robo

TSP Legend

- Reaction score

- 471

Chart In Focus

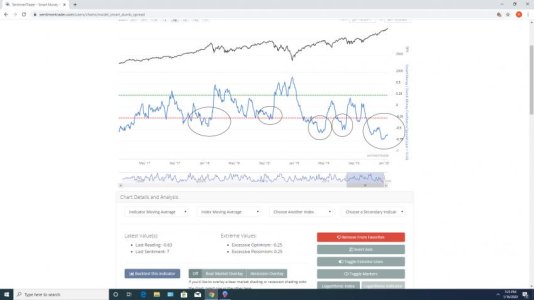

Fed Funds COT Leading Indication

The efforts of the Federal Reserve to inject extra liquidity into the banking system over the past 2 months have helped to fuel the year-end (2019) rally. Questions remain about how long the Fed may choose to keep up that effort, and whether the Fed has enough ink in the printing presses to overcome other market forces.

https://www.mcoscillator.com/learning_center/weekly_chart/fed_funds_cot_leading_indication/

Fed Funds COT Leading Indication

The efforts of the Federal Reserve to inject extra liquidity into the banking system over the past 2 months have helped to fuel the year-end (2019) rally. Questions remain about how long the Fed may choose to keep up that effort, and whether the Fed has enough ink in the printing presses to overcome other market forces.

https://www.mcoscillator.com/learning_center/weekly_chart/fed_funds_cot_leading_indication/