robo

TSP Legend

- Reaction score

- 471

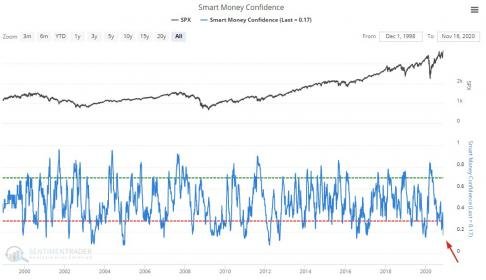

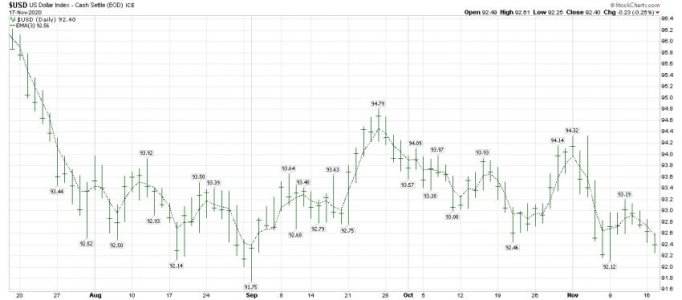

Another go at the all time highs... Time to hedge with a short position. My system remains on a buy signal, and the trend remains up.

https://twitter.com/jessefelder/status/1327646989262184449/photo/1

https://twitter.com/jessefelder/status/1327646989262184449/photo/1

Attachments

Last edited: