We're up, we're down, we're up again.

We had another mixed day with more volatility. The C fund tacked on some very modest gains after being up close to 1.5%. The S fund, while not advancing as high intraday as the C fund, was up over 1%, but fell by a moderate -.6% by the close. And the I fund, up around 2% at one point, ended the day with a nice 1% gain.

This action seems to indicate we are in the process of bottoming on this correction. And the seven sentinels seem to support that theory too.

Let's take a look:

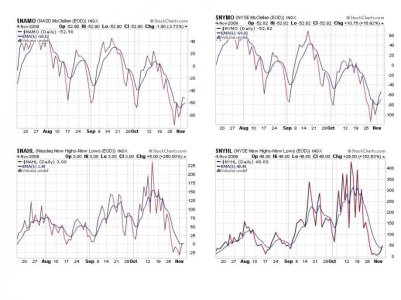

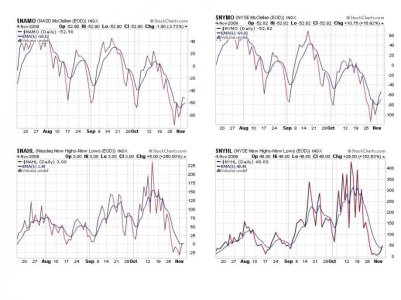

NAMO and NYMO remain on a buy close to their 6 day ema, which is at a multi-month low.

NAHL and NYHL both flashed buys today very close to their 6 day ema's, which are also at multi-month lows. They appear poised to begin moving back up again at this point.

TRIN flipped to a sell today, but it is right at its 13 day ema, which to me is not a hard sell.

TRINQ on the other hand remained on a buy.

BPCOMPQ has yet to flip back to a buy condition, but the lower bollinger band is dipping lower fast and is poised to intersect the signal itself on any strength.

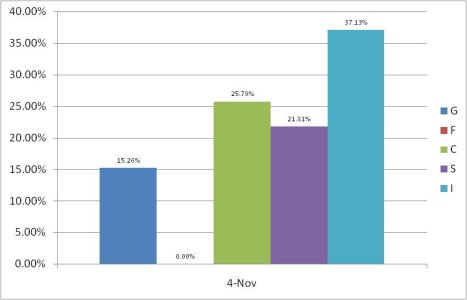

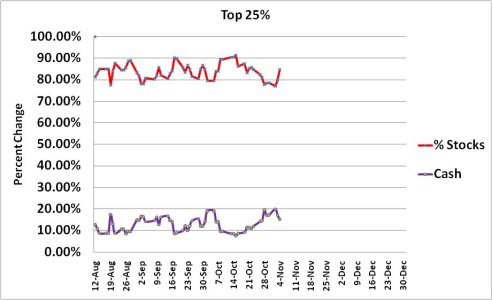

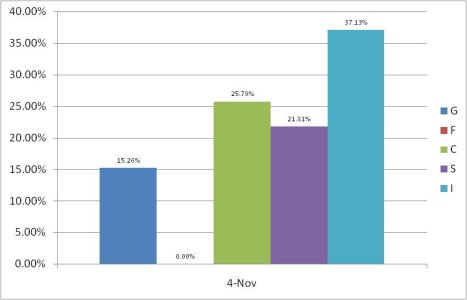

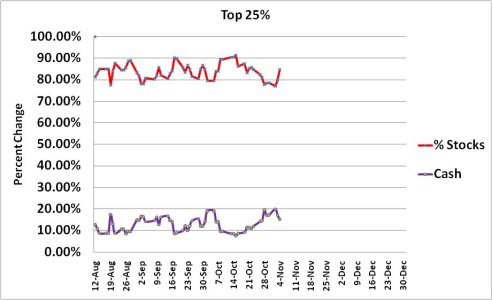

Our top 25% have completely bailed on the F fund and have added to their stock position, especially the I fund.

So we have 5 buys, one borderline sell, and one sell signal keeping the system on a sell.

Given the volatilty we're seeing, if this market resolves to the upside as the SS seems to be indicating it will, it could move quickly as it did on previous SS buy signals. I am very tempted to front run this system. But with limited IFTs it's a risk, because if it turns out to be a head fake, I could be forced to sell and be out of the market for the rest of the month (unless I decide to ride it out). But I don't think that scenario is likely. Even if we do drop some more at this point it will probably be contained.

So consider your strategy carefully. It is not guaranteed that the SS is about to give a buy signal, but it does look to be setting up that way.

We had another mixed day with more volatility. The C fund tacked on some very modest gains after being up close to 1.5%. The S fund, while not advancing as high intraday as the C fund, was up over 1%, but fell by a moderate -.6% by the close. And the I fund, up around 2% at one point, ended the day with a nice 1% gain.

This action seems to indicate we are in the process of bottoming on this correction. And the seven sentinels seem to support that theory too.

Let's take a look:

NAMO and NYMO remain on a buy close to their 6 day ema, which is at a multi-month low.

NAHL and NYHL both flashed buys today very close to their 6 day ema's, which are also at multi-month lows. They appear poised to begin moving back up again at this point.

TRIN flipped to a sell today, but it is right at its 13 day ema, which to me is not a hard sell.

TRINQ on the other hand remained on a buy.

BPCOMPQ has yet to flip back to a buy condition, but the lower bollinger band is dipping lower fast and is poised to intersect the signal itself on any strength.

Our top 25% have completely bailed on the F fund and have added to their stock position, especially the I fund.

So we have 5 buys, one borderline sell, and one sell signal keeping the system on a sell.

Given the volatilty we're seeing, if this market resolves to the upside as the SS seems to be indicating it will, it could move quickly as it did on previous SS buy signals. I am very tempted to front run this system. But with limited IFTs it's a risk, because if it turns out to be a head fake, I could be forced to sell and be out of the market for the rest of the month (unless I decide to ride it out). But I don't think that scenario is likely. Even if we do drop some more at this point it will probably be contained.

So consider your strategy carefully. It is not guaranteed that the SS is about to give a buy signal, but it does look to be setting up that way.