-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

The SPY weekly HLC bar closed back inside the Jaws pattern today. We shall see how that plays out in the days ahead. The last two tries failed....

IWM weekly: Notice the convergence of the 200,100,50,40 ma's.... A rare event! The last time that happened was in 2008. It's not a sell signal it's just a pattern so far that is repeating.

https://stockcharts.com/h-sc/ui?s=IWM&p=W&yr=3&mn=0&dy=0&id=p43374748232&a=842018597

IWM weekly: Notice the convergence of the 200,100,50,40 ma's.... A rare event! The last time that happened was in 2008. It's not a sell signal it's just a pattern so far that is repeating.

https://stockcharts.com/h-sc/ui?s=IWM&p=W&yr=3&mn=0&dy=0&id=p43374748232&a=842018597

Attachments

robo

TSP Legend

- Reaction score

- 471

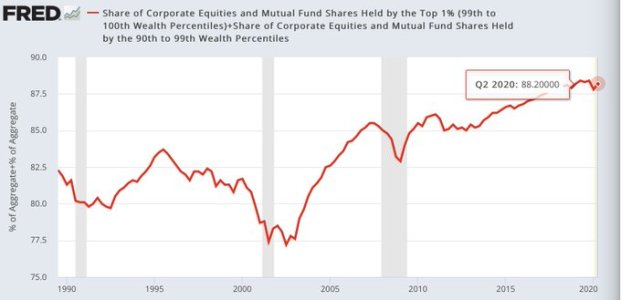

The Fed Bubble continues.....

Sven Henrich

@NorthmanTrader

2h

Bottomline: The top 10% own 88% of all corporate equities and mutual fund shares where as the bottom 50% own 0.6% and central bank policies have created the widest disconnect between markets & the economy in history benefitting disproportionally the top 10%.

Fact.

https://twitter.com/NorthmanTrader

David Rosenberg

@EconguyRosie

5h

Count up all the Americans on emergency jobless benefits, on mortgage forbearance and on the CDC no-eviction list, and it's nearly 30 million hanging on by a thread after Jan 1st. And we have strategists cheering over fiscal gridlock. Go figure.

David Rosenberg

@EconguyRosie

5h

When you look at the fact that "zombie" companies, via the long arm of the Fed, were able to raise $1tn since the pandemic began, is it any wonder we haven't had an insolvency crisis?

https://twitter.com/EconguyRosie?lang=en

Sven Henrich

@NorthmanTrader

2h

Bottomline: The top 10% own 88% of all corporate equities and mutual fund shares where as the bottom 50% own 0.6% and central bank policies have created the widest disconnect between markets & the economy in history benefitting disproportionally the top 10%.

Fact.

https://twitter.com/NorthmanTrader

David Rosenberg

@EconguyRosie

5h

Count up all the Americans on emergency jobless benefits, on mortgage forbearance and on the CDC no-eviction list, and it's nearly 30 million hanging on by a thread after Jan 1st. And we have strategists cheering over fiscal gridlock. Go figure.

David Rosenberg

@EconguyRosie

5h

When you look at the fact that "zombie" companies, via the long arm of the Fed, were able to raise $1tn since the pandemic began, is it any wonder we haven't had an insolvency crisis?

https://twitter.com/EconguyRosie?lang=en

Attachments

robo

TSP Legend

- Reaction score

- 471

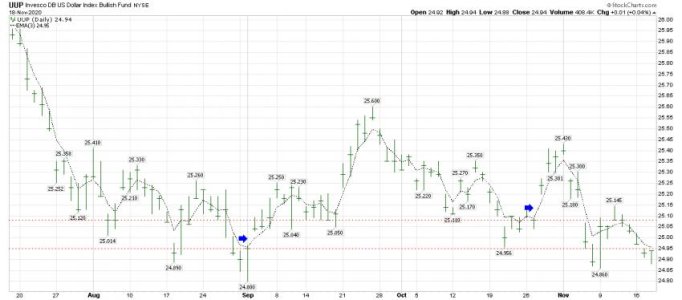

Did UUP just make a lower high? It's an important indicator if it did.....

https://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p72669124828&a=842367401

https://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p72669124828&a=842367401

Attachments

robo

TSP Legend

- Reaction score

- 471

Sven Henrich

@NorthmanTrader

4h

$SPX

#knowyourtrendlines

https://twitter.com/NorthmanTrader/status/1329358758888267777/photo/1

@NorthmanTrader

4h

$SPX

#knowyourtrendlines

https://twitter.com/NorthmanTrader/status/1329358758888267777/photo/1

Attachments

robo

TSP Legend

- Reaction score

- 471

Monthly equity put/call ratio

https://twitter.com/NorthmanTrader/status/1329353056606162946/photo/1

A link for my monthly data below: The trend remains up, but note what it took (The M1 move) The monthly $CPCE is on this chart too.

https://stockcharts.com/h-sc/ui?s=$SPX&p=M&yr=10&mn=0&dy=0&id=p30464346892&a=842390654

https://twitter.com/NorthmanTrader/status/1329353056606162946/photo/1

A link for my monthly data below: The trend remains up, but note what it took (The M1 move) The monthly $CPCE is on this chart too.

https://stockcharts.com/h-sc/ui?s=$SPX&p=M&yr=10&mn=0&dy=0&id=p30464346892&a=842390654

Attachments

Bullitt

Market Veteran

- Reaction score

- 75

The Fed Bubble continues.....

David Rosenberg

@EconguyRosie

5h

Count up all the Americans on emergency jobless benefits, on mortgage forbearance and on the CDC no-eviction list, and it's nearly 30 million hanging on by a thread after Jan 1st. And we have strategists cheering over fiscal gridlock. Go figure.

David Rosenberg

@EconguyRosie

5h

When you look at the fact that "zombie" companies, via the long arm of the Fed, were able to raise $1tn since the pandemic began, is it any wonder we haven't had an insolvency crisis?

To add to that theme:

About 300 companies that received as much as half a billion dollars in pandemic-related government loans have filed for bankruptcy, according to a Wall Street Journal analysis of government data and court filings.

https://www.wsj.com/articles/hundreds-of-companies-that-got-stimulus-aid-have-failed-11605609180

robo

TSP Legend

- Reaction score

- 471

Moving out (above) the Jaws pattern again. The Bulls are calling this a Breakout. We shall see how it plays out. The upper red line is a close up of the Jaws pattern. ( second link below)

https://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=4&mn=4&dy=0&id=p19393939597&a=837748028

A closeup of the pattern.

https://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=1&mn=4&dy=0&id=p70221761917&a=842578765

Bottom Line: Love it or hate it the trend remains up!

https://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=4&mn=4&dy=0&id=p19393939597&a=837748028

A closeup of the pattern.

https://stockcharts.com/h-sc/ui?s=SPY&p=D&yr=1&mn=4&dy=0&id=p70221761917&a=842578765

Bottom Line: Love it or hate it the trend remains up!

robo

TSP Legend

- Reaction score

- 471

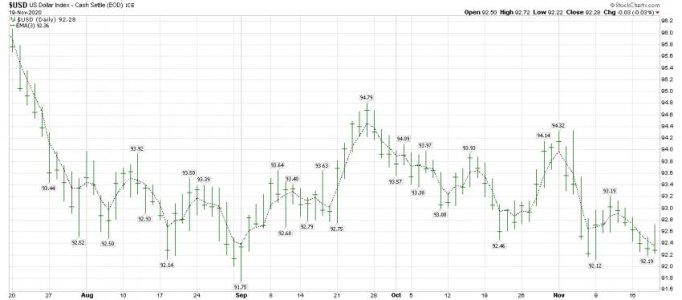

Most think the dollar will move much lower. Maybe it will in the long run, but I'm not so sure in the short-term. That would be a headwind for stocks. Smashed back down again today, but still making higher lows....

https://stockcharts.com/h-sc/ui?s=$USD&p=D&yr=0&mn=6&dy=0&id=p28478172345&a=818444515

November 19, 2020

Dollar Support

Since the big drop in August the dollar has been finding support along the 92.22 level.

https://likesmoneycycletrading.wordpress.com/2020/11/19/dollar-support/

https://stockcharts.com/h-sc/ui?s=$USD&p=D&yr=0&mn=6&dy=0&id=p28478172345&a=818444515

November 19, 2020

Dollar Support

Since the big drop in August the dollar has been finding support along the 92.22 level.

https://likesmoneycycletrading.wordpress.com/2020/11/19/dollar-support/

Attachments

robo

TSP Legend

- Reaction score

- 471

We shall have to see how this plays out... This could be big down the road - "US Treasury

withdraws support for some #Fed facilities"

The QQQs still haven't been able to move above the $303.06 marker on my chart..... I guess the rotation into small caps has slowed down it's run for now.

https://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=0&mn=6&dy=0&id=p39277196366&a=842377820

Mohamed A. El-Erian

@elerianm

4h

Evidence of more uncertain policy support

@USTreasury

withdraws support for some #Fed facilities and

@UK confronts significant increase in its fiscal deficit

Underlying this: My earlier notion that what was thought to be just a "1-round" policy response has proven to be much more

https://twitter.com/elerianm

In other news....

Sven Henrich

@NorthmanTrader

·

5h

“Rush to buy”

“Euphoria”

“the bank said inflows into global stocks in the last two weeks soared to $71.4 billion, the biggest ever.”

https://twitter.com/NorthmanTrader

withdraws support for some #Fed facilities"

The QQQs still haven't been able to move above the $303.06 marker on my chart..... I guess the rotation into small caps has slowed down it's run for now.

https://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=0&mn=6&dy=0&id=p39277196366&a=842377820

Mohamed A. El-Erian

@elerianm

4h

Evidence of more uncertain policy support

@USTreasury

withdraws support for some #Fed facilities and

@UK confronts significant increase in its fiscal deficit

Underlying this: My earlier notion that what was thought to be just a "1-round" policy response has proven to be much more

https://twitter.com/elerianm

In other news....

Sven Henrich

@NorthmanTrader

·

5h

“Rush to buy”

“Euphoria”

“the bank said inflows into global stocks in the last two weeks soared to $71.4 billion, the biggest ever.”

https://twitter.com/NorthmanTrader

Last edited:

robo

TSP Legend

- Reaction score

- 471

Some possible tax changes coming when Biden takes office - I sure like this one..... (sponsors on both sides of the aisle.)

"There are already two bills with sponsors on both sides of the aisle. The “Securing a Strong Retirement Act” would, among other things, push the required minimum distribution to age 75. The “Retirement Security and Savings Act” would do the same in its list of provisions.

Then there’s Biden’s call for a 26% refundable tax credit kicking in for each dollar contributed to an IRA or 401(k)."

5 ways Joe Biden can advance his tax agenda (without a Senate majority)

Published: Nov. 20, 2020 at 5:24 a.m. ET

By Andrew Keshner

27

With two Senate seats up for grabs, what does this mean for families thinking about their tax bill in a Biden era?

https://www.marketwatch.com/story/i...vance-his-tax-agenda-2020-11-13?mod=home-page

"There are already two bills with sponsors on both sides of the aisle. The “Securing a Strong Retirement Act” would, among other things, push the required minimum distribution to age 75. The “Retirement Security and Savings Act” would do the same in its list of provisions.

Then there’s Biden’s call for a 26% refundable tax credit kicking in for each dollar contributed to an IRA or 401(k)."

5 ways Joe Biden can advance his tax agenda (without a Senate majority)

Published: Nov. 20, 2020 at 5:24 a.m. ET

By Andrew Keshner

27

With two Senate seats up for grabs, what does this mean for families thinking about their tax bill in a Biden era?

https://www.marketwatch.com/story/i...vance-his-tax-agenda-2020-11-13?mod=home-page

robo

TSP Legend

- Reaction score

- 471

Gold and other news....

1. ETF traders are pulling out of gold. Funds that buy the bullion have seen a big drop in assets over the past 2 weeks, with the most outflows since March. [Daily Shot]

https://www.sentimentrader.com/blog...l&utm_term=0_1c93760246-515cecc905-1271291994

1. ETF traders are pulling out of gold. Funds that buy the bullion have seen a big drop in assets over the past 2 weeks, with the most outflows since March. [Daily Shot]

https://www.sentimentrader.com/blog...l&utm_term=0_1c93760246-515cecc905-1271291994

robo

TSP Legend

- Reaction score

- 471

David Rosenberg

@EconguyRosie

·

4h

I saw on my Bloomberg today that we are up to 20% of publicly-listed companies labeled as "zombies". Defunct without government support. And these stocks are up 16% month-to-date and 2x what strong balance sheet firms have done! A junk rally in the making.

https://twitter.com/EconguyRosie?lang=en

QQQ remains on it's buy signal as the trend up continues...... Trending above the 10 ma and the 3 and 13 ema.....

https://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=0&mn=6&dy=0&id=p99668248574&a=842377820

@EconguyRosie

·

4h

I saw on my Bloomberg today that we are up to 20% of publicly-listed companies labeled as "zombies". Defunct without government support. And these stocks are up 16% month-to-date and 2x what strong balance sheet firms have done! A junk rally in the making.

https://twitter.com/EconguyRosie?lang=en

QQQ remains on it's buy signal as the trend up continues...... Trending above the 10 ma and the 3 and 13 ema.....

https://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=0&mn=6&dy=0&id=p99668248574&a=842377820

Attachments

robo

TSP Legend

- Reaction score

- 471

My trend trading system remains on buy signal, but I'm buying my first tranche of PSQ. I think UUP, TLT and the VIX are indicating a flight to safety is closer then most think. A hedge for now since my system remains on a hold long positions.

https://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=0&mn=6&dy=0&id=p19273495675&a=842377820

HYG remains in a uptrend too - A very Bullish indicator, and part of my trend trading system.

https://stockcharts.com/h-sc/ui?s=HYG&p=D&yr=0&mn=4&dy=0&id=p48159647309&a=836201126

Why use the 3 ema for trading and the 10 dma to confirm? So I can keep it simple and take the emotion out of it....

WHAT’S THE BEST MOVING AVERAGE? What trading gurus don’t want you to know…

https://www.youtube.com/watch?v=yCa_P39nJJo

It's not the best system, but it keeps me in line with the uptrends and gets me out of the downtrends. And yes, I get whipsawed sometimes....

Pulling The Trigger

...the BUY or SELL signal has been issued. All you need to do is call your fund company or broker, or log into your online trading account and click on the "Trade" button.

But right at that moment, all the doubt and second-guessing comes to a head, and the buy or sell signal is never executed.

Sound familiar? It's probably the most common heartache faced by market timers and all market traders, and is only compounded when it turns out that it would have been a profitable trade.

https://www.fibtimer.com/subscribers/fibtimer_commentary.asp

Bottom Line: A simple system that keeps you in line for a major trend up and out of a major trend down. I'm trying to catch most of the move up and miss major moves down. Trend trading doesn't work well in markets that are driven by news events, but it's the way I trade these days based on years of testing systems. Back test it and see if it works for you.

Good Trading

https://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=0&mn=6&dy=0&id=p19273495675&a=842377820

HYG remains in a uptrend too - A very Bullish indicator, and part of my trend trading system.

https://stockcharts.com/h-sc/ui?s=HYG&p=D&yr=0&mn=4&dy=0&id=p48159647309&a=836201126

Why use the 3 ema for trading and the 10 dma to confirm? So I can keep it simple and take the emotion out of it....

