robo

TSP Legend

- Reaction score

- 471

What to Do With a “Failed” Buy Signal – Market Minute

jeffclarktrader.com

What to Do With a “Failed” Buy Signal – Market Minute

jeffclarktrader.com

What to Do With a “Failed” Buy Signal

The buy signal was a bust. Oddly enough, though, that’s bullish.Let me explain…

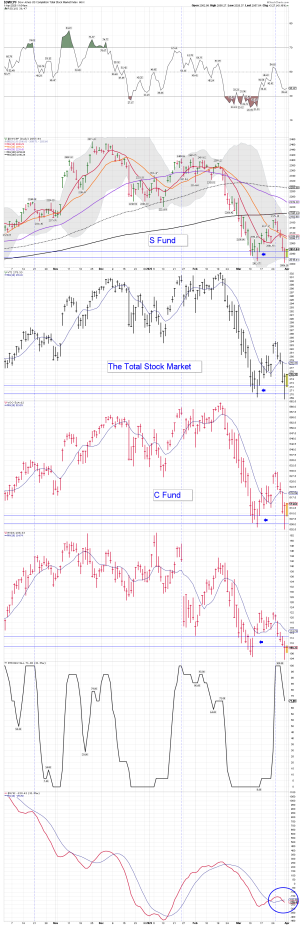

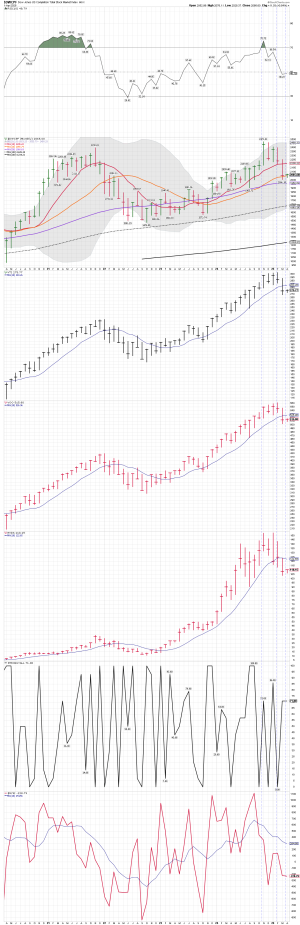

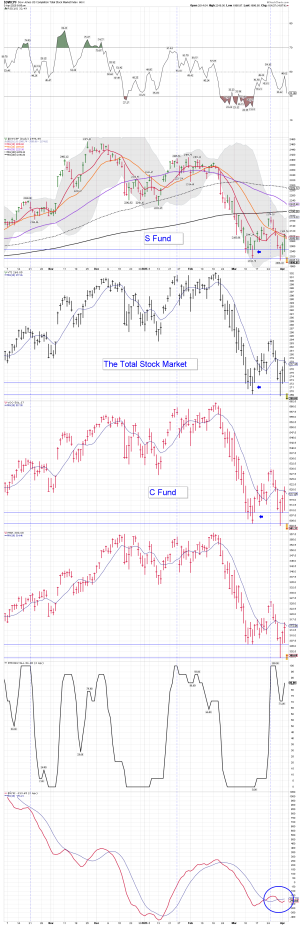

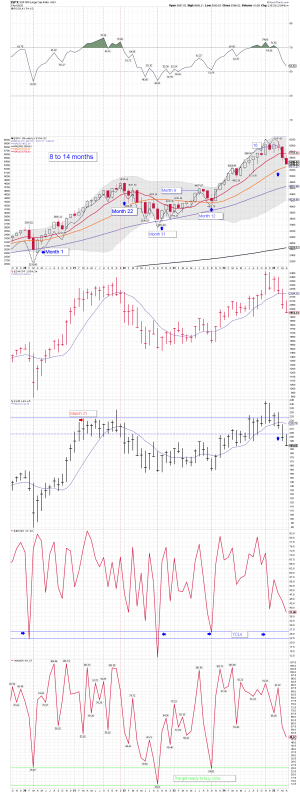

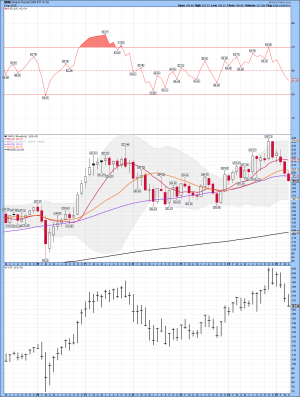

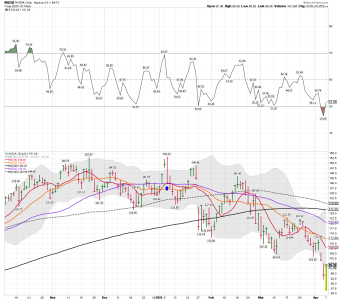

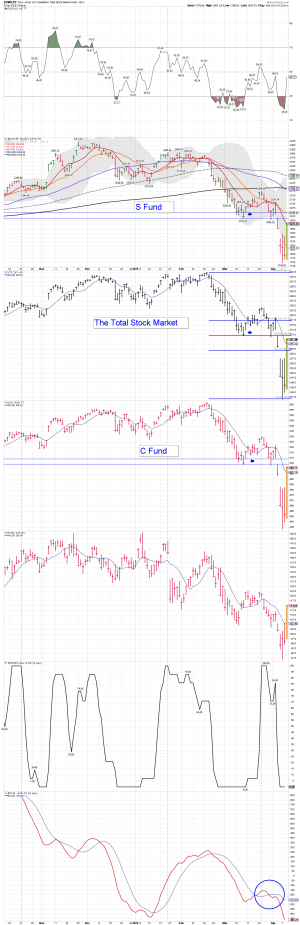

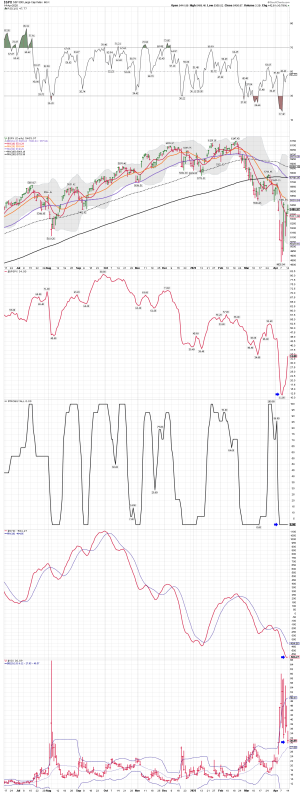

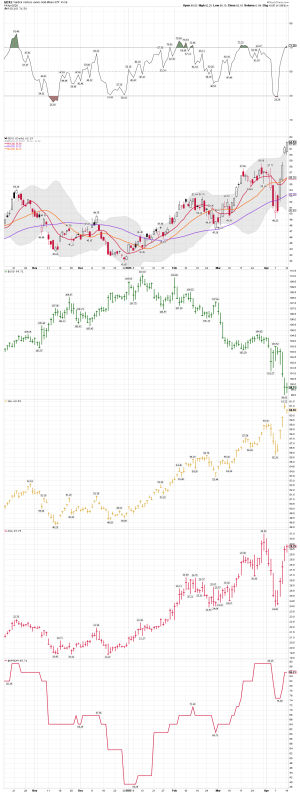

Last Friday, I boasted about the success of NYSE Summation Index (NYSI) buy signals. All seven of the previous signals since the start of 2024 led to immediate stock market rallies. So, I suggested readers should put money to work following last week’s NYSI buy signal.

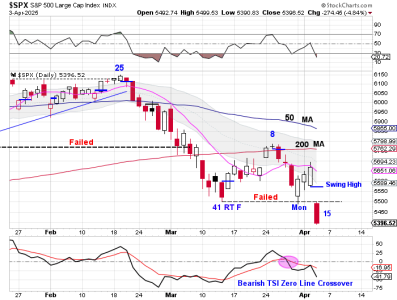

That signal failed on Friday when the NYSI closed back below its 9-day EMA. Here’s the updated chart…

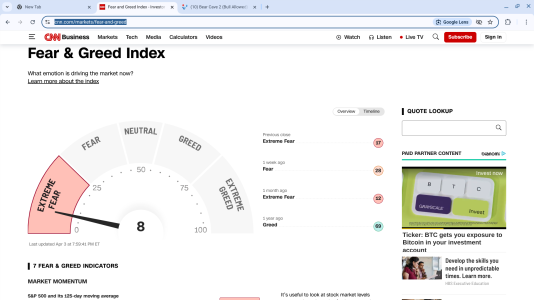

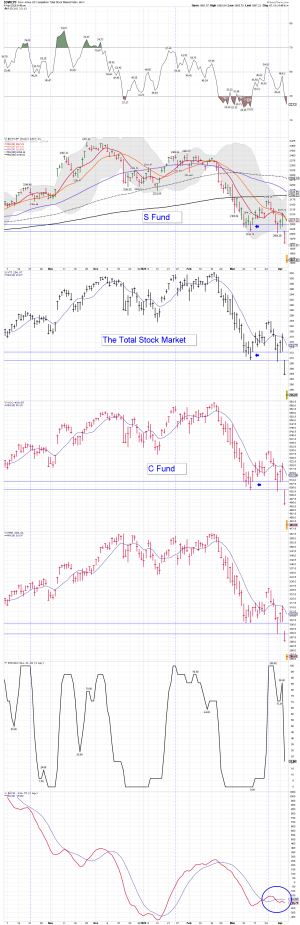

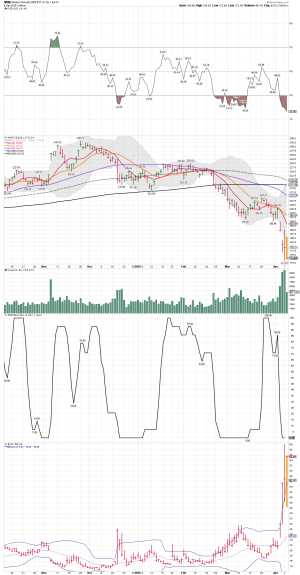

All of this is to suggest that no matter how ugly it may get early this week, buying into the decline will likely prove profitable in the weeks ahead – especially if we see extremely oversold conditions on the daily indicators.

Best regards and good trading,

Attachments

Last edited: