treasuries were beneficiaries of today's market rout as gold pushed higher by 1.6% to $1,822 per ounce. And the benchmark 10-year Note saw its yield fall even further to less than 2.0% during the course of today's trading.

As a result of today's decisive market action, the Seven Sentinels no longer appear to be neutral. Let's take a look:

NAMO and NYMO both fell and are highly suggestive of further selling pressure (especially now that we're in a bear market). Both are once again in sell conditions.

Same for NAHL and NYHL.

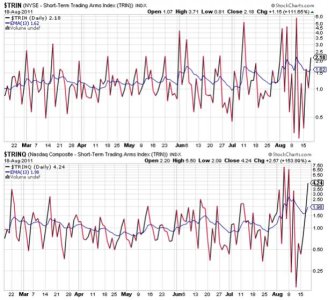

TRIN and TRINQ are now both flashing sells, but have not spiked to the levels we saw last week. This actually suggests to me that more selling pressure is on the way in spite of the moderately oversold short term condition of these signals.

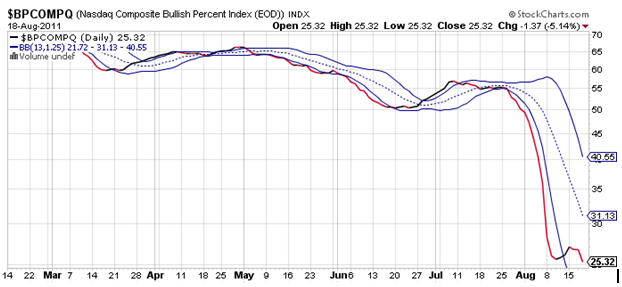

More disturbing for the bulls is the decisive turn lower by BPCOMPQ. It is the only signal still on a buy, but in a bear market that means very little given the condition of the other signals.

So toss out the unconfirmed buy signal the Seven Sentinels flashed last week. It is almost certain now that the brief rally we got through this past Monday was simply a bearish upthrust in what is now a bear market by some measures.

Officially, the Seven Sentinels remain is a sell condition and that is the context from which this market needs to be viewed in the bigger picture regardless of any rallies. At least until an official buy signal comes, which isn't likely anytime soon.