robo

TSP Legend

- Reaction score

- 471

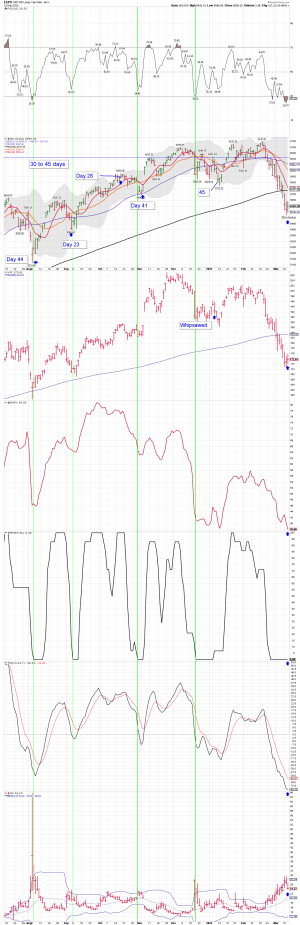

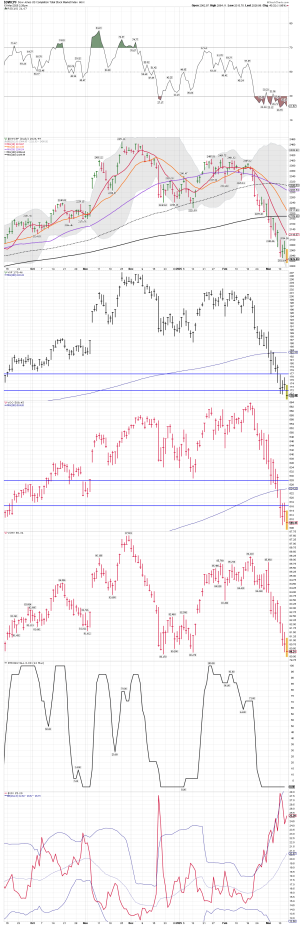

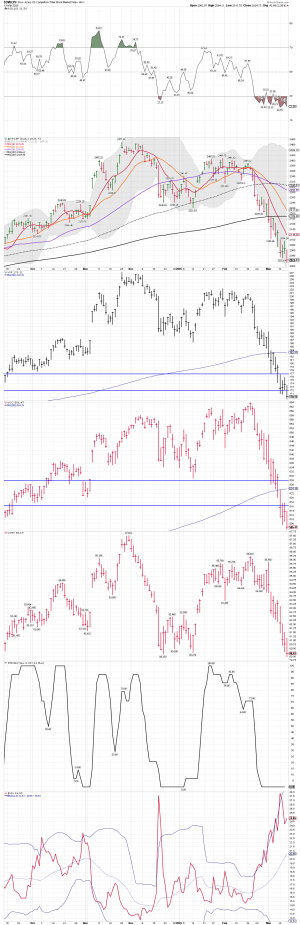

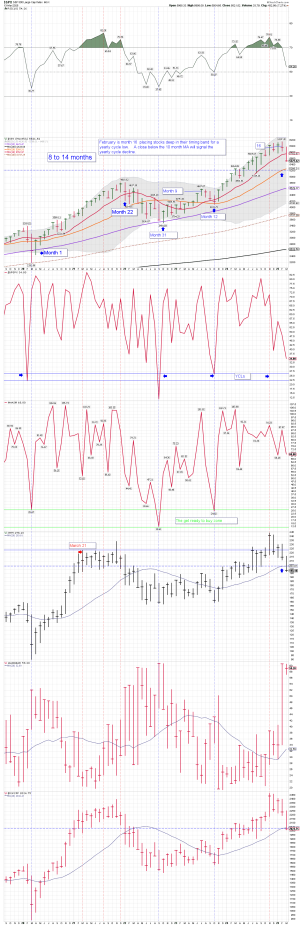

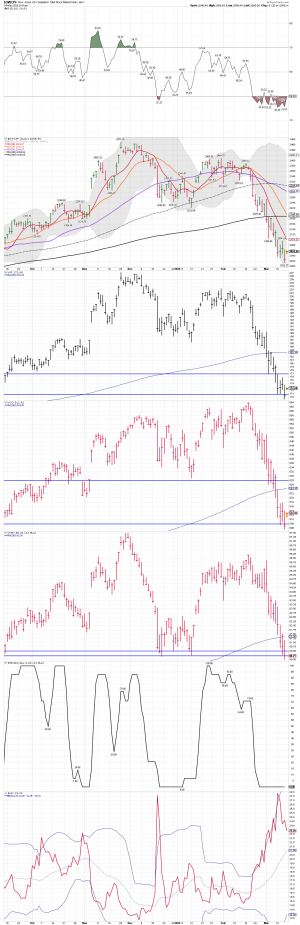

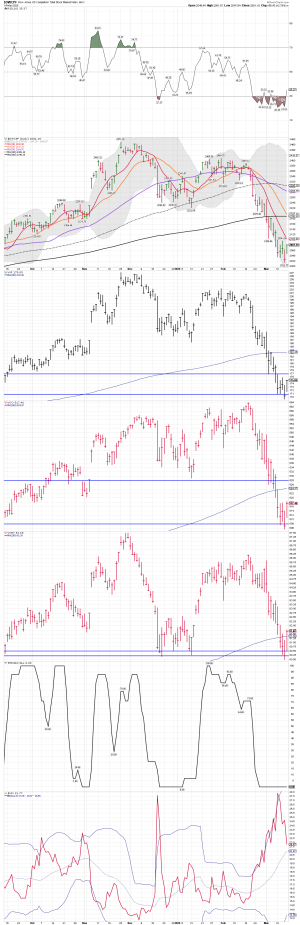

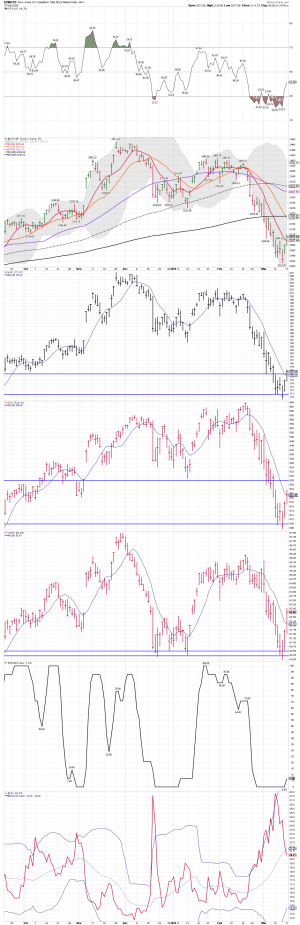

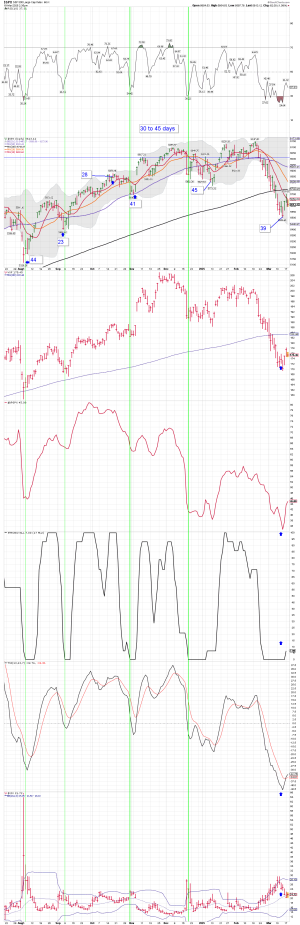