WHAT’S THE BEST MOVING AVERAGE? What trading gurus don’t want you to know…

https://www.youtube.com/watch?v=yCa_P39nJJo

It's not the best system, but it keeps me in line with the uptrends and gets me out of the downtrends. And yes, I get whipsawed sometimes....

Pulling The Trigger

...the BUY or SELL signal has been issued. All you need to do is call your fund company or broker, or log into your online trading account and click on the "Trade" button.

But right at that moment, all the doubt and second-guessing comes to a head, and the buy or sell signal is never executed.

Sound familiar? It's probably the most common heartache faced by market timers and all market traders, and is only compounded when it turns out that it would have been a profitable trade.

https://www.fibtimer.com/subscribers/fibtimer_commentary.asp

Bottom Line: A simple system that keeps you in line for a major trend up and out of a major trend down. I'm trying to catch most of the move up and miss major moves down. Trend trading doesn't work well in markets that are driven by news events, but it's the way I trade these days based on years of testing systems. Back test it and see if it works for you.

Good Trading

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

What's next! Watch the video...... It's Amazing in my opinion. We shall have to wait and see if it causes any problems in the next few weeks. Easy money Monday is up next!

Trump administration overrules Jerome Powell and cuts off Fed emergency lending programs

By Rob McLean, CNN Business

Updated 10:10 AM ET, Fri November 20, 2020

New York (CNN Business)US Treasury Secretary Steven Mnuchin has pulled the plug on emergency Federal Reserve lending programs, drawing a rare rebuke from the central bank, which said they are needed to support the economy as the coronavirus pandemic continues to rage.

In a letter sent Thursday to Fed Chairman Jerome Powell, Mnuchin asked the central bank to return some $455 billion in unused funding for programs set to expire December 31. He added that Congress would then be able to use the money for other purposes.

The decision would force several programs to end that were intended to help businesses that have been struggling as the pandemic wreaks havoc on the US economy. The money was set aside in March as part of the CARES Act, a $2 trillion stimulus package meant to prop up the ailing economy by providing financial assistance and loans for distressed companies, among other measures.

https://www.cnn.com/2020/11/19/business/steven-mnuchin-federal-reserve-cares-act/index.html

Trump administration overrules Jerome Powell and cuts off Fed emergency lending programs

By Rob McLean, CNN Business

Updated 10:10 AM ET, Fri November 20, 2020

New York (CNN Business)US Treasury Secretary Steven Mnuchin has pulled the plug on emergency Federal Reserve lending programs, drawing a rare rebuke from the central bank, which said they are needed to support the economy as the coronavirus pandemic continues to rage.

In a letter sent Thursday to Fed Chairman Jerome Powell, Mnuchin asked the central bank to return some $455 billion in unused funding for programs set to expire December 31. He added that Congress would then be able to use the money for other purposes.

The decision would force several programs to end that were intended to help businesses that have been struggling as the pandemic wreaks havoc on the US economy. The money was set aside in March as part of the CARES Act, a $2 trillion stimulus package meant to prop up the ailing economy by providing financial assistance and loans for distressed companies, among other measures.

https://www.cnn.com/2020/11/19/business/steven-mnuchin-federal-reserve-cares-act/index.html

robo

TSP Legend

- Reaction score

- 471

Well, I was expecting this week to be positive. Options Expiration week is usually a good one.....

Options Expiration Calendar 2020

https://www.marketwatch.com/optionscenter/calendar

We shall see what happens next week as the news cycle gets crazier everyday.

Bottom Line: The trend remains up no matter how bad the news is.

I don't trade based on Mark Hulbert's data. (See link below). He was one of the few news letter Guru's that was calling for a retest of the March lows based on his historical data. However, there has NEVER been a time in history were the Fed pumped so much money into the market. So it never happened.

Look at the M1 on this chart.

https://stockcharts.com/h-sc/ui?s=$SPX&p=M&yr=10&mn=0&dy=0&id=p44534865685&a=842390654

I say we shall see, but for now the trend remains up - Hold long positions, but take some profits and reduce risk is what my indicators told me to do. If I'm wrong that's ok too.

(Risk/Reward and Risk Management is an important part of ALL investing and trading)

Mark Hulbert

Opinion: The Dow has completely recovered its 2020 bear-market loss. Here’s what comes next

Published: Nov. 20, 2020 at 6:55 a.m. ET

By Mark Hulbert

32

Dow’s recovery since March is impressive but says nothing about how long the bull market will run

Might a more upbeat conclusion be reached if we focused on bear market recovery times that were extremely quick, like the one since March? Unfortunately no. There is no statistically significant correlation in the historical data between the speed of its bear-market recovery and how far and high the market goes subsequent to its recovery.

None of this diminishes the market’s impressive recovery over the past eight months. It’s understandable that such a rebound would put investors in a giddy mood. But my review of prior recoveries suggests that we temper our exuberance.

https://www.marketwatch.com/story/t...es-next-2020-11-20?mod=MW_section_top_stories

Options Expiration Calendar 2020

https://www.marketwatch.com/optionscenter/calendar

We shall see what happens next week as the news cycle gets crazier everyday.

Bottom Line: The trend remains up no matter how bad the news is.

I don't trade based on Mark Hulbert's data. (See link below). He was one of the few news letter Guru's that was calling for a retest of the March lows based on his historical data. However, there has NEVER been a time in history were the Fed pumped so much money into the market. So it never happened.

Look at the M1 on this chart.

https://stockcharts.com/h-sc/ui?s=$SPX&p=M&yr=10&mn=0&dy=0&id=p44534865685&a=842390654

I say we shall see, but for now the trend remains up - Hold long positions, but take some profits and reduce risk is what my indicators told me to do. If I'm wrong that's ok too.

(Risk/Reward and Risk Management is an important part of ALL investing and trading)

Mark Hulbert

Opinion: The Dow has completely recovered its 2020 bear-market loss. Here’s what comes next

Published: Nov. 20, 2020 at 6:55 a.m. ET

By Mark Hulbert

32

Dow’s recovery since March is impressive but says nothing about how long the bull market will run

Might a more upbeat conclusion be reached if we focused on bear market recovery times that were extremely quick, like the one since March? Unfortunately no. There is no statistically significant correlation in the historical data between the speed of its bear-market recovery and how far and high the market goes subsequent to its recovery.

None of this diminishes the market’s impressive recovery over the past eight months. It’s understandable that such a rebound would put investors in a giddy mood. But my review of prior recoveries suggests that we temper our exuberance.

https://www.marketwatch.com/story/t...es-next-2020-11-20?mod=MW_section_top_stories

Last edited:

robo

TSP Legend

- Reaction score

- 471

A market update: A short video....

Sven Henrich

@NorthmanTrader

·

1h

Quick market update: $SPX $VIX

https://twitter.com/NorthmanTrader

My daily SPX data: Are we starting to see a lower highs? We shall see how it plays out next week..... The SPX closed below the 3 ema, the 10 dma and the 13 ema be up next..... Close to a sell signal for my ST trading system. That doesn't mean my signal will NOT get whipsawed, but that is why I bought PSQ today as a hedge.... I posted it above... The QQQs remains in a uptrend.....

Good Trading next week!

https://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p22151151092&a=842367401

Sven Henrich

@NorthmanTrader

·

1h

Quick market update: $SPX $VIX

https://twitter.com/NorthmanTrader

My daily SPX data: Are we starting to see a lower highs? We shall see how it plays out next week..... The SPX closed below the 3 ema, the 10 dma and the 13 ema be up next..... Close to a sell signal for my ST trading system. That doesn't mean my signal will NOT get whipsawed, but that is why I bought PSQ today as a hedge.... I posted it above... The QQQs remains in a uptrend.....

Good Trading next week!

https://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p22151151092&a=842367401

Attachments

Last edited:

Bullitt

Market Veteran

- Reaction score

- 75

I think the Warren Buffett effect is hitting gold. Guy discloses a brand new stake in Barrick in June, then by September he dumps 40% of it.

Biden also calling for a $15,000 first time home buyer credit. I see the good intentions here, but those home buyer credits have done nothing but make homes less affordable.

The 26% tax credit would be "deposited into the taxpayer’s retirement account as a matching contribution", and that would be stimulus in itself.

Pushing the RMD to 75 would be great news as more baby boomers retire daily. The later they can be forced to sell stocks the better.

Short term I can see selling pressure into year end as insiders and high net worth individuals guarantee they can still get that 20% capital gains rate. It might go up to 39.6% for people making over $1M.

Long term, this train has already left station. Just need those cyclicals to weather this next wave of shutdowns.

Biden also calling for a $15,000 first time home buyer credit. I see the good intentions here, but those home buyer credits have done nothing but make homes less affordable.

The 26% tax credit would be "deposited into the taxpayer’s retirement account as a matching contribution", and that would be stimulus in itself.

Pushing the RMD to 75 would be great news as more baby boomers retire daily. The later they can be forced to sell stocks the better.

Short term I can see selling pressure into year end as insiders and high net worth individuals guarantee they can still get that 20% capital gains rate. It might go up to 39.6% for people making over $1M.

Long term, this train has already left station. Just need those cyclicals to weather this next wave of shutdowns.

robo

TSP Legend

- Reaction score

- 471

I think the Warren Buffett effect is hitting gold. Guy discloses a brand new stake in Barrick in June, then by September he dumps 40% of it.

Biden also calling for a $15,000 first time home buyer credit. I see the good intentions here, but those home buyer credits have done nothing but make homes less affordable.

The 26% tax credit would be "deposited into the taxpayer’s retirement account as a matching contribution", and that would be stimulus in itself.

Pushing the RMD to 75 would be great news as more baby boomers retire daily. The later they can be forced to sell stocks the better.

Short term I can see selling pressure into year end as insiders and high net worth individuals guarantee they can still get that 20% capital gains rate. It might go up to 39.6% for people making over $1M.

Long term, this train has already left station. Just need those cyclicals to weather this next wave of shutdowns.

If the Dem's win those two seats in Georgia taxes are going up, and probably a bunch for high earners. Capital gains will be the big one for the stock market. We could still see some selling this year for those that don't want to take a chance. Insiders are also selling at an historical rate right now.

You can track that data (insiders selling at the link below). It's free and easy to signup and it cost nothing. I use the sell summary reports. I don't trade using this data, but would never buy a stock when the insiders are selling. I was using it to track MTDR as that is the only stock I own. https://stockcharts.com/h-sc/ui?s=MTDR&p=D&yr=0&mn=11&dy=0&id=p88938474201&a=833277384 It went down to $1.11ish during the March selloff.

I normally only buy indexes.

J3SG - Activity Summaries

For me it's all about the RMD. I have NO DEBT and ensure we stay under the 75k tax rate every year. That would be hard to do with RMDs. As for the stock market many are very bullish again....

Some of the sentiment indicators I track.

https://stockcharts.com/h-sc/ui?s=!...D&yr=0&mn=11&dy=0&id=p13451865745&a=841426717

Have a nice weekened!

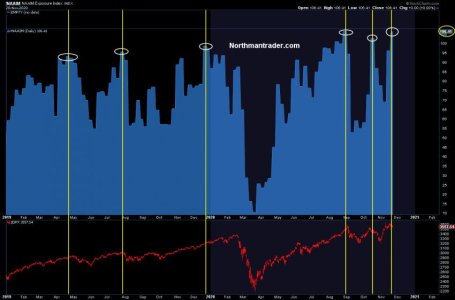

Talk about "All In Long".

Asset manager exposure index at 106+

$NAAIM

https://twitter.com/NorthmanTrader

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

I have been trading SILJ, but I'm currently flat. I think a better price is coming soon. Gold was very stretched above the 200 dma and historical likes to bottom in December...

Some thoughts on why I like trading the mean in this sector. However, I still trade the trend using SILJ.

https://stockcharts.com/h-sc/ui?s=GLD&p=W&yr=5&mn=0&dy=0&id=p54144737357&a=815473882

I have posted this before, but I like to trade "extremes" or confirmed trends after a very oversold condition. All other trades are for beer money.

Relativity Trading

Adam Hamilton October 16, 2009 3033 Words

The ultimate key to success in all trading, both long-term investment and short-term speculation, is simple. Buy low, sell high. Excel in this, and trading the financial markets will eventually make you wealthy. But implementing this well-known proverb into your own trading certainly isn’t easy. As always, the devil is in the details

To paraphrase Pontius Pilate’s famous rhetorical question to Jesus, what is low? What is high? In order to buy low and sell high, traders must gain insights into how to define these conditions in real-time. Without building this crucial skill set, everything else a trader achieves including emotional mastery will be for naught

While low and high are quantified in terms of prices, context is necessary to define them. A price considered in isolation is useless, but a price considered in context offers much insight. If I tell you I bought something today for $50, you have no idea whether I got a good deal at a low price or got robbed at a high price. What if my $50 bought me a new Nintendo Wii console? What if it bought me a hamburger?

Relativity Trading

Gold Stocks Still Correcting

Adam Hamilton October 23, 2020

Gold Stocks Still Correcting

GLD weekly data:

Looking for The Silver Lining

Posted on November 21, 2020

After peaking in August, precious metals are still seeking out their cycle lows. As the weekly cycles stretches this is causing the status of the daily cycles to not be clear. Silver certainly gives us a clear picture to watch.

https://likesmoneycycletrading.wordpress.com/2020/11/21/looking-for-the-silver-lining/

Some thoughts on why I like trading the mean in this sector. However, I still trade the trend using SILJ.

https://stockcharts.com/h-sc/ui?s=GLD&p=W&yr=5&mn=0&dy=0&id=p54144737357&a=815473882

I have posted this before, but I like to trade "extremes" or confirmed trends after a very oversold condition. All other trades are for beer money.

Relativity Trading

Adam Hamilton October 16, 2009 3033 Words

The ultimate key to success in all trading, both long-term investment and short-term speculation, is simple. Buy low, sell high. Excel in this, and trading the financial markets will eventually make you wealthy. But implementing this well-known proverb into your own trading certainly isn’t easy. As always, the devil is in the details

To paraphrase Pontius Pilate’s famous rhetorical question to Jesus, what is low? What is high? In order to buy low and sell high, traders must gain insights into how to define these conditions in real-time. Without building this crucial skill set, everything else a trader achieves including emotional mastery will be for naught

While low and high are quantified in terms of prices, context is necessary to define them. A price considered in isolation is useless, but a price considered in context offers much insight. If I tell you I bought something today for $50, you have no idea whether I got a good deal at a low price or got robbed at a high price. What if my $50 bought me a new Nintendo Wii console? What if it bought me a hamburger?

Relativity Trading

Gold Stocks Still Correcting

Adam Hamilton October 23, 2020

Gold Stocks Still Correcting

GLD weekly data:

Looking for The Silver Lining

Posted on November 21, 2020

After peaking in August, precious metals are still seeking out their cycle lows. As the weekly cycles stretches this is causing the status of the daily cycles to not be clear. Silver certainly gives us a clear picture to watch.

https://likesmoneycycletrading.wordpress.com/2020/11/21/looking-for-the-silver-lining/