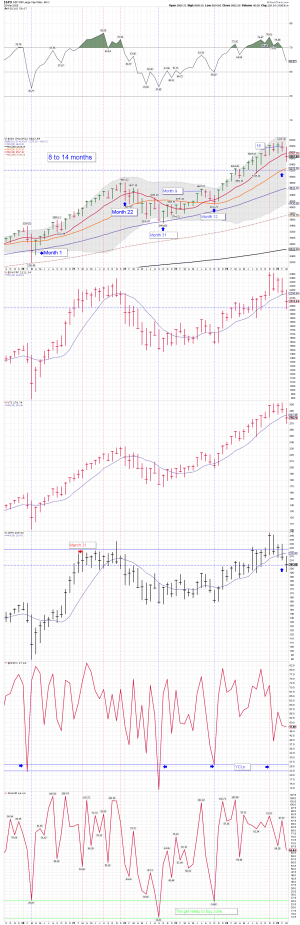

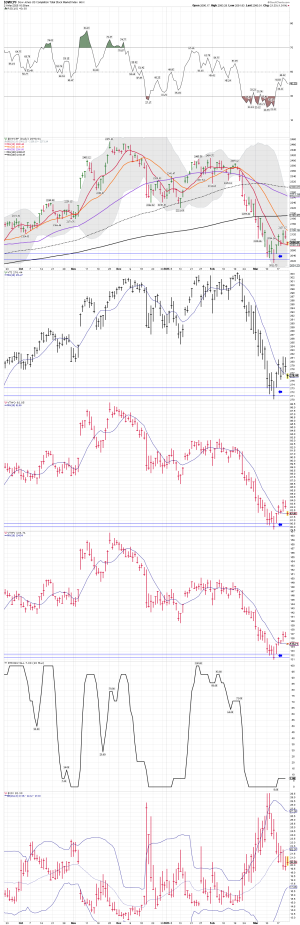

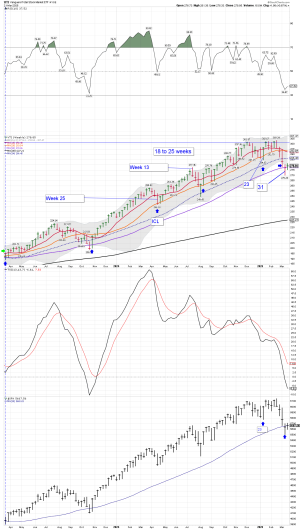

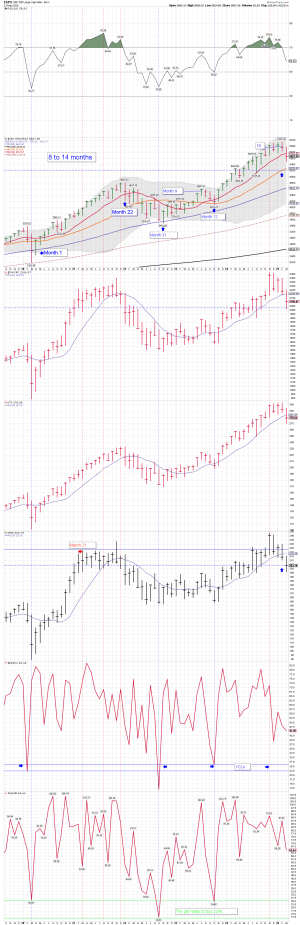

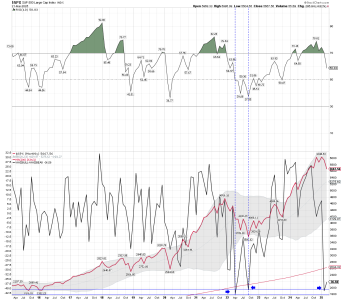

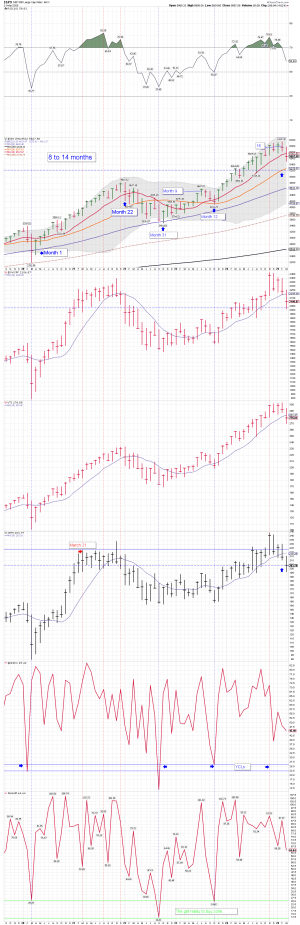

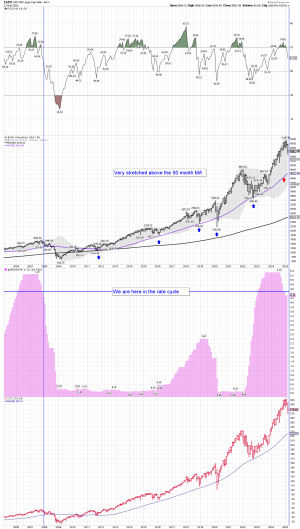

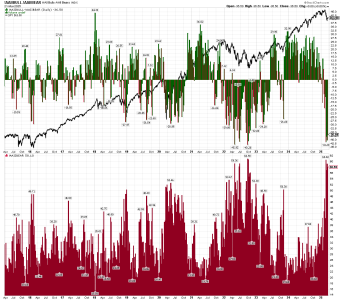

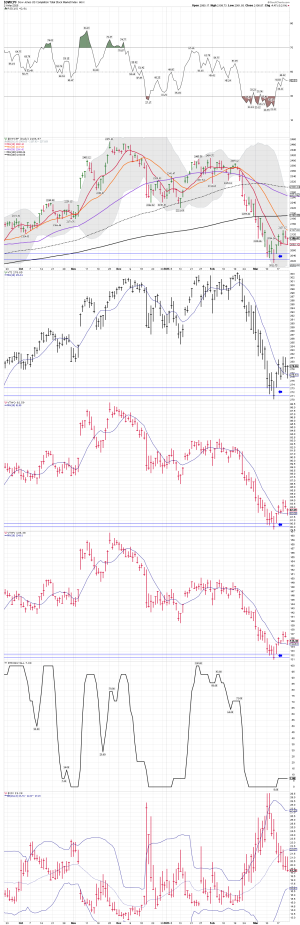

Sell the Rip is in play! We shall see if buyers come back in before the close. However, higher lows could work out if we can grind higher.

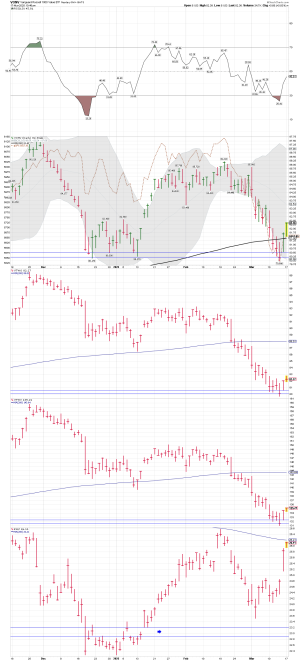

Daily trading charts: I bought some shares of VONV.... It made a lower low this morning after a nice Rip up...

Daily trading charts: I bought some shares of VONV.... It made a lower low this morning after a nice Rip up...

Attachments

Last edited: